Every dollar saved through strategic financial planning can be reinvested for growth, innovation, or even weathering unexpected challenges. In this comprehensive guide, we delve into actionable financial strategies to optimize business expenses effectively.

What is Business Finance?

Business finance refers to the management of money and assets within a business entity. It involves making financial decisions, managing risks, and ensuring economic stability. Here’s a closer look at its significance and different forms.

Business finance plays a pivotal role in every stage of a company’s lifecycle. From startup funding to strategic investments, it impacts decision-making and business sustainability.

Key Components of Business Finance

To navigate financial waters effectively, understanding the key components of business finance is essential.

-

Financial Planning

Financial planning involves setting financial goals, creating budgets, and forecasting future financial performance. It’s the roadmap that guides financial decision-making.

-

Investment Decisions

Businesses must make sound investment decisions to grow and thrive. This includes evaluating potential projects, calculating risks, and estimating returns on investment.

-

Funding Sources

Identifying suitable funding sources is crucial. From traditional bank loans to venture capital funding, businesses have various options depending on their stage and financial needs.

What are Financial Strategies?

Financial strategies encompass a range of approaches aimed at managing resources efficiently to achieve business goals. They are essential for sustainable growth and competitiveness in today’s market.

Types of Financial Strategies

Financial strategies can broadly be categorized into:

-

Cost Reduction Strategies

Cost reduction strategies focus on minimizing expenditures without compromising quality or productivity. They involve streamlining processes, renegotiating contracts, and adopting cost-effective technologies.

-

Revenue Enhancement Strategies

Revenue enhancement strategies aim to increase income streams through market expansion, product diversification, pricing optimization, and customer retention initiatives.

-

Risk Management Strategies

Risk management strategies are designed to identify, assess, and mitigate potential threats to financial stability. They involve insurance, hedging, and contingency planning.

The 5 Pillars of Business Finance

Effective financial management is the cornerstone of any successful business. Whether you’re a budding entrepreneur or a seasoned business owner, understanding and implementing the five pillars of business finance is crucial for sustainable growth and profitability. These pillars form the framework that supports decision-making, risk management, and strategic planning within an organization. Let’s explore each pillar in detail:

Pillar 1: Budgeting

Budgeting is the cornerstone of financial management. It involves setting financial goals, creating a budget plan, and meticulously tracking expenses and income.

-

Setting Financial Goals

Every successful business starts with a clear vision and financial goals. Whether it’s increasing revenue, expanding operations, or launching new products, setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals is crucial.

-

Creating a Budget Plan

Once you have your goals in place, it’s time to create a budget plan. This plan outlines your anticipated income and expenses, allowing you to allocate resources efficiently and avoid unnecessary spending.

-

Tracking Expenses and Income

Budgeting doesn’t stop at planning; it requires continuous monitoring. Tracking your actual expenses and income against your budget helps identify variances, adjust spending habits, and stay on course toward your financial objectives.

Pillar 2: Financial Reporting

Financial reporting provides insights into your company’s financial health and performance. It includes generating various types of reports and ensuring accuracy in financial data.

-

Types of Financial Reports

Financial reports such as income statements, balance sheets, and cash flow statements are vital tools for assessing profitability, liquidity, and overall financial stability.

-

Importance of Accurate Reporting

Accurate reporting is non-negotiable in business finance. It enables stakeholders, including investors, lenders, and management, to make informed decisions based on reliable financial information.

Pillar 3: Cash Flow Management

Cash flow management focuses on optimizing the flow of cash in and out of your business. It involves understanding cash flow patterns and implementing strategies to maintain healthy liquidity.

-

Understanding Cash Flow

Cash flow is the lifeblood of any business. It’s not just about revenue; it’s about timing—ensuring you have enough cash on hand to cover expenses, investments, and unexpected costs.

-

Strategies for Managing Cash Flow

To manage cash flow effectively, businesses can implement strategies such as improving invoicing and payment processes, negotiating favorable terms with suppliers, and maintaining adequate reserves for emergencies.

Pillar 4: Investment Strategy

An investment strategy is crucial for leveraging financial resources to generate returns and grow your business. It involves identifying suitable investment opportunities and managing risks.

-

Types of Investments

Businesses can invest in various assets, including stocks, bonds, real estate, and business expansion projects. Each type of investment carries its risk and return profile, requiring careful consideration based on your financial goals and risk tolerance.

