Every business startup begins with high hopes and investor confidence. However, there are certain odd circumstances that can either make a business startup or mar its success.

According to various studies conducted recently, a number of business startups capitulate due to a myriad of reasons, one of the most common being lack of budget. Capital is the basic ingredient for any business to thrive. Without adequate finance management, business startups tend to fall down, and this malignant obstacle often causes early-stage startup owners to seek financial backup.

If you are also one of those entrepreneurs who are finding effective ways to raise funds for your startups, then you are in the right place. In this blog, you will find everything right from what is funding to how to raise the funding at various stages of your startup.

Let’s dive in:

What is Funding?

Funding refers to the capital that is required to start and run a business. It is a financial investment in the company for manufacturing, expansion, office spaces, product development, inventory, sales, and marketing.

Many startups choose to not raise funding from external sources and are funded by their co-founders only, which prevents debts and saves them from equity dilution. However, as the startups grow large and scale their operations, they look forward to raising funding.

Why is Funding Required?

There are one, a few, or all of the below-mentioned reasons for a startup to raise funding. As an entrepreneur, you should be clear about why you should raise funding and you should also have a detailed business plan before you approach the investors.

- Team hiring

- Working capital

- Prototype creation, product development

- App/Website development

- Raw materials and equipment

- Licenses and certifications

- Legal and consulting services

- Marketing and Sales

- Office space.

Sources of Funding at Various Stages of Startups:

There are multiple funding options available for startups. However, the source of funding should align with the stage of your startup. It is important to note here that raising funds from external sources is a time-taking process and it can consume over 6 months to convert.

1. Ideation Stage:

This is the stage where you have an idea and working to bring it to life. At this stage, the amount of funds that is usually needed is small.

Given the fact that you are in the very low stage of the startup lifecycle, there are limited sources for raising funds. Common funding sources that are used by startups in this stage are:

2. Friends and Family:

This is the best source to raise funding at the initial stage is to ask your friends and family. You can also ask them to become a part of your plan.

3. Bootstrapping:

Bootstrapping a startup means growing your business with no venture capital. It means relying on your own savings and revenue to operate. This is the best option if you have enough savings as there will be no pressure to pay back the fund or make people part of your plan.

4. Pitching Events:

This is the prize money or financial benefit that is provided by organizations that conduct business plan competitions and challenges. Even though the amount of money that you will get through this is not generally large, it is usually enough for the idea stage. But, to win such pitching events it is a crucial and unique business plan.

5. Validation/Seed Stage

This is the stage where you have a prototype ready for your startup and you are looking forward to validating the potential demand for your startup’s product. This stage is also known as Proof of Concept, where you launch the prototype of the product to determine the market needs. And, to do this, you will be required to conduct the test of the product on potential customers and conduct field trials.

Common funding options that startups can utilize at this stage are:

Angel Investors:

No need to frown if you don’t have a rich uncle and you can’t get enough cash from your assets, you can always look for a wealthy non-relative. You can approach well-off individuals to invest in your startup in exchange for an equity stake. These investors are known as angel investors. Angel investors are generally the ones who are successful in a particular industry and looking for new opportunities in that same industry.

There are angel investors who not only provide you with the finances to get your business off the ground but also share their experience. Moreover, they can also leverage their current contacts within an industry to open the doors for your startup.

Here is a list of a few organizations that put your business in contact with angel investors:

- Tech Coast Angels

- MicroVentures

- Go4Funding

- Band of Angels

- Golden Seeds LLC

- AngelList

- Angel Capital Association

Incubators:

Business incubators are your go-to option if you have an excellent business, but need aid in terms of both money and guidance. Business incubators are organizations that are dedicated to providing services and support to fledgling companies. Business incubators are mainly run by government agencies, venture capital firms, and universities with the goal of nurturing new businesses. They are dedicated to providing early-stage startups with networking, infrastructure marketing, and financial assistance.

Here are some of the popular business incubators:

Crowdfunding:

There are crowdfunding websites such as Kickstarter, which allow artists, charities, entrepreneurs, and individuals to apply for cash online. Prospective entrepreneurs who are planning to raise funding through crowdfunding need to understand the rules of the game.

Some crowdfunding asks you to raise specified goals before releasing the collected funds. If the goal is not met, funds are returned to the donors. The important thing to note here is these platforms also take a cut of the money raised to fund their own operations.

Here are some recognized crowdfunding platforms:

- SeedUps

- EquityNet

- Peerbackers

- RocketHub

- SeedInvest

Early Traction Stage:

The early Traction Stage is defined as the stage in which the startup’s products or services are launched in the market. Key performance indicators such as revenue, app downloads, and customers become crucial at this stage. At this stage, funds are required to increase product offerings, grow user base and expand to new geographies.

