Startup success rates are still brutally low, under 10% worldwide. Yet a dangerous belief continues to dominate boardrooms and pitch decks: once funding arrives, success is inevitable.

The past decade has proven the opposite.

Some of the most heavily funded unicorn startups, valued at $1 billion or more, raised massive capital, achieved early market traction, and still collapsed. Funding didn’t save them. Growth didn’t protect them. In many cases, it accelerated their failure.

This 2026 deep-dive analyzes 10 high-profile unicorn startups that failed to uncover the common mistakes, execution gaps, and strategic blind spots that led to their downfall, mistakes that are even more dangerous in today’s AI-driven, capital-efficient startup environment.

10 Failed Unicorn Startups & How Much Funding They Raised

Below are 10 high-profile unicorn startups that failed despite raising significant funding. These companies operated across different industries, geographies, and market conditions, yet they share a critical commonality: capital alone could not prevent failure.

-

Solyndra: Raised $1.2 billion in clean energy funding before collapsing under high manufacturing costs and shifting market dynamics.

-

Arrivo: Secured $1 billion to build hyperloop-style transport systems but failed due to execution complexity and regulatory challenges.

-

Jawbone: Raised $929.9 million in consumer hardware funding but struggled with product reliability, margins, and competition.

-

The Verge (Media Arm): Raised $305 million, yet faced sustainability and monetization challenges in a highly competitive digital media market.

-

Beepi: Raised $149 million but collapsed due to aggressive expansion and unsustainable unit economics.

-

Juicero: Raised $118.5 million and became a symbol of overengineering without sufficient customer value.

-

Yik Yak: Raised $73.5 million but failed to retain users after early viral growth.

-

Shyp: Raised $62.1 million but struggled with logistics costs and operational scalability.

-

PepperTap: Raised $51.2 million and failed due to thin margins and intense competition in hyperlocal delivery.

-

Doppler Labs: Raised $51.1 million but faced product-market fit and hardware adoption challenges.

Despite operating in different markets and business models, these startups exhibited five recurring failure patterns, from flawed cost structures to execution gaps, that remain highly relevant for founders building in the AI-driven, capital-efficient startup era of 2026.

Read More: Best Automation Software in 2026: Top Platforms to Streamline Workflows & Boost Efficiency