-

Risk Management

Investing inherently involves risk. A sound investment strategy incorporates risk management techniques such as diversification, asset allocation, and thorough due diligence before committing funds.

Pillar 5: Financing Options

Financing options provide the capital needed to fund business activities and initiatives. Understanding the different sources of financing helps businesses make informed decisions about debt and equity.

-

Debt Financing

Debt financing involves borrowing money from lenders, such as banks or financial institutions, with the promise of repayment plus interest over time. It can be an effective way to access capital for expansion or investment.

-

Equity Financing

Equity financing involves selling shares of ownership in your company to investors in exchange for capital. While it doesn’t require repayment like debt, it involves sharing profits and decision-making with shareholders.

Why Implementing Financial Strategies Is important for business?

They are not just tools for managing funds but strategic blueprints that delineate the path to sustainable growth, resilience, and prosperity. Let’s delve into the pivotal reasons why implementing financial strategies is paramount for every business, regardless of its scale or industry.

1. Enhanced Decision-Making:

At the core of effective financial strategies lies the ability to make informed decisions. By analyzing financial data, market trends, and future projections, businesses gain invaluable insights into the potential risks and opportunities. This empowers decision-makers to allocate resources wisely, invest strategically, and capitalize on emerging trends, fostering a culture of agility and adaptability.

2. Risk Mitigation:

In the dynamic landscape of business, risks are omnipresent. However, a well-crafted financial strategy acts as a shield, mitigating potential risks and uncertainties. Whether it’s market fluctuations, economic downturns, or unexpected expenses, businesses equipped with robust financial strategies are better prepared to navigate challenges without compromising their long-term viability.

3. Optimized Resource Allocation:

Efficient resource allocation is a cornerstone of financial success. Financial strategies provide a roadmap for optimizing resource allocation across various departments, projects, and initiatives. This ensures that resources, be it capital, manpower, or technology, are utilized effectively to maximize returns and drive sustainable growth.

4. Improved Financial Performance:

Financial strategies play a pivotal role in driving improved financial performance. By setting clear financial goals, monitoring key performance indicators, and regularly evaluating financial health, businesses can identify areas for improvement, streamline operations, and enhance profitability. This not only attracts investors and stakeholders but also strengthens the overall financial standing of the business.

5. Strategic Planning and Forecasting:

The essence of financial strategies lies in their ability to facilitate strategic planning and forecasting. By conducting thorough financial analysis and scenario planning, businesses can anticipate market trends, identify emerging opportunities, and proactively adapt their strategies. This foresight enables businesses to stay ahead of the curve, capitalize on market shifts, and maintain a competitive edge.

6. Investor Confidence and Stakeholder Trust:

For businesses seeking external investments or partnerships, a robust financial strategy is indispensable. It instills confidence in investors, lenders, and stakeholders by showcasing a clear roadmap for financial growth, risk management, and sustainable profitability. This, in turn, fosters trust, strengthens relationships and paves the way for long-term collaborations and expansions.

7. Compliance and Governance:

In an increasingly regulated business environment, adherence to financial regulations and governance standards is non-negotiable. Financial strategies encompass not just financial management but also compliance with legal, ethical, and industry-specific standards. By integrating compliance into their financial strategies, businesses uphold transparency, integrity, and accountability, building a solid foundation for long-term success.

8. Adaptability and Resilience:

The business landscape is characterized by constant evolution and disruption. Financial strategies equip businesses with the flexibility and resilience to weather storms, adapt to market dynamics, and capitalize on emerging opportunities. Whether it’s scaling operations, entering new markets, or innovating products/services, a well-defined financial strategy serves as a compass, guiding businesses through change and uncertainty.

The implementation of robust financial strategies is not just a choice but a necessity for businesses aiming to thrive in today’s competitive environment. From driving informed decision-making to fostering resilience and stakeholder trust, financial strategies underpin every aspect of business success. Embracing a strategic and proactive approach to financial management is not just about managing money; it’s about shaping a sustainable future for businesses and stakeholders alike.

How often should businesses review their financial performance?

Financial health is the lifeblood of any business. Just as individuals monitor their health regularly, businesses must consistently assess their financial performance to ensure sustainability and growth. The frequency of these reviews can vary based on factors like the industry, business size, and market dynamics. However, there are general guidelines that businesses can follow to optimize their financial management strategies.

