Welcome to the gateway of seamless transactions! Are you looking to revolutionize your business’s payment experience? Look no further! Our team of experienced payment gateway software developers is here to deliver customized payment gateway solutions tailored to your specific needs. From seamless transaction systems to secure and efficient payment processing, we build robust and user-friendly platforms that elevate your business to new heights.

Eliminate payment hassles with a seamless, efficient, and secure transaction experience. Our expert payment processing software developers specialize in building customized payment gateway software tailored to your company’s needs. Whether you're a startup or an industry expert, hire our skilled payment gateway developers for payment reengineering. At GraffersID, we pride ourselves on speed and reliability. Let us craft a custom payment gateway solution for you. Schedule a free consultation today!

Talk to our team for custom pricing

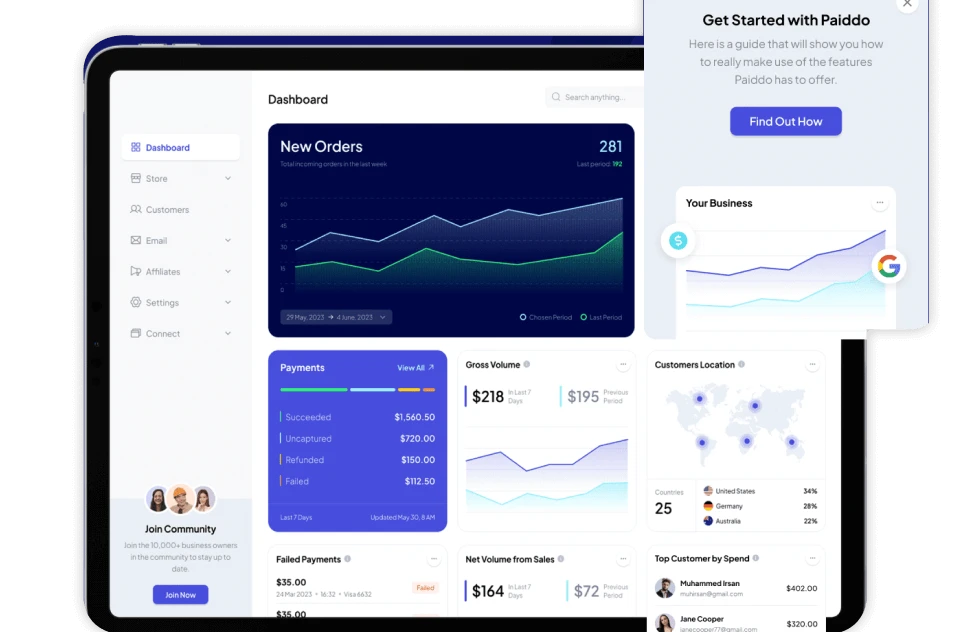

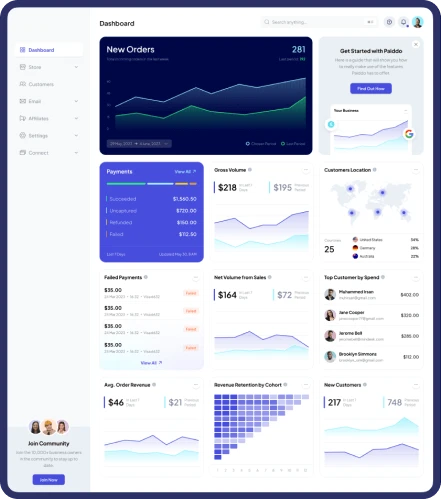

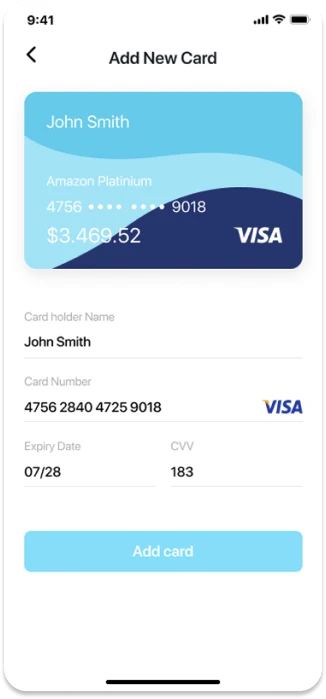

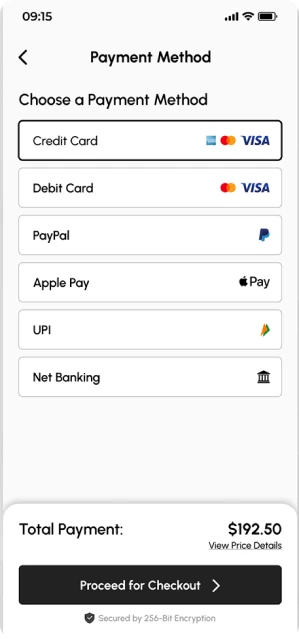

The Payment Gateway software is a flexible technology solution that serves as a bridge between various entities in the payment ecosystem. It enables online businesses to accept payments through multiple methods, including credit cards, debit cards, mobile wallets, and cryptocurrencies. Additionally, it ensures compliance with security standards and regulatory requirements throughout the transaction process.