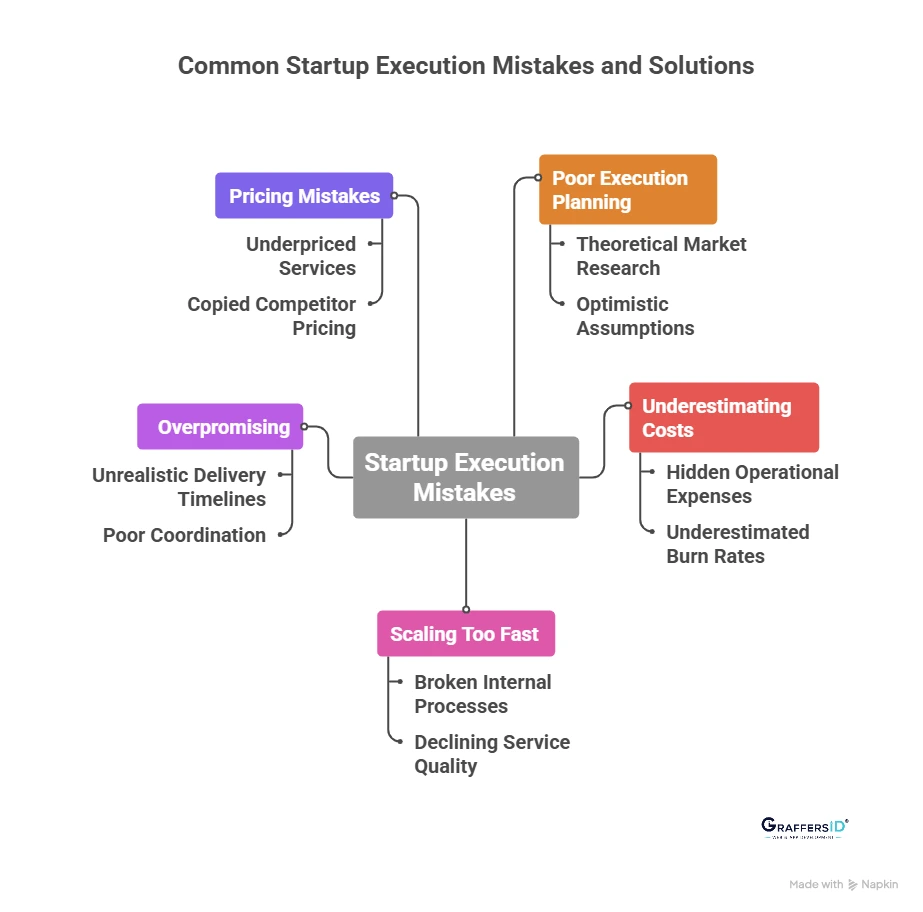

Common Execution Mistakes That Cause Even Funded Startups to Fail

Lesson 1: Poor Execution Planning Is One of the Biggest Reasons Startups Fail

“A startup idea can look perfect on paper, and still fail during execution.”

What Went Wrong?

Many failed unicorn startups focused heavily on ideas and vision, but failed at execution planning. Their decisions were driven by:

-

Theoretical or outdated market research

-

Optimistic assumptions without validation

-

Investor-driven growth timelines instead of customer reality

Once real customers entered the picture, these assumptions collapsed. In fact, most failed startups discovered their early hypotheses were wrong only after burning significant capital.

2026 Reality Check

In today’s AI-powered startup ecosystem, speed is an advantage, but poor execution now destroys startups faster than ever. Automation and AI tools amplify both good and bad decisions.

What Founders Should Do Instead?

To avoid common startup execution mistakes, founders should:

-

Validate ideas using low-risk MVPs

-

Launch pilot versions before full-scale rollout

-

Test assumptions early using:

-

No-code MVP builders

-

AI prototyping tools

-

Direct customer interviews and feedback loops

-

Key Questions Every Founder Must Answer Early

-

How will we realistically acquire the first 100 users?

-

What does the actual delivery workflow look like?

-

What is our financial failure threshold?

-

How many months of real runway do we have if growth slows?

Lesson 2: Underestimating Costs Is a Silent Startup Killer

“Funding delays failure, but it doesn’t fix broken economics.”

What Went Wrong?

One of the most common startup mistakes is misjudging costs. Many unicorns either:

-

Ignored hidden operational expenses, or

-

Severely underestimated monthly burn rates

This created the illusion of growth while quietly destroying sustainability.

Commonly Overlooked Startup Costs

-

Founder salary vs. company profitability

-

Hiring, onboarding, and attrition costs

-

SaaS tools and AI subscriptions

-

Cloud infrastructure and security

-

Travel, sales meetings, and onboarding

-

Culture and retention expenses

2026 Startup Cost Planning Framework

To avoid cash flow mistakes, founders should:

-

Clearly separate:

-

Founder income

-

Company reserves

-

Operational expenses

-

-

Use rolling 12-month forecasts, supported by AI tools

-

Always maintain a worst-case runway scenario

Lesson 3: Scaling Too Fast Breaks Startups from the Inside

“Growth without control creates chaos, not success.”

What Went Wrong?

Many unicorn startups failed because they scaled:

-

Too quickly

-

Across too many markets

-

Without leadership and operational readiness

The result was predictable:

-

Broken internal processes

-

Declining service quality

-

Rising customer churn

Smart Scaling Strategy for Startups in 2026

Successful startups now scale intentionally, not aggressively:

-

Expand one market at a time

-

Use AI-driven analytics to forecast demand

-

Delegate early with clear ownership and accountability

Proven Startup Scaling Checklist

-

Defined KPIs for each growth stage

-

Dedicated leaders for new regions or verticals

-

Clear internal communication systems

-

The discipline to say no to bad growth

Lesson 4: Overpromising Is a Fast Way to Lose Trust and Customers

“Sales promises don’t matter if delivery can’t keep up.”

What Went Wrong?

Many startups collapsed due to:

-

Unrealistic delivery timelines

-

Poor coordination between sales and execution teams

-

Underpriced contracts with oversized scope

Industry data shows that over 70% of projects miss deadlines, which is fatal for early-stage startups trying to build trust.

How Founders Can Fix Execution Gaps?

