Do you want to elevate your Neobank app idea with a cutting-edge Neobank platform? Our team of expert Neobank software developers is here to turn your vision into reality. Picture a Neobank system that goes beyond transactions, offering a seamless and user-friendly experience for all your clients.

At GraffersID, our team of experienced fintech developers specializes in custom neobank development solutions to deliver secure and efficient Neobank app development services to your clients. Impress your customers with a unique Neo-bank application tailored to their needs. If you're looking to develop an exceptional Neo-bank app and enhance customer engagement, hire Neo developers from GraffersID today, and let's revolutionize banking together.

Talk to our team for custom pricing

The financial industry is evolving rapidly, and neo-banks, also known as digital banks, are gaining popularity over traditional banks by transforming online business transactions. These banks leverage mobile and user-friendly technology to revolutionize conventional Neobank models, offering clear and accessible financial services. Unlike traditional banks, neo-banks operate exclusively in the digital space without physical branches, providing all their Neobank app development services through mobile apps or web platforms. What sets them apart is their unwavering commitment to delivering a seamless and user-friendly banking experience.

Talk to our team for custom pricing

The global neobanking market, valued at $262.362 billion in 2025, is expected to reach $2,048.53 billion by 2030, growing at a CAGR of 54.8% from 2025 to 2030.

The Asia-Pacific region is projected to experience rapid growth during this period, with an average annual growth rate of 52.7% CAGR between 2023 and 2030. Meanwhile, the European market follows closely with a growth rate of 60.9%.

In the U.S., neo-banks have demonstrated a strong market presence, securing over $12 billion in funding in 2021.

The number of American customers using neobanks is expected to exceed 100 million in 2023 and reach approximately 376.9 million by 2027.

Talk to our team for custom pricing

Our Neobank system software enables customers to connect with us and access our Neobank app development services. However, recent changes in the update process have resulted in a 25% increase in negative complaints. To address this, our team of neo bank developers is dedicated to enhancing efficiency throughout the update cycle, from development and testing to deployment and monitoring. Therefore, we require DevOps specialists to streamline these processes and ensure seamless operations.

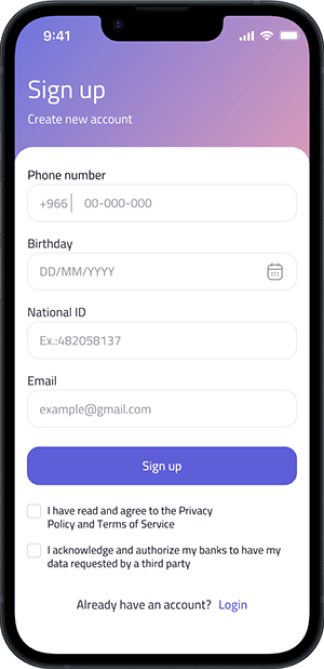

Currently, our onboarding process has a 15% abandonment rate. To improve onboarding times, we are committed to developing more user-friendly mobile apps and web interfaces. As a result, only 10% of our clients successfully explore all the features available online and within the Fintech Mobile App Development Services. Our goal is to enhance user adoption and engagement.

We plan to introduce a new range of products in our Neobank system to provide customers with clear insights into their spending patterns and categories. Additionally, we aim to leverage this data to develop personalized products tailored to each customer segment. According to our research, this initiative is expected to drive the next phase of our startup’s growth, with an estimated 400% increase in revenue and at least four new products per customer category.