In addition to processing transactions, payment gateway software solutions serves as the primary connection between a customer's payment request and the financial institution responsible for authorizing or settling the payment. It verifies the authenticity of payment details, encrypts sensitive information, and ensures the seamless transfer of funds within seconds.

Talk to our team for custom pricing

According to a report by Spherical Insights & Consulting, the global consumer finance market is projected to reach USD 1,160 billion by 2033, growing at a rate of 30.43%. .

The Payment Gateway market is projected to be valued at USD 18.94 billion in 2025 and is expected to grow to USD 40.53 billion by 2030, with a CAGR of 16.43%.

Research projects eCommerce market revenue to reach **US$4,324 billion** in 2025, with an **8.02% CAGR (2025-2029)**, reaching **US$5,887 billion** by 2029.

Online payments have grown to $137.43 billion in 2025, significantly transforming the landscape of digital transactions.

The Asia-Pacific region is expected to experience the highest rate of change in the future.

Talk to our team for custom pricing

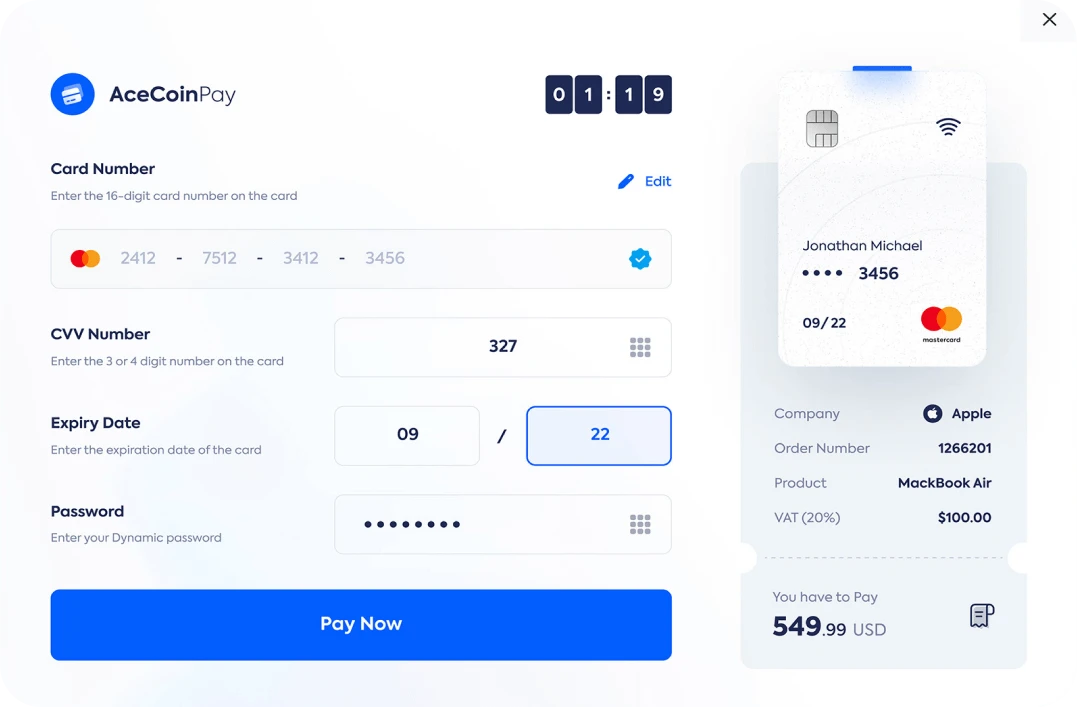

Payment Data Security

Handling a high volume of daily transactions, we prioritize payment data security as a critical aspect of our operations. Cyber threats have surged by 25% in the past year alone, underscoring the urgent need to strengthen security measures. Additionally, evolving compliance standards now impose fines of up to $500,000 per month for non-compliance. Therefore, continuous investment in security is essential, with PCI DSS 4.0 remaining a fundamental requirement for our online payment gateway platform.