-

Add a 30% buffer to delivery timelines

-

Validate the scope internally before closing deals

-

Maintain written documentation and sign-offs

Golden Rule: Never let sales grow faster than delivery capacity.

Lesson 5: Pricing Mistakes Destroy Long-Term Startup Sustainability

“Cheap pricing attracts the wrong customers and kills margins.”

What Went Wrong?

Many startups failed because they:

-

Underpriced their services

-

Copied competitors without understanding costs

-

Failed to communicate real value

Low pricing may win early deals, but it erodes profitability and positioning.

Winning Startup Pricing Strategy in 2026

-

Price based on outcomes, not hours

-

Demonstrate value through pilots and demos

-

Be transparent about pricing logic

-

Accept that not every client is a fit

Apple’s success reinforces a core principle: customers trust value more than low cost.

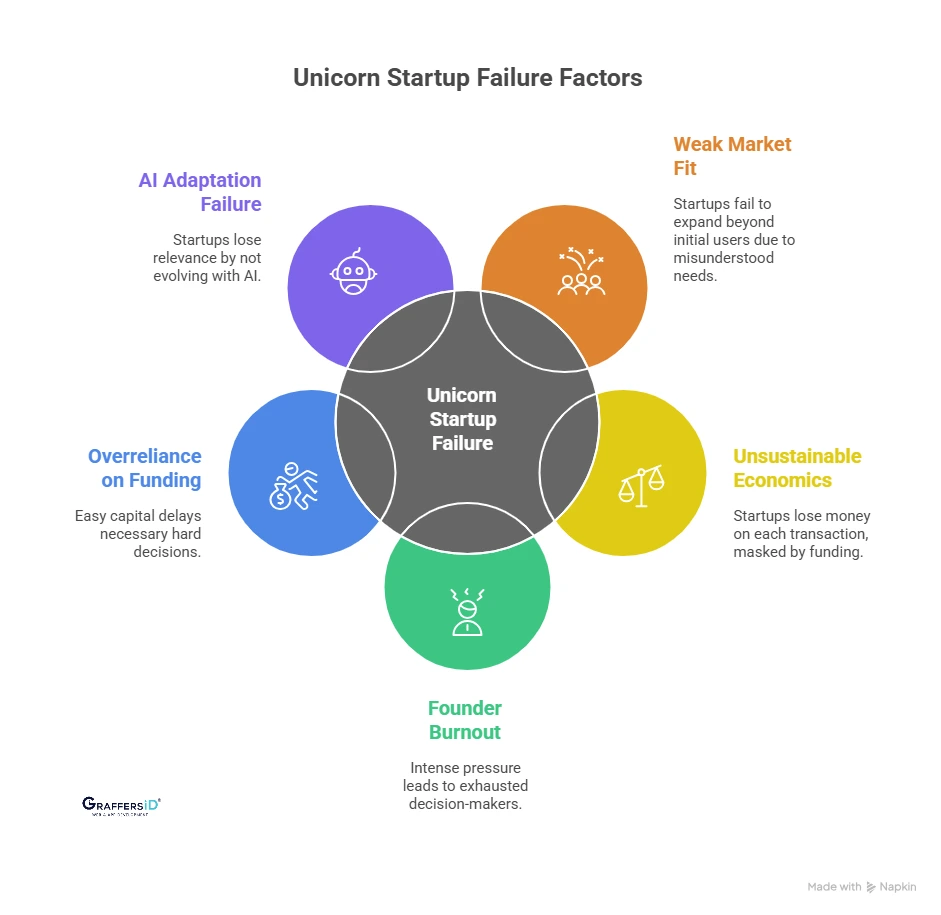

Why Unicorn Startups Fail Even After Raising Funding?

Even after raising millions or billions in funding, many unicorn startups still fail. Capital provides speed and visibility, but it cannot fix weak fundamentals. In fact, excessive funding often amplifies underlying problems rather than solving them.

Below are the most common reasons why unicorn startups fail despite funding, based on patterns seen across high-profile collapses.

1. Weak Market Fit at Scale

Many startups show early traction but fail when expanding beyond their initial user base. What works for early adopters often does not translate to a broader market.

-

Customer pain points are misunderstood or overestimated

-

Product solves a niche problem that doesn’t scale

-

Growth is driven by incentives, not real demand

AI-era insight (2026):

With faster go-to-market cycles enabled by AI, startups now reach scale quicker, meaning poor market fit is exposed earlier and more brutally.

