We live in a world where contemporary enterprises are constantly developing. To achieve success, automation may be a highly strong instrument in your organization, transforming sectors throughout the world. With a rising reliance on tools and technology, firms must embrace business automation. This includes technology like RPA (Robotic Process Automation) and IDP (Intelligent Document Processing). The blog will dig into the important areas where automating processes can have an influence, how it can increase productivity, the technologies that may help with business process automation, methods to overcome opposition to automation, and projections for automation in 2025.

Read Also: How Outsourcing IT services can help you stay ahead in 2025

Key Areas Where Automation Will Make an Impact

Automation is not a one-size-fits-all solution- its uses range throughout industries, with each benefitting distinctively. Business automation have a substantial impact in many fields by 2025, because technological advances like RPA and IDP. Here are the main areas where automating is expected to have a substantial impact:

1.Customer Service

Automated chatbots and virtual assistants run by RPA and AI are getting more intelligent, with the ability to handle a wide range of client questions without any human interference. These solutions deliver immediate replies, tailored advice, and 24/7 help, thus improving the customer experience. Furthermore, IDP technologies allow for the extraction and processing of client data from multiple documents, which streamlines customer care activities.

2. Marketing and Sales

Marketing automation can create campaigns and segment audiences to evaluate consumer behavior with the use of RPA. Automation can also simplify basic sales operations such as managing leads, following up on customers, and CRM updates. These activities are intended to save sales professionals time for closing transactions. Precision and efficacy in marketing campaigns are improved using marketing automation crm to reach higher audience engagement and conversion rates.

3. Human Resources

From recruitment to employee onboarding, automation has helped simplify HR procedures within companies. For example, RPA can screen resumes, schedule interviews, manage payroll, and manage employee performance-monitoring activities to reduce administrative burdens and increase accuracy. IDP, on the other hand, facilitates the processing of HR documents, ensuring that the data is accurately captured and managed.

4. Supply Chain Management

Supply chain management has a lot of areas where automation can ease the burden. Inventory control, order processing, logistics, all of these tasks can be automated using RPA and IDP. automated systems can estimate demand, optimize routes, and manage suppliers, resulting in a more efficient and robust supply chain. The technologies in use offer real-time tracking and data analysis, resulting in enhanced decision-making and operational agility.

5. Finance and Accounting

Finance automation tools like RPA and IDP which take care of activities such as invoice preparation, expense tracking along with financial reporting. The advantages of these tools include reduced errors, ensured compliance as well as real-time views of one’s finances for better decision-making. RPA automates routine finance processes, while IDP improves accuracy in extracting data from financial documents.

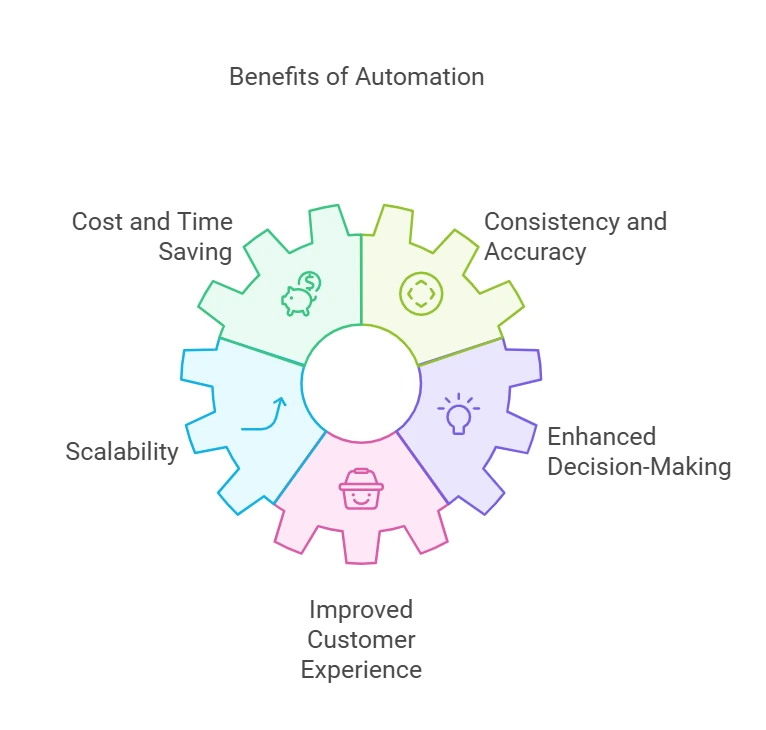

How Automation Improves Efficiency

Automation significantly enhance efficiency across various business operations, delivering tangible benefits that contribute to overall organizational success. Using technologies like RPA and IDP in business automation can drive substantial improvements in efficiency. Here’s how:

1. Cost Reduction

Two of the biggest assets-time and money- can be saved with the help of automation, as it reduces the need for manual labor. Additionally, RPA and IDP makes minimal errors which are otherwise costly to rectify, further contributing to financial and time efficiency. By automating routine tasks, businesses can allocate resources effectively and save on costs and time.

2. Consistency and Accuracy

To ensure consistency and accuracy, automation tools can be deployed to perform complicated tasks, eliminating the variability associated with human errors. RPA executes predefined rules with precision, and IDP accurately extracts and processes the data from documents. Accuracy is very important for maintaining quality standards and meeting regulatory requirements.

3. Scalability

When companies expand, automation allows for smooth scalability of activities without the need for commensurate increase in resources. Business process automation, in such cases, can easily handle growing workloads, letting organizations expand and grow their market reach. RPA can be used to handle bigger transaction volumes, and IPD can process more data without compromising the speed.