1) Monthly Financial Reviews

For many businesses, conducting monthly financial reviews is essential. These reviews provide a snapshot of the company’s financial status, including revenue, expenses, cash flow, and profitability. Monthly reviews allow businesses to identify trends, spot any anomalies or discrepancies early on, and make timely adjustments to their strategies.

During monthly financial reviews, businesses can:

- Track Key Performance Indicators (KPIs): Monitoring KPIs such as gross profit margin, operating margin, and customer acquisition cost on a monthly basis helps businesses gauge their performance and identify areas that need improvement.

- Assess Budget Variance: By comparing actual financial results with budgeted figures, businesses can assess their spending patterns and make necessary budget adjustments to stay on track.

- Evaluate Cash Flow: Cash flow is critical for business operations. Monthly reviews help businesses analyze their cash flow statements, identify cash gaps, and plan for adequate liquidity.

- Review Debt Levels: For businesses with loans or credit lines, monitoring debt levels monthly ensures they stay within manageable limits and can strategize debt repayment effectively.

2) Quarterly Financial Reviews

In addition to monthly reviews, businesses should conduct more comprehensive quarterly financial reviews. These reviews provide a deeper analysis of financial performance over a longer period, offering insights into seasonal trends and market fluctuations. Quarterly reviews also align with regulatory requirements for reporting in many jurisdictions.

During quarterly financial reviews, businesses can:

- Evaluate Long-Term Goals: Quarterly reviews allow businesses to assess progress toward long-term financial goals and adjust strategies if needed to stay on course.

- Analyze Market Trends: Monitoring market trends and competitor performance on a quarterly basis helps businesses stay competitive and adapt their strategies accordingly.

- Conduct Cost-Benefit Analysis: Evaluating the ROI of major investments, marketing campaigns, or operational initiatives helps businesses make informed decisions about resource allocation.

- Review Financial Statements: Analyzing balance sheets, income statements, and cash flow statements quarterly provides a comprehensive view of the business’s financial health and performance trends.

3) Annual Financial Reviews

While monthly and quarterly reviews are ongoing, businesses should also conduct annual financial reviews as part of their strategic planning process. Annual reviews serve as a holistic assessment of the business’s financial performance throughout the year and help set goals for the upcoming year.

During annual financial reviews, businesses can:

- Set Budgets and Forecasts: Based on insights from monthly and quarterly reviews, businesses can set realistic budgets and financial forecasts for the next fiscal year.

- Conduct Audits: Annual financial reviews often coincide with external audits or internal audits, ensuring compliance with regulations and identifying areas for improvement in financial processes.

- Evaluate Risk Management: Assessing risks such as market volatility, regulatory changes, or operational challenges helps businesses develop risk mitigation strategies for the future.

- Plan for Growth: Annual reviews provide an opportunity to evaluate growth opportunities, whether through expansion, acquisitions, or new product/service development and allocate resources accordingly.

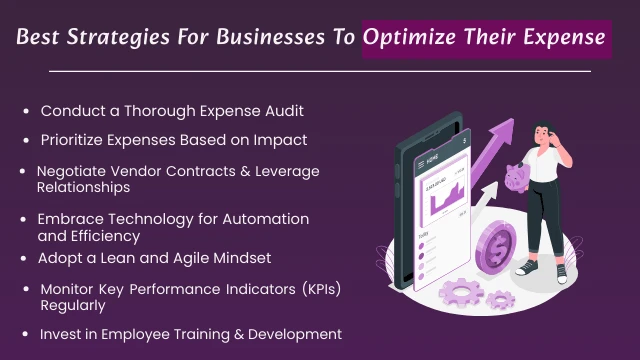

Best Strategies That Can Help Businesses Optimize Their Expense

1. Conduct a Thorough Expense Audit

The first step in optimizing expenses is to understand where every dollar is going. Conducting a thorough expense audit involves categorizing expenses, analyzing trends, and identifying areas of potential savings. Use accounting software or tools that offer detailed expense tracking and reporting functionalities.

2. Prioritize Expenses Based on Impact

Not all expenses are equal in terms of their impact on business operations and profitability. Prioritize expenses based on their contribution to revenue generation, customer satisfaction, or operational efficiency. Allocate resources strategically to high-impact areas while reevaluating or reducing expenditures in low-impact segments.

