Welcome to GraffersID, where you can unlock the potential of your insurance solutions with the help of hiring our InsurTech developers. That's why our professionals — our developers — are dedicated to clarifying and improving your insurance processes. Whether you are an established insurer or a new InsurTech disruptor, our team is your ally in developing strong and intuitive solutions.

Whether it's claim processing or policy management, we strive for solutions that improve business productivity and customer satisfaction. Let’s start the evolution of the insurance industry together. Invest in the development of InsurTech and other market players to benefit from today’s advantages in the rapidly evolving digital environment. Get in touch with our team and fill out the form to use the most popular marketing service on the market and get started!

Talk to our team for custom pricing

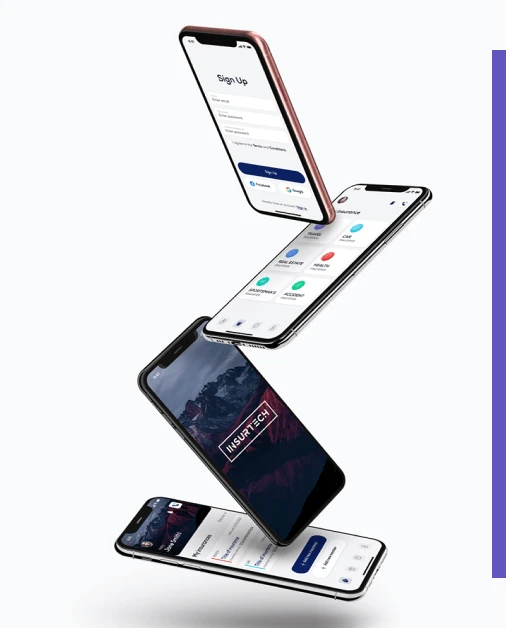

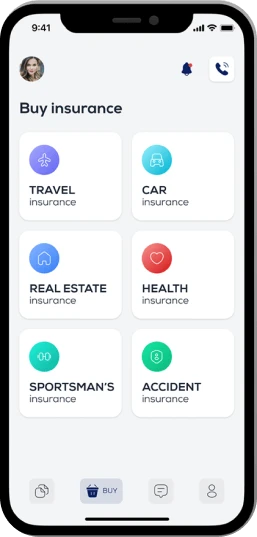

It's worth noting that the insurance industry has never been very liberal, but in the recent past, it has undergone a drastic change, mainly due to Insurtech. Insurtech is a composite term that encompasses “insurance” and “technology” and is taking the practice of insurance products in a new direction. The categorization of the global InsurTech market includes product type, distribution channel, and geographic regions. The market by product type consists of general insurance, motor insurance, life insurance, property and casualty insurance, health insurance, and others.

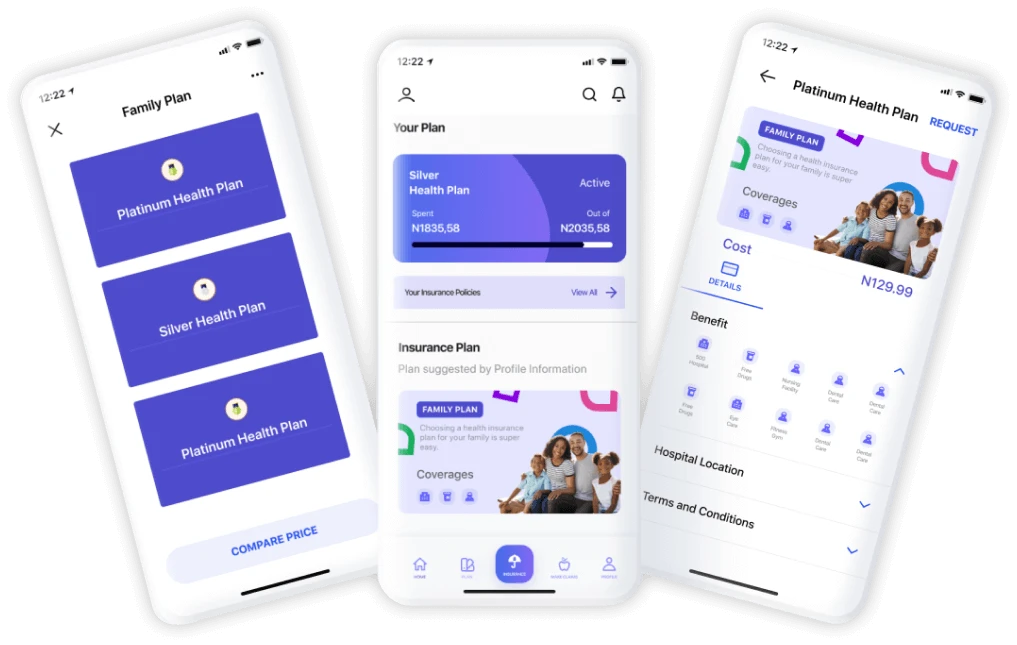

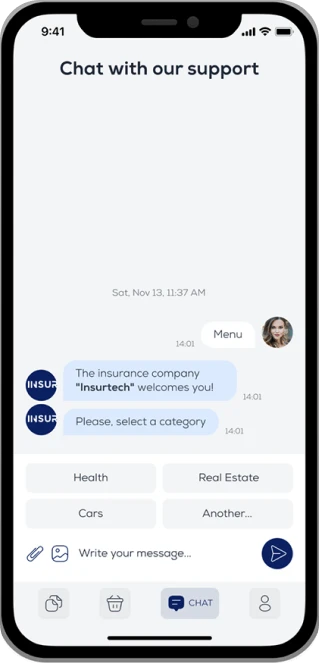

Insurtech platforms offer a detailed comparison of various insurance products from different insurance providers enabling the customers to select the best insurance for their needs with complete transparency. These platforms provide info, subscription, management, claim application, claim tracking, and settlement among all other features.