Here are Mistakes and Solutions: 5 Lessons from 10 Failed Unicorn Startups!!

Common funding sources available at this stage are:

Banks/NBFCs:

At this stage, startups can show market traction and revenue to raise the format debt from banks and NBFCs. This is especially applicable to working capital. Here some entrepreneurs might prefer debt funding over equity as the former does not dilute equity stake.

Venture Capital Funds:

Venture Capital funds are professionally managed investment funds that are exclusively available for high-growth startups. Each VC fund has got certain investment criteria like the stage of a startup, preferred sectors and funding amount, which should align with the startup.

Venture Debt Funds:

These are private investment funds that invest money in startups mainly in the form of debt. Venture Debt Funds typically involve funding along with an angel or VC round.

Scaling & Above Stage:

This is the stage at which a startup is experiencing a fast rate of market growth and boosting revenues.

Know about What is the best eCommerce platform to use for a startup?

Common funding sources utilized at this stage are:

Venture Capital Funds:

It is recommended to go for this approach only after the startup has achieved significant market traction. A pool of VCs may come together and fund your startup.

Private Investment Firms:

Private Investment Firms have lately started funding fast-growing startups that have successfully maintained a consistent growth record.

What is Seed Funding And How Does It Work?

The journey of entrepreneurship is often likened to a roller coaster ride, filled with exhilarating highs and challenging lows. One of the most daunting challenges faced by aspiring entrepreneurs is securing the initial capital to turn their innovative ideas into viable businesses. This is where seed funding emerges as a critical catalyst for startup success. In this comprehensive guide, we will delve deep into the world of seed funding, unraveling its nuances, and exploring how it can kickstart your entrepreneurial dreams.

Key Points:

- Seed funding is the first pivotal stage of investment for startups.

- It provides the much-needed capital to initiate business operations and product development.

- Equity in the company is exchanged for financial support, aligning investor and entrepreneur interests.

What is Seed Funding?

Seed funding, also known as seed capital or seed money, represents the initial infusion of capital that startups receive to set their wheels in motion. It serves as the foundational financial support that enables entrepreneurs to breathe life into their visions, develop cutting-edge products or services, and ignite their entrepreneurial journey. In exchange for this crucial funding, startups offer equity shares to their investors, aligning their interests in the company’s growth and prosperity.

Types of Seed Funding

There are various types of seed funding sources and methods, each with its own characteristics and requirements. Here are some common types of seed funding:

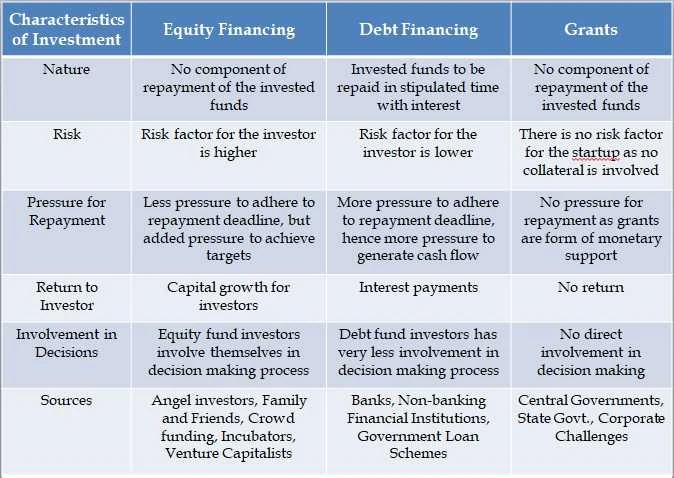

Equity Financing

Equity financing involves exchanging ownership shares or equity in the company for capital. This type of seed funding is common among startups and allows investors to become partial owners of the business. Equity financing is a long-term investment, and investors share in the company’s profits and losses.

Convertible Notes

Convertible notes, also known as convertible debt, are loans provided to startups with the option to convert the debt into equity at a later stage. This type of seed funding offers flexibility to both the startup and the investor. If the startup succeeds, the investor can convert the debt into equity, and if not, they can seek repayment.

Crowdfunding

Crowdfunding has gained immense popularity in recent years. It involves raising small amounts of money from a large number of individuals, typically through online platforms. Crowdfunding allows startups to access capital while also building a community of supporters and potential customers.

Angel Investors

Angel investors are high-net-worth individuals who invest their personal funds into startups in exchange for equity. They often provide not only capital but also valuable mentorship and networking opportunities. Angel investors play a crucial role in nurturing early-stage companies.