3. Negotiate Vendor Contracts and Leverage Relationships

Vendor relationships play a crucial role in expense management. Negotiate contracts with suppliers, service providers, and vendors to secure favorable terms, discounts, or bulk pricing. Leverage long-term relationships and explore alternative suppliers to ensure cost-effectiveness without compromising on quality.

4. Embrace Technology for Automation and Efficiency

Modern technology offers a plethora of tools and solutions for automating repetitive tasks, streamlining processes, and reducing manual errors. Implement expense management software, cloud-based platforms, and digital payment systems to improve efficiency, track expenses in real time, and gain valuable insights for informed decision-making.

5. Adopt a Lean and Agile Mindset

A lean and agile mindset encourages continuous improvement and cost-conscious decision-making. Encourage employees at all levels to contribute ideas for cost savings, process optimization, and resource utilization. Foster a culture of accountability and innovation where everyone is invested in driving efficiency across the organization.

6. Monitor Key Performance Indicators (KPIs) Regularly

Establish key performance indicators related to expenses, such as cost per unit, overhead ratio, or budget variance. Monitor these KPIs regularly and compare them against industry benchmarks or historical data. Identify deviations or areas of concern promptly to address issues and make data-driven adjustments to expense management strategies.

7. Invest in Employee Training and Development

Well-trained and skilled employees can contribute significantly to cost optimization efforts. Invest in training programs that enhance employees’ financial literacy, analytical skills, and understanding of cost-saving techniques. Encourage cross-functional collaboration and knowledge sharing to leverage diverse perspectives in expense management strategies.

8. Implement Sustainable Practices for Cost Reduction

Sustainability initiatives not only benefit the environment but also contribute to cost reduction and brand reputation. Explore opportunities to reduce waste, energy consumption, and resource inefficiencies within your operations. Implement eco-friendly practices, such as digital documentation, recycling programs, or energy-efficient technologies, to lower long-term expenses.

9. Continuously Evaluate and Adjust Strategies

Financial strategies for expense optimization are not static; they require continuous evaluation and adjustment. Conduct regular reviews of expense management processes, policies, and outcomes. Solicit feedback from stakeholders, analyze market trends, and adapt strategies to evolving business needs, industry dynamics, and economic conditions.

10. Seek Professional Financial Advice When Needed

Complex financial challenges or strategic decisions may benefit from professional advice. Consult with financial advisors, accountants, or business consultants who specialize in expense management and financial optimization. Gain insights into industry best practices, regulatory compliance, tax implications, and tailored strategies to maximize cost savings and profitability.

What are some common cost-cutting measures for businesses?

Whether you’re a startup or an established enterprise, implementing effective cost-cutting measures is vital for sustainable growth and financial health. Let’s delve into some common strategies that businesses can employ to trim expenses without compromising quality or productivity.

1. Evaluate and Optimize Operational Processes

Streamlining operational processes is a cornerstone of cost reduction. Conduct a comprehensive review of your workflows to identify inefficiencies and redundancies. Look for areas where automation or technology upgrades can improve efficiency and reduce labor costs. For example, implementing project management software can enhance collaboration and productivity among teams, leading to cost savings in the long run.

2. Negotiate with Suppliers

Building strong relationships with suppliers can yield significant cost savings. Negotiate for bulk discounts, extended payment terms, or rebates based on volume purchases. Explore alternative suppliers or sourcing options to ensure you’re getting the best value for your money without compromising product quality.

3. Opt for Energy Efficiency

Energy expenses can account for a substantial portion of operational costs, especially for manufacturing or large-scale operations. Invest in energy-efficient equipment, upgrade lighting systems to LED, and implement energy conservation practices such as turning off equipment when not in use. Consider renewable energy sources like solar power to further reduce long-term energy expenses.

4. Remote Work and Flexible Schedules

The shift towards remote work has become a cost-saving boon for many businesses. Embracing remote work policies can lead to reduced office space requirements, lower utility bills, and savings on commuting allowances. Additionally, offering flexible work schedules can improve employee satisfaction and retention, further contributing to cost savings through reduced turnover costs.

5. Outsource Non-Core Functions

Outsourcing non-core functions such as IT support, customer service, or payroll processing can be a cost-effective strategy. By leveraging third-party providers, businesses can access specialized expertise, scale services as needed, and reduce overhead costs associated with in-house departments. However, ensure careful vetting of outsourcing partners to maintain quality standards.