Scalability Challenge

Our rapid growth has been remarkable, with a 35% increase in transaction volume last quarter. However, this expansion presents a significant challenge as we now process over a million transactions daily. Ensuring a stable infrastructure that can handle this traffic without downtime is crucial. With a projected 50% growth rate next year, inadequate scalability measures could lead to service interruptions, potentially resulting in customer loss.

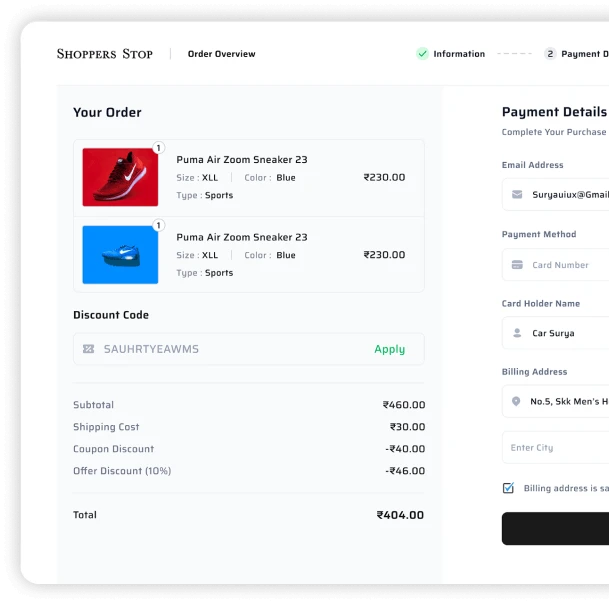

Payment Method Integration

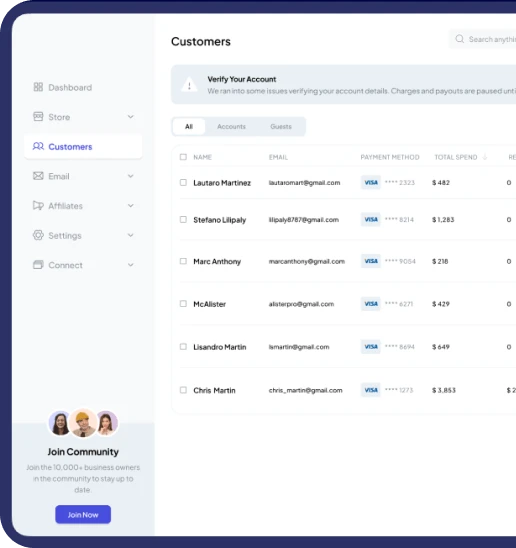

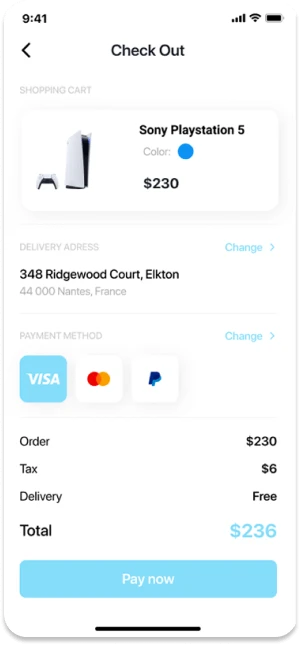

Our clients operate in 20 countries and require diverse payment options to meet their audience's needs. Integrating these methods, from credit cards to local e-wallets, can be time-consuming. On average, each payment method took approximately an hour to integrate last year, based on a total of 1,000 hours spent on new integrations in 2020. Since customers have requested five additional payment methods this quarter, we should allocate extra staff to expedite the process while maintaining high service quality.