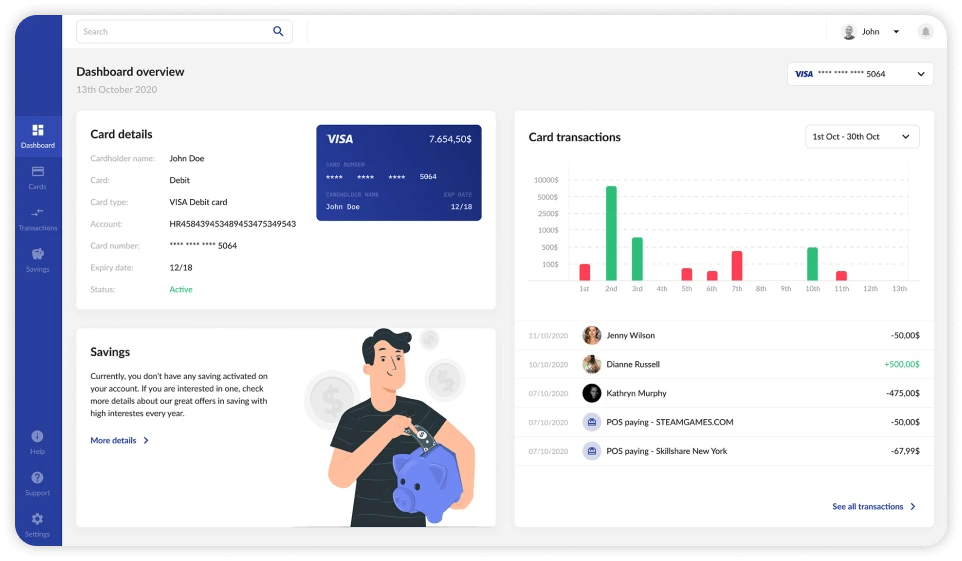

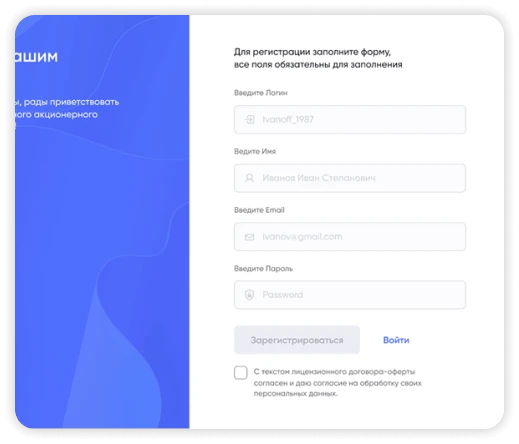

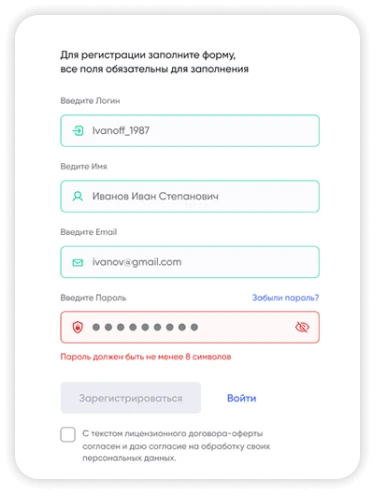

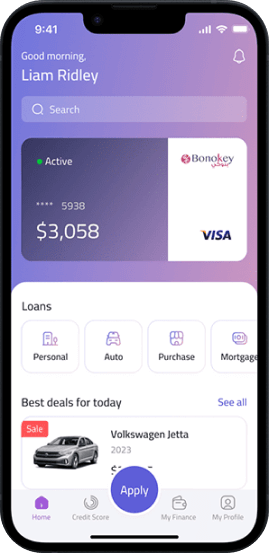

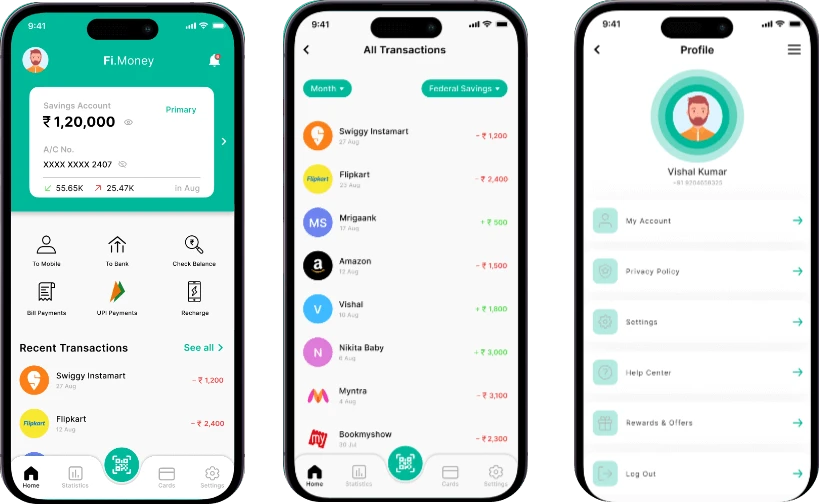

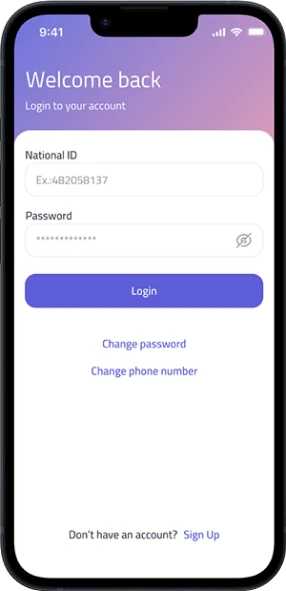

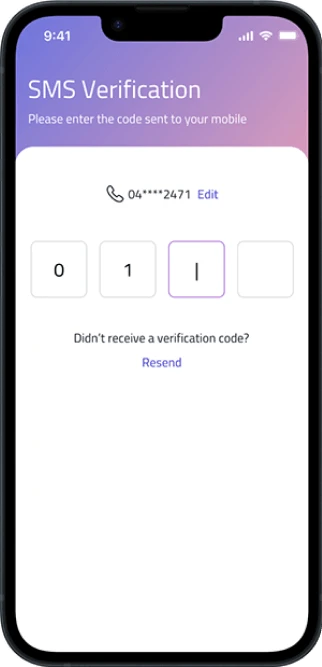

Effortless Account SetupThis user-friendly mobile app and web interface ensure a seamless onboarding experience while maintaining ease of use. Advanced biometric authentication strengthens security features.

