In 2026, banking is no longer a race for better interest rates. It’s a race for intelligence, automation, and real-time decision-making. Today’s leading financial institutions are:

- Approving loans in under 60 minutes

- Detecting fraud in real time using AI models

- Automating KYC and AML workflows end-to-end

- Running compliance audits with AI copilots

- Operating 24/7 with digital workers

Meanwhile, banks relying on manual processes are facing rising operational costs, delayed onboarding, compliance bottlenecks, and growing regulatory pressure.

According to McKinsey & Company, nearly 40–45% of banking activities can be automated using current technologies. The opportunity is massive, but only for institutions that choose the right automation strategy.

For CTOs, COOs, and digital transformation leaders, the key question in 2026 isn’t whether to automate. It’s: “Which banking automation tools deliver AI-readiness, regulatory compliance, scalability, and measurable ROI?”

This guide explores the top banking automation platforms in 2026, real enterprise use cases (KYC, lending, fraud, compliance), and key technologies driving intelligent banking.

If you’re responsible for digital banking strategy, AI implementation, or operational efficiency, this article will help you make informed, future-ready decisions.

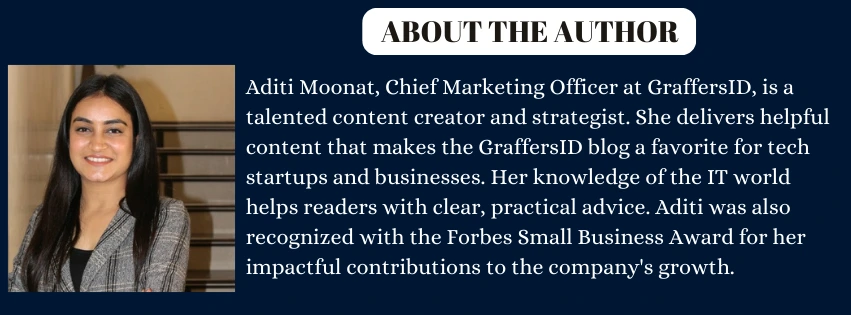

What is Banking Automation in 2026?

Banking automation in 2026 means using AI, RPA, and intelligent systems to streamline operations, reduce manual work, and improve compliance in financial institutions. It goes beyond basic task automation. Modern banks now combine:

- AI-powered decision systems

- Intelligent document processing

- API-driven integrations

- Predictive analytics models

- Low-code workflow automation

This integrated approach is known as Intelligent Automation (IA), the fusion of AI, ML, RPA, and orchestration platforms to create scalable, AI-ready banking systems.

Core Technologies Powering Banking Automation in 2026

1. Robotic Process Automation (RPA) in Banking

RPA automates repetitive, rule-based banking tasks without changing core systems. It improves speed, accuracy, and cost efficiency. Common RPA use cases in banks:

- KYC data entry and verification

- Compliance documentation processing

- Account reconciliation workflows

- Claims and transaction processing

2. Artificial Intelligence (AI) in Banking Operations

AI enables real-time decision-making and risk intelligence across financial systems. It enhances customer experience while reducing fraud and compliance risks. AI applications in banking include:

- Real-time fraud detection

- AI-based credit scoring

- Conversational banking chatbots

- Automated risk assessment models

3. Machine Learning (ML) for Predictive Banking

Machine learning models analyze historical and real-time data to detect patterns and improve predictions over time. ML is used for:

- Behavioral anomaly detection

- Transaction risk scoring

- Predictive loan underwriting

- Customer churn prediction

4. Intelligent Document Processing (IDP) in Financial Services

IDP combines OCR (Optical Character Recognition) with AI to extract and process data from structured and unstructured documents. IDP helps banks:

- Extract financial statements automatically

- Process loan and mortgage documents

- Automate underwriting workflows

- Reduce manual document review time

5. API-Led Connectivity for Modern Banking Systems

API-led integration connects legacy core banking systems with modern fintech and AI tools. It eliminates data silos and enables real-time data exchange. API connectivity supports:

- Core banking system integrations

- CRM and customer data platforms

- Compliance and AML engines

- Third-party fintech and payment gateways

This combination of RPA, AI, ML, IDP, and API-led integration forms the foundation of a scalable, secure, and AI-ready banking infrastructure in 2026.

