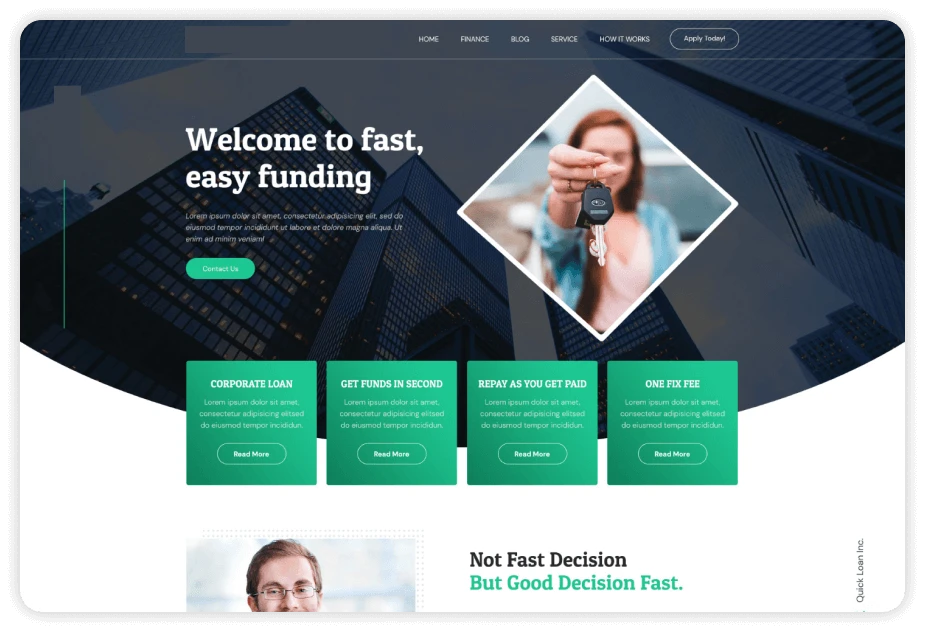

Do you want to transform your loan services into a seamless online experience? Don't worry— our dedicated financial software developers committed to making your dream of an online lending platform a reality.

At GraffersID, our online lending software developers specialize in crafting customized solutions for fintech companies and banks like yours, helping you stand out in the competitive online lending market. We understand the evolving landscape of modern lending and its strong reliance on technology. Whether you're launching a new fintech venture or looking to enhance your existing institution, we're ready to collaborate with you to develop a platform that exceeds your expectations. Fill out this form to hire p2p developers for your project.

Talk to our team for custom pricing

Online lending is a prime example of financial innovation that has transformed the traditional borrowing and lending process. It leverages digital platforms to connect individuals in urgent need of funds with those willing to lend in exchange for interest. These platforms have played a pivotal role in reshaping the lending landscape, making capital more accessible to both individuals and businesses. In today's digitally driven financial era, services have evolved significantly, reflecting the rapid pace of innovation.

Online lending platforms offer a convenient and efficient way for borrowers to access loans at competitive rates. They also promote financial inclusion by serving individuals with limited credit histories. However, some users may find it challenging to navigate these platforms, especially when participating in loans across different risk profiles. Additionally, online lending platforms provide investors with alternative investment opportunities, allowing for portfolio diversification and potentially high returns. By leveraging advanced algorithms and data analytics, these platforms make precise loan decisions, helping to minimize default rates.

Talk to our team for custom pricing

According to studies, the global online lending market is valued at $12,165.09 billion in 2025 and is expected to grow to $45.29 billion by 2029, with a compound annual growth rate (CAGR) of 23.7%.

In 2024, peer-to-peer (P2P) lending had fully deployed $167.9 billion in loans, while buy-now-pay-later (BNPL) schemes emerged as the most profitable forms of consumer credit.

China and India lead the Asia-Pacific region, with their online credit market share exceeding 40%, while the market is rapidly expanding in North America and Europe.

By the end of 2024, approximately 55 out of every 100 mobile devices registered on the Internet worldwide were used to access financial solutions.

Talk to our team for custom pricing

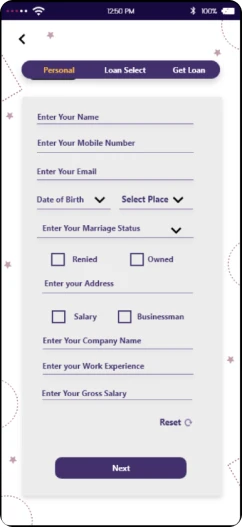

As we scale up, we increasingly rely on inefficient and error-prone manual processes. To streamline operations, it is crucial to automate routine tasks such as loan origination, document processing, and customer onboarding. Engaging a skilled technical team for automation not only enhances efficiency but also reduces operational costs. Addressing this challenge effectively requires the implementation of automation in these key processes

Currently, the platform maintains an average customer satisfaction rate of 75%. Our goal is to increase this to 90% within the next twelve months to remain competitive in the industry. Achieving this will be challenging, as it requires redesigning our website’s appearance and responsiveness to create a more intuitive interface. Fortunately, our UX team will collaborate closely with us, along with developers who understand user behavior, helping us retain more clients and enhance overall customer satisfaction.