6. Review Marketing and Advertising Expenses

Marketing and advertising are essential for business growth, but they can also consume significant financial resources. Evaluate the performance of your marketing campaigns and focus on channels that deliver the highest ROI. Embrace digital marketing strategies that offer cost-effective targeting and measurement capabilities compared to traditional advertising methods.

7. Implement Cost-Conscious Policies

Encourage a culture of cost-consciousness within your organization. Set clear budgetary guidelines for departments, encourage employees to suggest cost-saving ideas, and incentivize savings initiatives through recognition or rewards programs. Foster a mindset of resource optimization and responsible spending at all levels of the company.

8. Reduce Overhead Expenses

Trimming overhead expenses is a fundamental aspect of cost-cutting. Evaluate lease agreements, renegotiate rent or lease terms where possible, and consider subleasing unused office space. Opt for virtual meetings instead of costly travel arrangements whenever feasible, and scrutinize subscriptions or memberships for services that are underutilized.

9. Invest in Employee Training and Development

While it may seem counterintuitive, investing in employee training and development can lead to long-term cost savings. Well-trained employees are more efficient, productive, and engaged, resulting in lower error rates, reduced turnover, and enhanced customer satisfaction. Leverage online learning platforms and internal training programs to develop employee skills cost-effectively.

10. Monitor and Analyze Financial Data

Regularly monitor and analyze financial data to identify spending trends, cost outliers, and areas for improvement. Implement robust financial reporting tools or work with financial advisors to gain insights into your business’s financial health. Use data-driven decision-making to prioritize cost-cutting initiatives that yield the greatest impact on profitability.

By incorporating these cost-cutting measures into your business strategy, you can navigate economic challenges more effectively, optimize resource allocation, and position your company for long-term success and sustainability. Remember that cost-cutting should not be a one-time effort but an ongoing commitment to operational excellence and financial prudence.

How can businesses diversify their revenue streams effectively?

Diversifying revenue streams is a crucial strategy for businesses to ensure stability, growth, and resilience in the face of economic uncertainties. In this section, we’ll delve into various effective methods that businesses can adopt to diversify their revenue streams successfully.

-

Expand Product or Service Offerings:

One of the most straightforward ways to diversify revenue is by expanding the range of products or services offered. This can involve introducing new variations of existing products, developing complementary services, or even venturing into entirely new markets. For example, a software company specializing in productivity tools might diversify by adding project management software or offering consulting services.

-

Target New Market Segments:

Businesses can also diversify by targeting new market segments. Conducting market research to identify untapped customer demographics or geographic regions can provide valuable insights. By customizing marketing strategies and product offerings to appeal to these new segments, businesses can capture additional revenue streams.

-

Invest in E-commerce and Online Platforms:

With the rapid growth of e-commerce, businesses can leverage online platforms to diversify revenue. Setting up an e-commerce store, selling through third-party platforms like Amazon or Etsy, or even developing a mobile app can open up new avenues for reaching customers and generating sales.

-

Create Subscription or Membership Models:

Subscription-based revenue models can provide a steady stream of income and enhance customer loyalty. Businesses can offer subscription services for software, content, memberships, or curated product bundles. This approach not only generates recurring revenue but also fosters long-term relationships with customers.

-

Explore Strategic Partnerships and Collaborations:

Collaborating with other businesses or forming strategic partnerships can lead to mutual benefits and revenue diversification. For instance, a clothing brand might collaborate with a popular influencer for a limited edition collection or partner with a retail chain to expand distribution channels.

-

Monetize Data and Analytics:

In the digital age, data has become a valuable asset. Businesses can monetize data by offering analytics services, insights, or customized reports to other businesses or industry stakeholders. This not only creates a new revenue stream but also establishes the business as a trusted source of information.

-

Invest in Digital Marketing and SEO:

Enhancing digital marketing efforts and optimizing for search engines (SEO) can significantly impact revenue diversification. By increasing online visibility, attracting more organic traffic, and improving conversion rates, businesses can boost sales across multiple channels and platforms.

-

Offer Value-added Services:

Providing value-added services such as extended warranties, maintenance plans, training programs, or exclusive access to events can differentiate a business from competitors and generate additional revenue from existing customers.

-

Embrace Innovation and R&D:

Investing in research and development (R&D) to innovate new products, technologies, or solutions can open doors to novel revenue streams. By staying ahead of market trends and consumer demands, businesses can position themselves as industry leaders and capture new market opportunities.