Transparent Fee StructuresBy leveraging the cost-efficiency of digital operations, these Neobank app platforms offer competitive interest rates and lower fees. Automated financial tracking and budgeting tools provide users with valuable financial insights.

Customizable Financial ProductsAdvanced financial software utilizes sophisticated algorithms to analyze user-provided data, recommending tailored financial options such as personal savings accounts and investment policies. APIs integrate seamlessly with data analytics to offer custom neobank development solutions.

Enhanced Security MeasuresUser security is a top priority for these Neobank app platforms. They provide instant transaction alerts, the ability to freeze cards via mobile apps, and robust two-factor authentication (2FA). Security is further enhanced through encryption and biometric authentication.

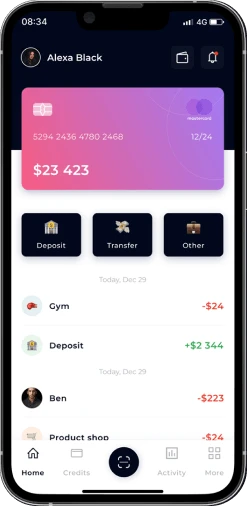

Seamless Fund TransfersIntegrated payment APIs enable effortless fund transfers, allowing users to send money securely to peers and process quick, secure international transactions.

Round-Up SavingsImplement a feature that allows the Neobank app platform to automatically round up deals and save the spare change; a move that is intended to encourage the behavior of saving.

Cashback Rewards Offer cashback enticements for specific spending types like mobile recharge, bill payments, etc or through Neo bank partnerships.

AI-Powered Financial InsightsMachine learning (ML) and artificial intelligence (AI) calculations examine how people behave when they spend money to provide useful information on their economic behavior. This way, clients feel more confident managing their money.

Instant Account OpeningThe neo bank application allows users to open a new bank account instantly, without the need for physical paperwork. Through a fully digital process, users can verify their identity, submit documents, and set up their account in minutes. This feature ensures a seamless onboarding experience, enabling customers to start managing their finances immediately.

Real-Time Financial TrackingTransactions can be tracked and categorized in real-time using fintech mobile apps, which allow users to get instant notifications in case money is spent or received so that they control everything that is related to their finances.

Virtual and Disposable CardsDevelopments in technology allow people to produce virtual or non-reusable retail cards that make their online shopping secure. This creative aspect boosts security by minimizing the chances of exposing confidential information about one’s card.

Contactless PaymentsHelp in enabling contactless payments, including NFC technology, and digital wallets such as Apple Pay and Google Pay.

Multi-Currency SupportThese Neobank platforms often provide accounts and cards likely used to hold multiple currencies, thus facilitating transactions in multiple currencies without any hidden charges.

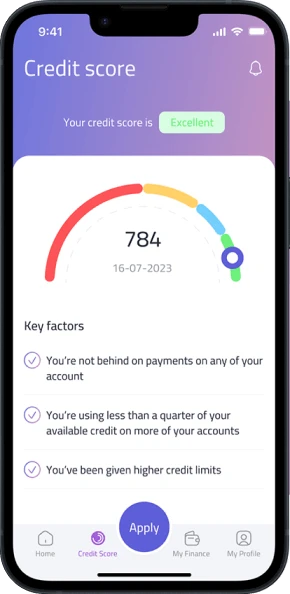

Credit Building ToolsInclusive credit-building aspects involve monitoring one’s credit score and accessing credit lines. The linking with credit bureaus and scoring APIs provides an opportunity for users to enhance their financial situation.

Instant Customer SupportThe team prioritizes customer support which ensures rapid assistance due to in-app chatbots and live chat features. Integration with CRM systems maximizes customer support productivity.

From Security to Code Quality we have got your covered

GraffersID offer a ready to join pool of in-house developers

who you can trust with your code and product.

Mandatory NDA Resources

Restricted Data Sharing

Manage As you Like

Complementary Tracking Tools

Direct Control of Resources

Connect with GraffersID experts to hire remote developer on contractual basis.