Talk to our team for custom pricing

The global market for InsurTech amounted to 10,553 million dollars. When asked for an estimate of Microsoft’s total revenue for 2021, they stated that it was $94 billion and they expect it to be $27.12 billion by 2026, a compound annual growth rate of 18%. A decrease of 6 is forecast for the period from 2022 to 2026.

Among all countries, the United States is the leading market for InsurTech, followed by Europe and China in second and third place. Even the Asia-Pacific region is lagging with a growth rate of 22.4% CAGR.

Life insurance is the largest segment in terms of InsurTech, followed by property and health insurance.

Global InsurTech companies received funding of over 7.1 billion dollars in 2020.

Talk to our team for custom pricing

We have invested many months in the integration process with most insurers to ensure a smooth flow of products and customer applications. As we grow, we would like to expand our list of cooperating insurance companies. The process is quite time-consuming and can involve a lot of work. We need at least 10 developers to increase the number of insurance companies and achieve market penetration.

The fact that we have more than 10 million users on our portal means that we have a huge amount of data, around 100 TB, which we would like to turn into a single dashboard from which fully comprehensive strategies can be derived to develop a suitable user profile for each user and their spending capacity. This would allow us to develop new insurance products and recommend the right insurance products to our customers.

Introducing changes in the existing processes to enhance the flexibility and productivity of the organizational systems. What concerns us is the scalability and general architecture; we would like to avoid the involvement of many people in the claims-management process and use automation to increase the speed of operations and the speed of payments to customers. We are interested in sophisticated approaches to accelerating the analysis of claims by 30 percent.

Effortless Application ProcessOnline Lending Platforms present clear and easy to use web-sites and applications through which a borrower may apply for a loan. Applicants can fill out the forms for loans without much time and without the need to go to the lender physically.

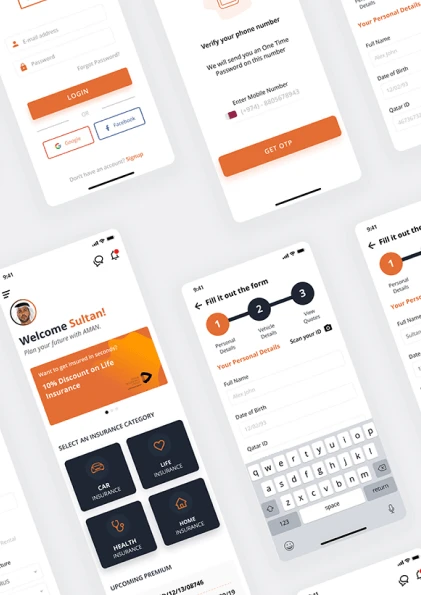

Policy ComparisonA tool that gives users the ability to select the kind of policy they want and not one by default; a tool that brings in competitiveness so that users and customers get to decide on which policy to take.

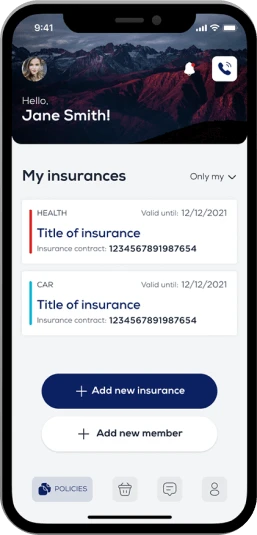

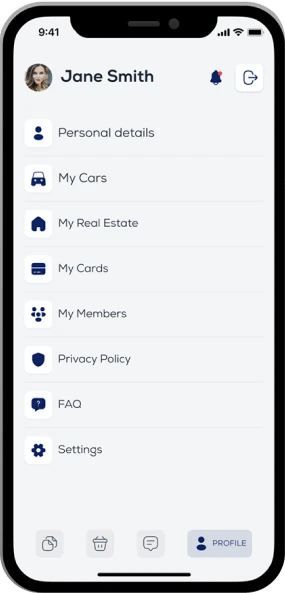

Easy Policy ManagementEfficient policy acquisition and administration that will allow a user to quickly get a policy, renew it, or to alter existing policy.

Digital Claims SubmissionAn online simple and efficient system for the submission of claims; for uploading of documents and check status of the claims.

Claim TrackingSome of the features include real-time visibility of users on the progress of their claims from the time they submit them to the time they are settled.

Instant QuotesInstant and easy-to-use quote process for different insurance plans and the ability of a customer to make a side by side comparison between the plans and prices.

Document Repository Policy documents and certificates, receipts which are related with insurance can be stored in one place and the user can find them easily.

Real-time NotificationsNewsletter with on-going policy changes, Due dates of policy premium payments, Approvals of users’ claims to enhance user engagement.

Live Chat SupportIn-app live chat for timely help, queries, and claim related issues, it improves the customer support experience.

Mobile AccessibilityInstant and easy reach on mobile applications where policy holders have an easy time learning about policies and filing for claims.

From Security to Code Quality we have got your covered

GraffersID offer a ready to join pool of in-house developers

who you can trust with your code and product.

Mandatory NDA Resources

Restricted Data Sharing

Manage As you Like

Complementary Tracking Tools

Direct Control of Resources

Connect with GraffersID experts to hire remote developer on contractual basis.