Key Benefits of Banking Automation in 2026

Banking automation in 2026 delivers:

- Faster KYC and AML Compliance: Automation speeds up identity verification and anti-money laundering checks, reducing onboarding time from days to minutes while maintaining regulatory accuracy.

- Real-Time Fraud Detection: AI-powered monitoring systems analyze transactions instantly, identifying suspicious behavior and preventing financial losses before they escalate.

- Lower Operational Costs: Robotic Process Automation (RPA) and AI reduce manual work, helping banks cut operational expenses by 20–40% through streamlined workflows.

- Faster Loan and Mortgage Approvals: Intelligent document processing and automated underwriting accelerate credit decisions, improving approval speed and customer satisfaction.

- 24/7 Digital Banking Operations: AI chatbots and digital workers enable continuous customer support, transaction handling, and backend processing without downtime.

- Stronger Audit and Compliance Readiness: Automation creates detailed digital audit trails, improving transparency and making regulatory reporting faster and more accurate.

- Improved Customer Experience and Retention: Personalized AI-driven insights, faster services, and seamless onboarding increase customer trust and long-term retention.

6 Best Banking Automation Tools in 2026 (AI, RPA & Finance Software)

Below are the most relevant automation platforms financial institutions are using in 2026 to improve compliance, speed, integration, and operational efficiency.

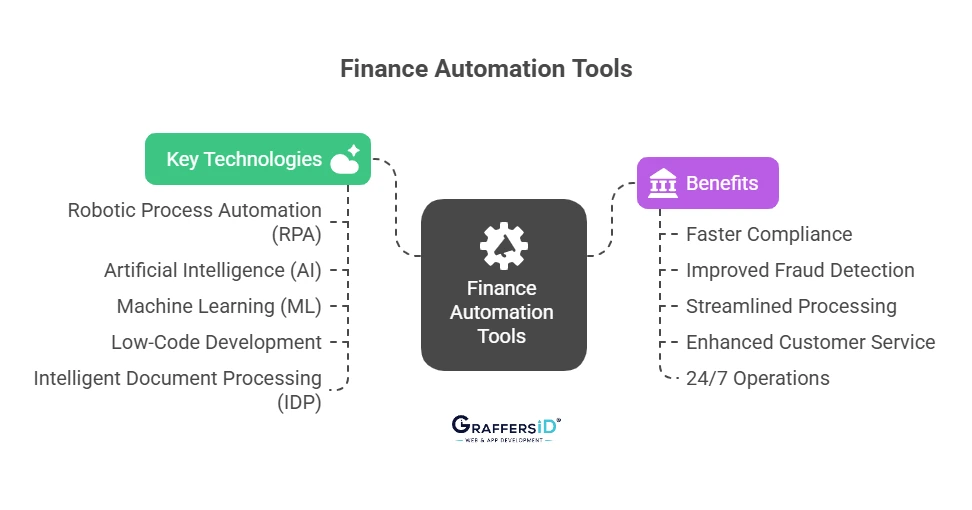

1. UiPath: AI-Powered RPA for Banking Operations

UiPath is a leading enterprise RPA platform that combines automation, AI, and process mining. In banking, it helps digitize repetitive, compliance-heavy workflows at scale.

Key Banking Use Cases of UiPath:

-

Automated KYC & customer onboarding

-

AML and compliance workflow automation

-

Loan processing and reconciliation

-

Fraud detection task automation

UiPath now integrates AI copilots and process intelligence, enabling banks to identify automation gaps, optimize workflows continuously, and improve regulatory audit readiness.

Best For: Large banks and financial institutions driving enterprise-wide digital transformation.