2. Unsustainable Unit Economics

Several unicorns grow revenue but lose money on every transaction. Funding masks the problem temporarily, but losses compound as the company scales.

-

High customer acquisition costs (CAC)

-

Low lifetime value (LTV)

-

Heavy discounts and incentives to maintain growth

Key takeaway:

If unit economics don’t work at a small scale, they won’t work at a billion-dollar scale.

3. Founder Burnout and Leadership Fatigue

Hypergrowth creates intense pressure on founders and leadership teams. Many unicorn failures trace back to exhausted decision-makers.

-

Constant fundraising distractions

-

Short-term thinking under investor pressure

-

Inability to build strong second-level leadership

In 2026, founders are expected to manage products, teams, AI strategy, and investor expectations simultaneously, making burnout a growing risk.

4. Overreliance on Funding Instead of Execution

Easy access to capital often delays hard decisions.

-

Inefficient processes remain unfixed

-

Poor-performing teams are retained

-

Product and customer feedback loops are ignored

Funding should support execution, not replace discipline.

5. Failure to Adapt to AI-Led Market Disruption

Startups that don’t evolve with AI-driven changes quickly lose relevance.

-

Manual workflows where automation is expected

-

Slower decision-making than AI-native competitors

-

Outdated pricing, delivery, or support models

In today’s market, AI is no longer optional; it’s a competitive baseline.

In simple terms: Unicorn startups fail despite funding because capital cannot fix weak market fit, poor unit economics, founder burnout, execution gaps, or slow adaptation to AI-driven disruption.

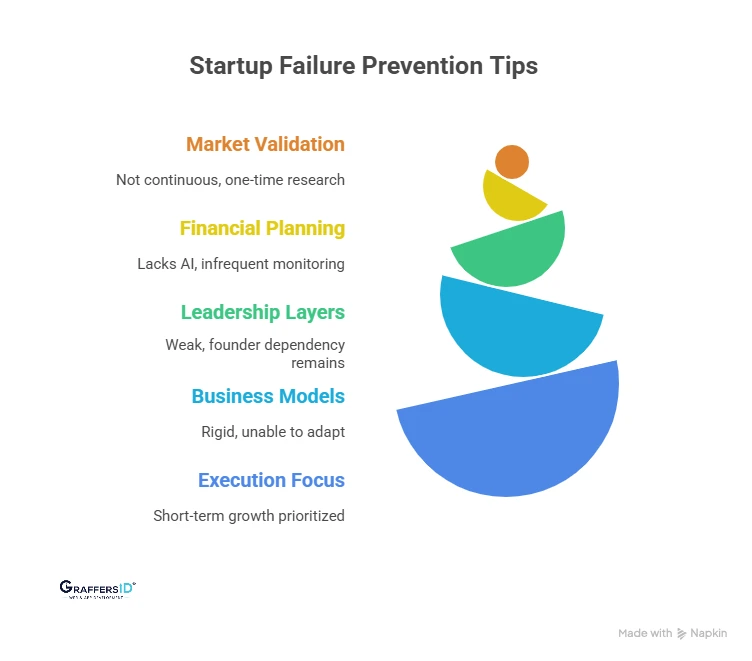

Best Practices to Prevent Startup Failure in 2026

Modern startups don’t fail because of a lack of ideas or funding; they fail due to poor execution, weak decision systems, and an inability to adapt. Founders who successfully scale in 2026 follow a disciplined, data-driven approach focused on sustainability, not hype.

1. Continuous Market Validation (Not One-Time Research)

Successful founders treat market validation as an ongoing process, not a launch checklist. Customer needs evolve rapidly, especially in AI-driven markets.

Best practices:

-

Collect real-time customer feedback through product analytics and user interviews

-

Validate features before full-scale development using MVPs and pilots

-

Regularly test pricing, messaging, and positioning

2. AI-Assisted Financial Planning and Cost Forecasting

In 2026, founders use AI tools to predict burn rate, optimize costs, and extend runway.

Best practices:

-

Use AI-powered financial modeling to simulate best- and worst-case scenarios

-

Monitor cash flow, unit economics, and margins monthly, not quarterly

-

Separate the founder’s salary, operational costs, and profit clearly

3. Build Strong Leadership Layers Early

As startups scale, founders can no longer manage everything themselves. Strong leadership layers reduce dependency on a single decision-maker.