4. Enhanced Decision-Making

Automation technologies often include analytics and reporting functions that provide useful insights for better corporate performance. RPA and IDP create comprehensive data that lets managers to make informed decisions, leading to strategic growth. These insights help in identifying patterns, optimizing operations, and projecting future demands.

5. Improved Customer Experience

Structured procedures lead to faster service delivery and enhanced client relations. RPA enables prompt replies and individualized services, whereas IDP correctly manages client data, improving the customer satisfaction and loyalty. Managing large volumes of client contacts can be a little difficult to do manually, but with the help of automated systems, you can ensure a consistent and high-quality experience.

Tools for Business Process Automation

The landscape of business process automation is rich with tools designed to cater to various organizational needs. Leveraging technologies like RPA and IDP can significantly enhance operational efficiency. Here are some of the top tools that are shaping the future of automation in 2025:

1. Robotic Process Automation (RPA)

Everyday tasks can be automated using RPA solutions like UiPath, Automation Anywhere, and Blue Prism, which are tools that can replicate human behaviors. They are specifically useful for data input, transaction processing, and record management. RPA works with existing systems to deconstruct procedures and reduce manual labor.

2. Intelligent Document Processing (IDP)

Products like ABBYY FlexiCapture, Kofax, and Ephesoft which are suitable for IDP utilize AI and ML to extract and analyze data from a variety of documents. These tools enhance data quality and speed, letting companies manage massive amounts of documents more efficiently. For document-intensive procedures in finance, human resources, and customer support, it is important to use IDP for automation.

3. Customer Relationship Management (CRM) Systems

CRM tools like Salesforce, HubSpot, and Zoho CRM deploy automation to handle customer interactions, monitor sales prospect, and analyze data. By using these solutions, companies can simplify tasks like sales and marketing while improving client connections with the help of automated follow-ups and individualized messaging.

4. AI and Machine Learning Tools

AI-powered solutions like IBM Watson, Google AI, and Microsoft Azure AI allow sophisticated automation capabilities like predictive analytics, NLP (natural language processing), and intelligent decision-making for a variety of business operations. Adoption of such technologies allows for more advanced and adaptable automation solutions.

Overcoming Resistance to Automation

Overcoming resistance towards automation is necessary with the changing times. There are several strategies that can facilitate this transition.

- Effective communication

- Involvement and inclusion

- Training and development

- Addressing job concerns

- Incremental implementation

- Leadership support

- Monitoring and feedback

With the help of these strategies, an organization can ensure a smooth transition to automation for all employees. It is important to make the end-goal of this shift clear, so that everyone is on the same page about the benefits that accompany automation. Upper level management should also stress on dedicating good time towards the research for every tool, as a good tool can be very helpful in the long run, while a bad tool can become an unnecessary cost to the organization.

Predictions for Automation in 2025

As we move closer towards 2025, the landscape of automation is poised for significant advancements and broader adoption across industries. Technologies like RPA and IDP will drive these changes, enabling more intelligent and comprehensive solutions. Here are some key predictions:

1. Increased Integration of AI and Machine Learning

Experts predict that AI and Machine Learning will play crucial roles in automation, creating more intelligent and adaptable systems. These technologies will improve predictive skills, customize consumer interactions, and streamline complicated company procedures. Together, RPA and AI can handle more sophisticated jobs, whereas IDP will increase data extraction accuracy.

In 2025, you’ll hardly find a company that does not use it for routine operations. Many businesses are likely to implement AI-driven code generators that will assist developers by auto-completing code lines. In such a way, professionals will reduce the time they spend on routine tasks and minimize syntax errors.

2. Expansion of Hyperautomation

Hyperautomation integrates several automation techniques and technologies, and it will become increasingly common. This method will allow end-to-end automation of complicated workflows, filling gaps between various systems and processes to ensure smooth operations. Collaborated together, RPA, IDP, and AI will form a unified environment, increasing overall efficiency and agility.

3. Growth of No-Code and Low-Code Platforms

By enabling non-technical individuals to easily build and manage automated workflows, no-code and low-code automation systems will democratize business automation. This shift will let more departments inside firms to use RPA and IDP without depending largely on IT resources. These platforms will also reduce obstacles to automation, further promoting adaptability and innovation.

4. Enhanced Cybersecurity Automation

As our dependence on technology grows, automating cybersecurity will become very important. Organazations can protect their data and preserve resilience against cyberattacks by using automated threat detection, response, and recovery processes. RPA can automate boring security processes, and AI-powered IDP can analyze and process security-related documents and data to fasten threat detection.

5. Personalized Customer Experiences

Automation will drive more personalized and engaging customer experiences. Advanced data analytics and AI will enable businesses to deliver tailored recommendations, customized services, and proactive support, fostering stronger customer relationships. RPA and IDP will work together to analyze customer data, automating personalized interactions, enhancing the overall customer journey.

6. Prevalence of cloud solutions

Cloud computing will become even more integral to many businesses. In 2025, most big firms will likely use it for data and system integration and deployment to accelerate the software delivery lifecycle. Additionally, cloud platforms can support international cooperation. They enable teams across states and even continents to work together on projects and utilize common resources without access to local infrastructure.

Conclusion

With 2025 just around the corner, it is evident that automation will revolutionize the business landscape. It will offer unprecedented opportunities for efficiency, scalability and innovation. Businesses can realize the full potential of automating operations by analyzing the key areas where it will have an impact, employing the right technologies like RPA and IDP, overcoming any resistance, and staying updated on future developments. Embracing business automation is larger than a technology revolution- it is a strategic necessity that will shape the corporate landscape in the next years.

Looking for dedicated remote developers or an offshore development team! Conact us at GraffersID today and learn more about our services!