2. MuleSoft: API Integration for Core Banking Systems

Owned by Salesforce, MuleSoft is an API-led integration platform that connects legacy banking infrastructure with modern AI applications and fintech tools.

Key Banking Use Cases of MuleSoft:

-

Connecting core banking systems with CRM platforms

-

Integrating lending, payments, and fintech apps

-

Real-time customer data orchestration

Automation without integration creates data silos. MuleSoft acts as a digital backbone, enabling secure, compliant data flow across departments and third-party systems.

Best For: Large financial institutions managing multi-system and hybrid environments.

3. Appian: Low-Code Workflow Automation for Banks

Appian is a low-code automation platform that allows banks to design and deploy workflows quickly. It combines AI, business process automation, and case management.

Key Banking Use Cases of Appian:

-

Loan origination automation

-

AML investigation case management

-

Customer dispute resolution workflows

-

Regulatory reporting automation

Low-code platforms reduce IT dependency and accelerate compliance-driven workflow deployment, making banks more agile in responding to regulatory updates.

Best For: Mid-to-large banks prioritizing agility, faster deployment, and operational efficiency.

4. BlackLine: Financial Close & Reconciliation Automation

BlackLine is a finance automation platform focused on accounting accuracy and financial transparency. It is widely used for automating reconciliation and financial close processes.

Key Banking Use Cases of BlackLine:

-

Account reconciliation automation

-

Journal entry management

-

Intercompany accounting workflows

-

Financial close and audit preparation

With increasing regulatory scrutiny, BlackLine strengthens internal controls, improves audit trails, and reduces manual accounting errors.

Best For: Banks with complex accounting structures and high transaction volumes.

Read More: Data Privacy in the AI Era: How to Protect Your Personal Information Online in 2026

5. Selenium: Automated Testing for Secure Banking Applications

Selenium is an open-source automation framework used for testing web-based banking applications. It ensures reliability, security, and performance across digital platforms.

Key Banking Use Cases of Selenium:

-

Online banking login & authentication testing

-

Payment workflow validation

-

Regression testing for core system updates

-

Cross-browser security testing

As banks deploy AI-driven apps and digital portals, continuous testing is critical. Selenium supports CI/CD pipelines, ensuring secure and stable releases.

Best For: Banks with strong in-house QA teams and continuous digital deployment cycles.

6. Xero: Cloud-Based Accounting Automation for Financial Institutions

Xero is a cloud-based accounting automation platform popular among small to mid-sized banks, fintech startups, and credit unions.

Key Banking Use Cases of Xero

-

Automated bank feeds & transaction reconciliation

-

Real-time financial reporting dashboards

-

AI-powered expense categorization

-

Multi-currency financial management

Xero enables real-time financial visibility, simplified compliance reporting, and scalable accounting automation without enterprise-level complexity.

Best For: Small to mid-sized banks, fintech startups, and digital-first financial institutions.