Best practices:

-

Hire or promote leaders for product, engineering, sales, and operations

-

Clearly define ownership and decision authority

-

Encourage transparency and fast internal communication

4. Design Flexible and Adaptable Business Models

Rigid business models break when markets shift. Flexible startups pivot faster and survive longer.

Best practices:

-

Design modular products and services that can evolve

-

Stay open to changes in pricing, distribution, or customer segments

-

Monitor competitors and industry trends continuously

5. Focus on Long-Term Execution Over Short-Term Growth

Short-term growth often hides long-term weaknesses. Sustainable startups prioritize execution quality.

Best practices:

-

Set realistic growth targets aligned with operational capacity

-

Optimize processes before scaling aggressively

-

Measure success through customer retention, not just acquisition

To prevent startup failure in 2026, founders must focus on continuous market validation, AI-driven financial planning, strong leadership teams, flexible business models, and disciplined long-term execution.

How Successful Startups Scaled Differently? Real Growth Lessons From Top Companies

1. Facebook: Growth Through Trusted, Closed Communities

Facebook didn’t start as a global social network. It began by leveraging closed, high-trust networks, initially limited to Harvard students and later expanded to other universities.

By restricting access, Facebook created:

-

Strong early engagement

-

Organic word-of-mouth growth

-

Built-in social proof

Takeaway: Startups that grow fastest today still follow this model: own a niche community first, build trust, then scale outward.

2. Alibaba: Scaling With Relentless Market Education

Alibaba’s early growth wasn’t driven by digital ads or automation. Jack Ma focused on direct, offline sales execution, sending teams to manufacturers across China.

These teams:

-

Educated businesses on how e-commerce could scale revenue

-

Helped sellers adopt digital workflows

-

Built long-term platform dependency

Takeaway: When markets are not fully digital-ready, education-driven sales beat pure technology.

3. Uber: Timing, Relevance, and Purpose-Led Growth

Uber combined aggressive expansion with perfect timing and cause-driven campaigns. One of its early breakthroughs came during public transport strikes, when Uber positioned itself as a real-time solution, not just a convenience.

Campaigns tied to:

-

Local events

-

Cultural moments

-

Social causes

Takeaway: Successful startups don’t just market products; they insert themselves into real-world problems at the right moment.

4. Airbnb: Winning Through Obsessive Customer Trust

Airbnb faced a massive trust barrier, convincing people to host strangers in their homes. Instead of scaling blindly, the founders focused on manual trust-building.

They:

-

Visited hosts in person

-

Used professional photography

-

Personally onboarded early users

Takeaway: In trust-sensitive industries, manual processes early on create scalable trust later.

5. Tinder: Hyper-Targeted Distribution With Built-In Virality

Tinder’s early growth wasn’t accidental. The team identified a clear target audience, college students, and met them where they already were.

By:

-

Seeding profiles before launches

-

Driving adoption at campus events

-

Designing viral loops into onboarding

Tinder achieved rapid network effects.

Takeaway: Growth accelerates when distribution is intentional, and virality is built into the product, not added later.

Final Takeaway: Execution, Not Just Funding, Drives Startup Success

The failures of high-profile unicorns prove a critical lesson: capital alone does not guarantee success. In fact, funding often amplifies operational flaws and strategic missteps faster than it accelerates growth.

In 2026, the startups that thrive share four key traits:

-

Capital-efficient: Smart use of resources without overspending

-

AI-enabled: Leveraging AI tools for automation, insights, and scalability

-

Execution-obsessed: Prioritizing disciplined delivery over flashy launches

-

Customer-first: Delivering consistent value to build trust and loyalty

If you are building or scaling a product today, the lesson is clear: execution is the engine, funding is the fuel.

GraffersID empowers founders to execute smarter, faster, and sustainably. Our services include:

-

Expert AI developers for automation and product intelligence

-

Remote tech teams to scale development efficiently

-

Custom web and app development aligned with your growth goals

-

AI-powered automation solutions to reduce costs and accelerate time-to-market

Partner with GraffersID to turn your vision into a capital-efficient, AI-driven, and execution-focused startup.

Contact GraffersID today to build smarter, faster, and sustainably.