-

Implement Flexible Pricing Strategies:

Adopting flexible pricing strategies such as tiered pricing, pay-per-use models, or bundling options allows businesses to cater to diverse customer preferences and budgets. This flexibility can attract a wider range of customers and drive revenue growth.

Businesses can diversify their revenue streams effectively by adopting a combination of these strategies tailored to their industry, target audience, and organizational strengths. Continual adaptation, innovation, and strategic decision-making are key to sustaining growth and competitiveness in today’s dynamic business landscape.

How can businesses balance cost-cutting with maintaining quality?

While reducing expenses is essential for profitability, compromising on quality can have detrimental effects on customer satisfaction and brand reputation. So, how can businesses strike a harmonious balance between these two seemingly conflicting objectives? Let’s delve into some strategies and insights that can help achieve this delicate equilibrium.

-

Identify Cost-Cutting Opportunities:

- Conduct a thorough analysis of your business processes to identify areas where cost reductions can be made without compromising quality. This could include optimizing supply chain operations, renegotiating contracts with suppliers, or streamlining internal workflows to eliminate inefficiencies.

- Leverage technology solutions such as automation and digitization to reduce manual work, minimize errors, and enhance productivity. Investing in scalable software and tools can initially incur costs but can lead to significant long-term savings.

-

Prioritize Value-Adding Activities:

- Focus on activities that directly contribute to value creation for customers. This involves identifying core competencies and allocating resources strategically to areas that drive revenue and customer satisfaction.

- Evaluate non-core activities that may be consuming resources without delivering proportional value. Outsourcing or automating these tasks can often result in cost savings without compromising quality in essential areas.

-

Implement Lean Practices:

- Embrace lean principles to eliminate waste and optimize processes. This involves continuous improvement, employee empowerment, and a culture of efficiency throughout the organization.

- Encourage cross-functional collaboration and communication to identify bottlenecks and implement solutions collaboratively. Empowering employees to suggest and implement process improvements can lead to innovative cost-saving measures.

-

Supplier Relationship Management:

- Cultivate strong relationships with suppliers based on mutual trust and transparency. Negotiate contracts that are fair and beneficial for both parties, leveraging economies of scale and long-term partnerships to secure favorable terms.

- Regularly assess supplier performance and explore alternative sourcing options to ensure competitive pricing while maintaining product quality. Diversifying suppliers can also mitigate risks associated with disruptions in the supply chain.

-

Quality Control and Continuous Monitoring:

- Invest in robust quality control processes to ensure that cost-cutting measures do not compromise product or service quality. Implement stringent standards, conduct regular audits, and solicit customer feedback to identify areas for improvement.

- Monitor key performance indicators (KPIs) related to both cost and quality metrics. Utilize data analytics to track trends, identify deviations, and make data-driven decisions to optimize resource allocation.

-

Employee Training and Engagement:

- Invest in employee training and development programs to enhance skills, productivity, and job satisfaction. Engaged and motivated employees are more likely to contribute innovative ideas and solutions that can lead to cost savings while maintaining quality standards.

- Foster a culture of accountability and ownership where employees understand the importance of cost control and quality assurance in achieving organizational goals. Recognize and reward employees for their contributions to cost-saving initiatives.

-

Strategic Communication and Transparency:

- Communicate cost-cutting initiatives transparently across the organization to gain buy-in and support from employees at all levels. Clearly articulate the rationale behind cost-saving measures and the expected impact on business performance.

- Solicit feedback from employees, customers, and other stakeholders to gauge the effectiveness of cost-cutting efforts and make adjustments as needed. Transparency builds trust and alignment towards common objectives.

-

Risk Management and Contingency Planning:

- Identify potential risks associated with cost-cutting initiatives, such as reduced product quality, supply chain disruptions, or decreased employee morale. Develop contingency plans to mitigate these risks and ensure business continuity.

- Conduct scenario planning and stress tests to anticipate potential challenges and develop proactive strategies to address them. Flexibility and adaptability are key in navigating unforeseen circumstances while maintaining quality standards.

In conclusion, achieving a balance between cost-cutting and maintaining quality requires a holistic approach that encompasses strategic decision-making, continuous improvement, and stakeholder collaboration. By leveraging technology, optimizing processes, nurturing relationships, and fostering a culture of efficiency and innovation, businesses can navigate the complexities of cost management.