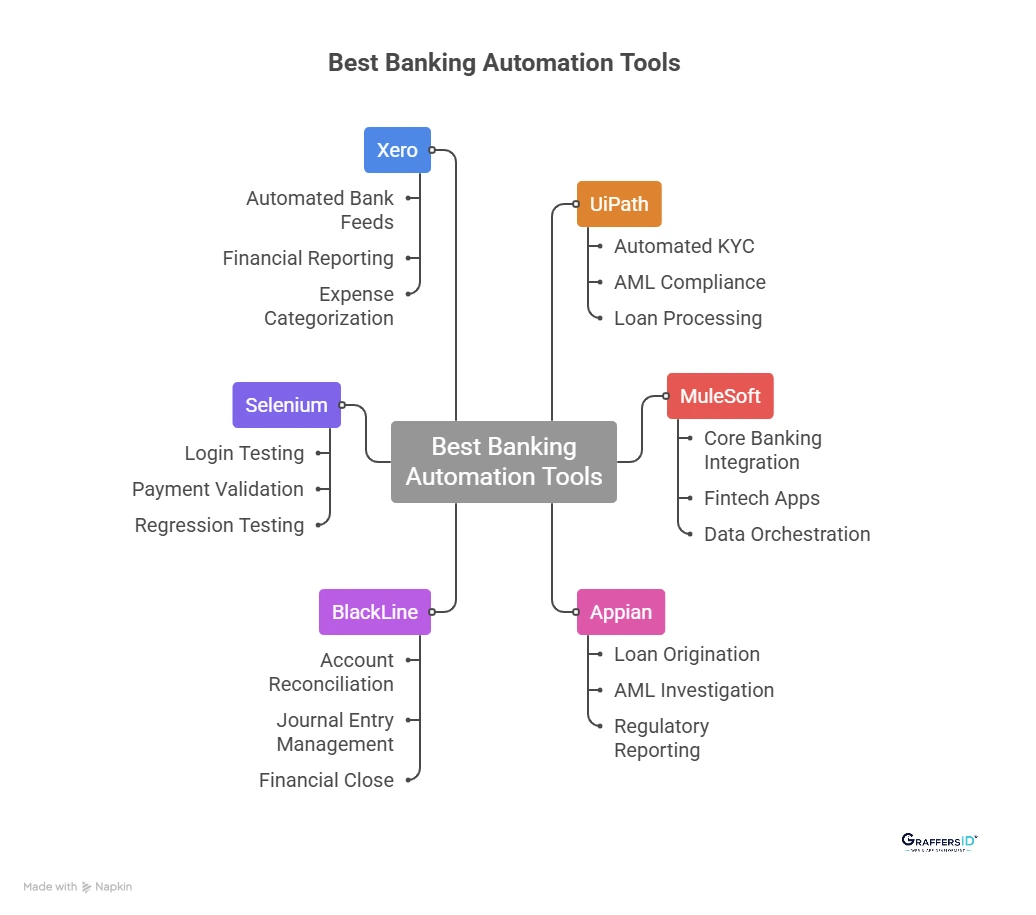

How to Choose the Best Banking Automation Software in 2026?

Selecting the right banking automation platform requires more than feature comparison. Below is a practical evaluation framework designed for CTOs, CIOs, and digital transformation leaders.

1. Strategic Alignment with Business Goals

Ensure the automation platform directly supports your digital banking roadmap.

- Does it align with your AI, cost-optimization, and customer experience strategy?

- Can it support long-term transformation, not just short-term efficiency gains?

Automation should accelerate competitive advantage, not create disconnected systems.

2. Regulatory Compliance and Data Security

Banking automation tools must meet strict financial regulations and security standards.

- Does the platform support GDPR, SOC 2, PCI DSS, and regional banking compliance?

- Are audit trails, encryption, and role-based access controls built in?

Compliance should be embedded into the workflow, not managed separately.

3. Integration with Core Banking and Fintech Systems

Seamless integration is critical for scalable automation.

- Can the tool connect with legacy core banking systems, CRMs, and APIs?

- Does it support real-time data exchange across departments?

Strong API capabilities prevent data silos and reduce operational friction.

4. AI and Intelligent Automation Capabilities

Modern banking automation in 2026 must go beyond rule-based bots.

- Does the platform support AI-driven decision-making and predictive analytics?

- Can it integrate AI copilots, fraud detection models, or intelligent document processing?

AI-readiness determines whether your system can evolve with emerging technologies.

5. Scalability and Performance at Enterprise Scale

Automation should support growth without frequent system overhauls.

- Can it handle increasing transaction volumes and multi-branch expansion?

- Does it offer modular expansion without full re-architecture?

Scalable infrastructure ensures long-term ROI and operational resilience.

6. Deployment Model: Cloud, On-Premise, or Hybrid

Deployment flexibility impacts compliance, cost, and control.

- Does the platform offer secure cloud hosting with regional data compliance?

- Is a hybrid or on-premise deployment available for sensitive banking environments?

Choosing the right deployment model balances innovation with regulatory requirements.