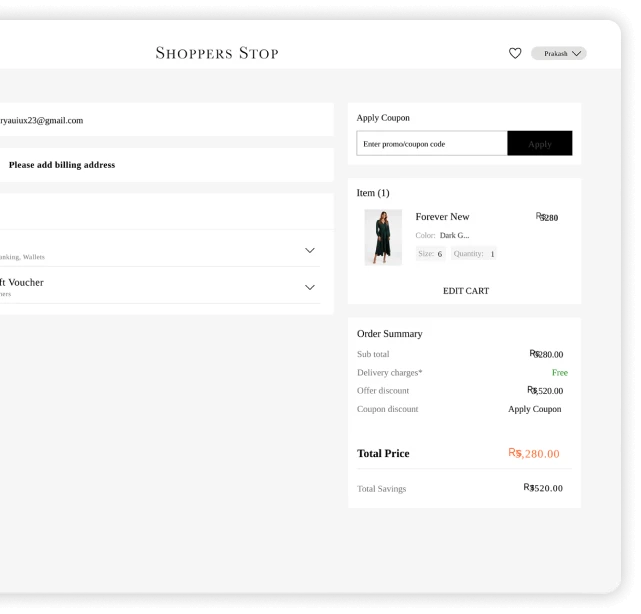

Improving User Checkout Percentage

While our customer base continues to grow, we have identified complexity as the primary reason why 30% of users abandon the onboarding process. This has resulted in an estimated revenue loss of approximately $250,000 over the past year. Optimizing the onboarding experience is essential for our company’s financial health, and we aim to reduce the drop-off rate to 10% within the next three months.

Secure Transaction ProcessingPayment gateway solutions enhance security during transactions by implementing advanced encryption mechanisms and robust security protocols like Transport Layer Security (TLS) to protect sensitive data.

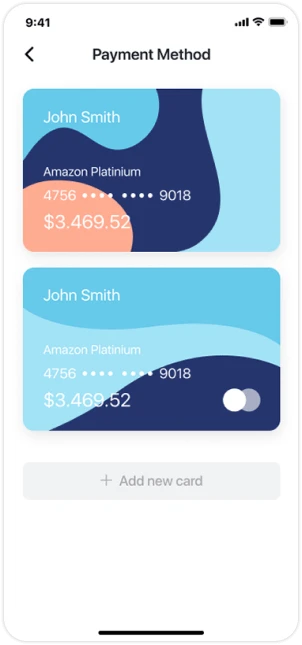

Multi-Platform CompatibilityTo ensure seamless transactions, payment gateway software systems support multiple platforms, allowing customers to make payments online, via mobile devices, or through card readers while maintaining flexible compatibility standards.

Multiple Payment OptionsA diverse range of payment methods is supported, including credit cards, digital wallets, bank transfers, and cryptocurrencies, providing customers with greater flexibility.

Biometric AuthenticationFor enhanced security and convenience, biometric verification methods such as fingerprint scanning and facial recognition are used for payment authorization.

TokenizationTo strengthen security and reduce PCI compliance requirements, tokenization replaces sensitive card data with unique tokens, minimizing the risk of data breaches.

Real-time Transaction MonitoringImplement advanced fraud detection algorithms and real-time transaction monitoring to create a secure and resilient payment ecosystem.

One-Click Checkout Streamline the checkout process by enabling one-click purchasing for registered customers, reducing cart abandonment rates.

Fault ToleranceEnsure uninterrupted service with fault-tolerant payment gateway systems. Data centers equipped with redundant hardware and failover mechanisms enhance system availability.

Subscription ManagementOffer advanced subscription management tools that enable businesses to automate recurring billing and easily modify subscription plans.

Dynamic PricingAllow companies to set personalized pricing based on customer behavior, location, and past transactions.

Fraud ProtectionLeverage advanced fraud detection systems to identify and prevent fraudulent transactions, enhancing overall security.

Cross-Border PaymentsFacilitate seamless cross-border transactions with competitive exchange rates and support for multiple currencies.

Two-Factor Authentication (2FA)Payment gateway softwares implement 2FA methods, such as one-time passwords (OTP) or biometric verification, during payment verification to strengthen security.

Multi-Currency SupportEnjoy hassle-free international purchases with automatic currency conversion, ensuring accurate pricing in various currencies.

Support Integration of PCI and DSS CompliancePayment gateway systems comply with PCI (Payment Card Industry) and DSS (Data Security Standard) at the highest level, ensuring secure data storage, encryption, and continuous security audits.

Recurring PaymentsHelp vendors set up and manage recurring payments for subscriptions or long-term memberships through automated billing and scheduled payments.

Peer-to-Peer PaymentsSimplify peer-to-peer payments, allowing users to transfer money directly to others without intermediaries, making personal transactions more convenient.

Digital InvoicingEnable businesses to request payments effortlessly by generating and sending digital invoices with embedded payment links.

From Security to Code Quality we have got your covered

GraffersID offers a ready-to-join pool of in-house developers who you can trust with your code and product.

Mandatory NDA Resources

Restricted Data Sharing

Manage As you Like

Complementary Tracking Tools

Direct Control of Resources

Connect with GraffersID experts to hire remote developer on contractual basis.