Currently, our standard rates are operating at 10%, but we aim to reduce this default rate to below 5% by leveraging insights derived from data. However, this is challenging as it requires developing sophisticated models to make informed decisions on credit reductions in cases where borrowers fail to repay. To make progress, we begin by establishing simple guidelines that will guide us in this process.

Our operations currently rely heavily on manual processes, leading to slow workflows and occasional errors. To improve efficiency, we plan to automate various tasks, including customer risk assessment, loan processing, document validation, and credit score checks. This automation will save significant time and financial resources while reducing errors. By implementing routine automation, we aim to cut costs and reallocate resources to more strategic projects that align with the organization’s goals.

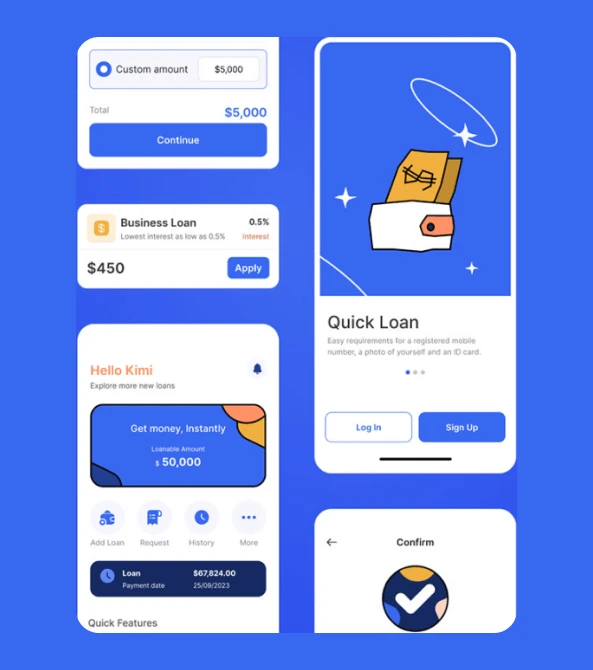

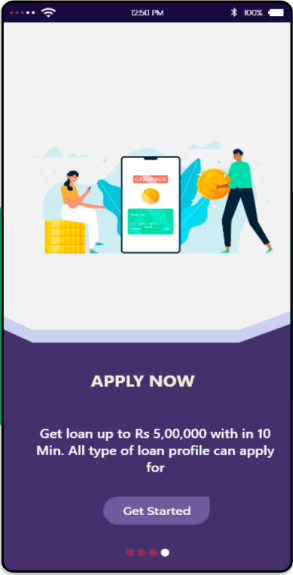

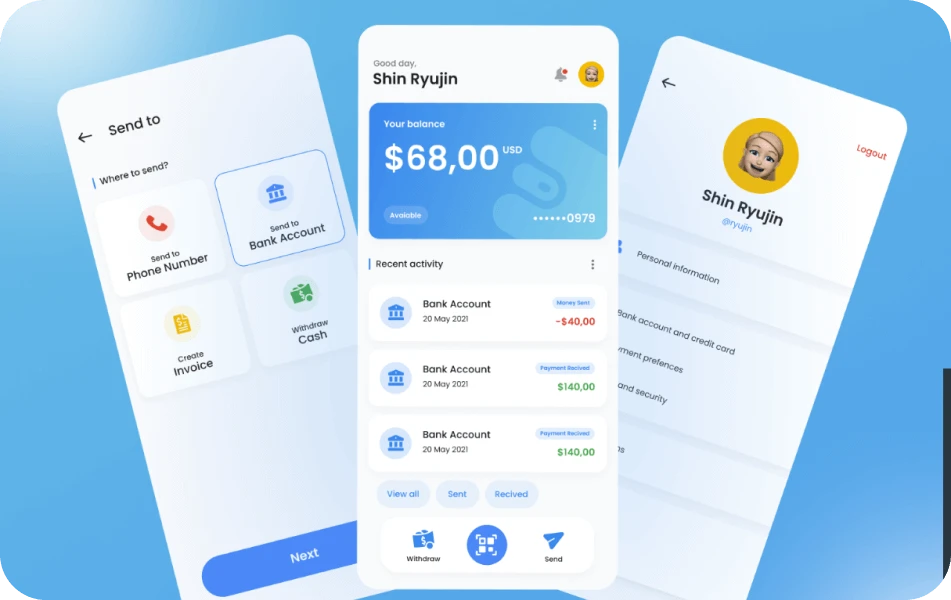

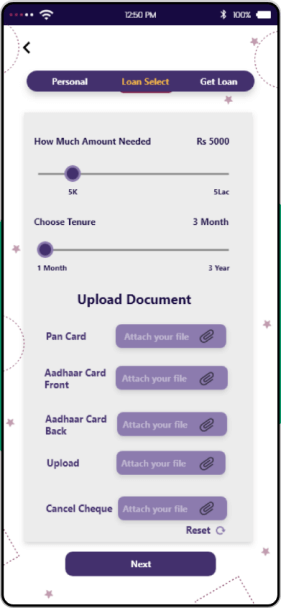

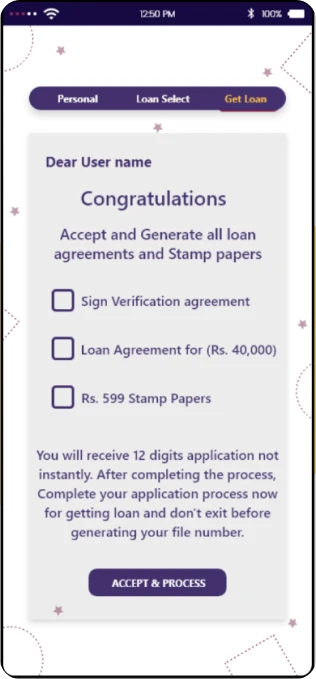

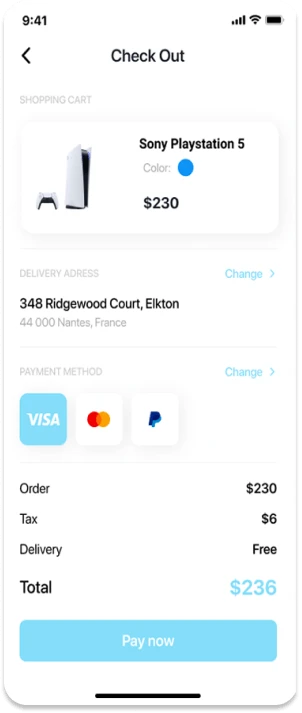

Effortless Application ProcessDigital lending platforms simplify websites and mobile apps, making it easy for users to apply for loans. This allows borrowers to complete their applications within seconds from the comfort of their homes, without compromising security.

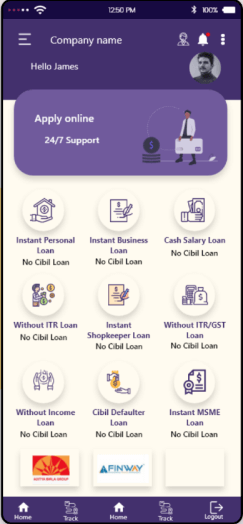

Alternative Credit Scoring AlgorithmsAdvanced algorithms assess creditworthiness based on various criteria, including credit history, income, and other less common indicators. These sophisticated methods enable platforms to more accurately determine who qualifies for credit, ultimately expanding access to financial opportunities for a broader range of individuals in need of loans.

MicroloansProviding micro-loans to support marginalized small businesses and individuals.

Automated UnderwritingAutomated underwriting utilizes self-programmed mechanisms to evaluate creditworthiness, income, and financial security.

Fast Approval and DisbursementThese digital processes enable rapid loan approval on such platforms. Once all approvals are completed, funds are quickly disbursed to borrowers' accounts, addressing urgent financial needs.