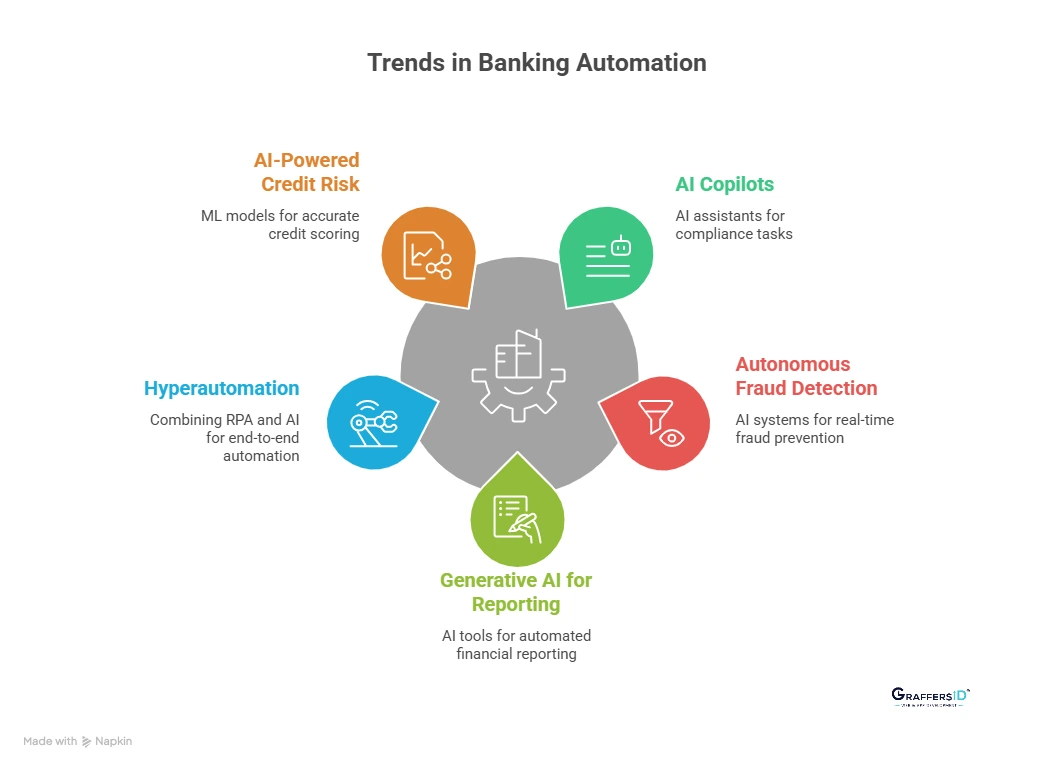

Top Banking Automation Trends in 2026 & Beyond

Conclusion: Why Banking Automation is Critical for Growth in 2026?

Banking automation in 2026 is no longer a cost-cutting experiment; it is a strategic growth driver. The most competitive financial institutions are using automation to:

- Increase operational accuracy and reduce human error

- Minimize compliance risks and regulatory penalties

- Accelerate product innovation cycles

- Improve speed-to-market for digital services

- Deliver seamless, personalized customer experiences

Modern banks that integrate RPA, AI, low-code platforms, and API-led connectivity are not just improving efficiency; they are building intelligent, adaptive systems that scale with regulatory and market demands.

For CTOs, CIOs, and digital transformation leaders, the takeaway is clear: to build an AI-ready automation ecosystem, not isolated tools. Institutions that adopt this approach are outperforming competitors in cost efficiency, agility, compliance readiness, and customer trust.

Build AI-Powered Banking Solutions with GraffersID

At GraffersID, we help fintech startups & enterprises build AI-powered banking and financial platforms and create secure web and mobile banking applications.

If you’re planning to modernize your banking infrastructure or implement intelligent automation in 2026, our team can help you design and deploy scalable, compliant, and future-ready solutions.

Hire AI Developers from GraffersID today and build the next generation of intelligent banking systems.