Personalized Loan ProductsOnline lending platforms leverage data analysis to offer customized loan options. This enables borrowers to determine the loan amount, repayment period, and interest rate based on their specific needs.

Transparent Terms and Fees Transparency is a key feature of these platforms. Borrowers receive clear information about terms, fees, and repayment schedules before accepting a loan, allowing them to make informed financial decisions.

Automated RepaymentAutomatic repayment features simplify the borrowing process. Borrowers can enable automatic deductions, minimizing the risk of missed payments.

Automated Debt CollectionImplement automated debt collection systems with follow-up reminders, notifications, and structured payment plans for overdue loans.

Secure Data HandlingAdequate measures for data security protect sensitive data for the borrowers. Encryption and secure servers protect data from cyber threats.

24/7 Customer SupportOnline lending software ensures round-the-clock assistance through live chat, email, or phone, providing instant query resolution, loan application guidance, and troubleshooting support for a seamless user experience.

Custom Loan MarketplaceAllow companies to develop their own unique, industry-specific online loan marketplaces.

Credit Building OpportunitiesCertain platforms assist borrowers in building or improving their credit scores by reporting positive repayment behavior to credit bureaus.

Investor Opportunities (P2P Lending)These platforms attract investors looking to diversify their portfolios by funding loans. Peer-to-peer lending models directly connect borrowers with investors.

Integration with Financial InstitutionsCollaborate with traditional banks and credit unions to expand borrowing options and funding sources.

Customizable lending-as-a-service platformProvide businesses and financial institutions with white-label solutions to help them launch their own digital lending platforms.

From Security to Code Quality we have got your covered

GraffersID offer a ready to join pool of in-house developers

who you can trust with your code and product.

Mandatory NDA Resources

Restricted Data Sharing

Manage As you Like

Complementary Tracking Tools

Direct Control of Resources

Connect with GraffersID experts to hire remote developer on contractual basis.