Venture Capital

Venture capital (VC) firms are professional investment organizations that provide funding to startups in exchange for equity. VC funding is usually sought by startups with significant growth potential. Venture capitalists are known for their strategic guidance and involvement in the companies they invest in.

Comparison of Seed Funding Types

To help you understand the differences between these types of seed funding, let’s compare them in terms of key factors:

| Factor | Equity Financing | Convertible Notes | Crowdfunding | Angel Investors | Venture Capital |

|---|---|---|---|---|---|

| Ownership | Partial | Potential | N/A | Partial | Partial |

| Repayment | No repayment | Optional | No repayment | No repayment | No repayment |

| Investor Involvement | Varied | Limited | Limited | High | High |

| Funding Amount | Varies | Varies | Varies | Varies | Large |

| Time to Access Funds | Moderate | Quick | Moderate | Moderate | Moderate |

| Source of Funds | Investors | Investors | Crowd | Individual | Investment Firm |

Why Is Seed Funding Important?

Securing seed funding is crucial for several reasons:

1. Validation of Concept

Seed funding allows entrepreneurs to validate their business ideas and concepts in a real-world setting. It provides the financial support needed to turn abstract ideas into tangible products or services, proving their viability in the market.

2. Accelerated Growth

With seed funding, startups can scale and grow more rapidly than they would without it. This financial boost enables them to hire key personnel, invest in marketing, and expand their operations.

3. Access to Expertise

Investors who provide seed funding often bring valuable industry expertise and networks to the table. This mentorship and guidance can be instrumental in steering the startup toward success.

4. Product Development

Seed funding is crucial for developing a prototype or MVP. This working model can be used to attract further funding and refine the product based on real user feedback.

5. Marketing and Expansion

Seed funding can be allocated to marketing efforts, helping startups reach a wider audience and gain a competitive edge. It also facilitates geographic or market expansion.

How Does Seed Funding Work?

Seed funding operates within a structured framework involving several key stages:

Finding Investors

Finding the right investors for your startup is the first step in the seed funding process. Look for individuals or organizations that have an interest in your industry and a history of supporting early-stage companies. Networking events, online platforms, and even angel investor groups can be valuable resources in your search.

Pitching Your Idea

Once you’ve identified potential investors, it’s time to pitch your startup idea to them. Your pitch should be concise, and compelling, and highlight the unique value proposition of your business. Make sure to clearly articulate how their investment will contribute to your success.

Due Diligence

Investors will conduct due diligence to assess the feasibility and potential risks of your venture. Be prepared to provide them with detailed information about your business plan, financial projections, and market research. Transparency is key during this phase.

Negotiating Terms

Negotiating the terms of the investment is a critical step. This includes determining the valuation of your startup, the percentage of equity you’re willing to offer, and any specific conditions or expectations from the investor. Seek legal counsel to ensure a fair deal.

Closing the Deal

Once both parties agree on the terms, it’s time to close the deal. This involves legal documentation, the transfer of funds, and the formalization of the investor’s role in your startup. Celebrate this milestone as you prepare to take your business to the next level.

Key Players in Seed Funding

Several essential stakeholders are integral to the seed funding ecosystem:

- Angel Investors: These high-net-worth individuals invest their personal capital in startups in exchange for equity. They often bring invaluable industry knowledge and mentorship.

- Venture Capitalists: Venture capital firms pool funds from diverse sources, such as corporations, pension funds, and affluent individuals. They seek high-growth potential startups for investment.

- Crowdfunding Platforms: Online platforms like Kickstarter and Indiegogo allow a multitude of individuals to contribute small amounts of money to a startup in exchange for rewards or equity.

- Incubators and Accelerators: These organizations provide startups with a nurturing environment, mentorship, and resources in return for equity or a stake in the company.

Key Points:

- Angel investors, venture capitalists, crowdfunding platforms, and incubators play pivotal roles in the seed funding landscape.

- Each category of investor may have distinct investment criteria and expectations.

Benefits of Seed Funding

Now that we understand what is seed funding how it works and the importance of seed funding, let’s delve deeper into its key benefits:

Accelerated Growth

Seed funding provides the financial injection necessary for startups to grow quickly. This capital allows companies to hire the right talent, invest in infrastructure, and take their products or services to market faster.

Access to Expertise

Investors who provide seed funding often bring more than just money to the table. They offer valuable industry knowledge, experience, and connections. This mentorship can guide startups through challenges and help them make informed decisions.

Validation of Concept

Securing seed funding is a strong validation of your startup’s concept. It indicates that investors believe in your idea and are willing to invest in its success. This validation can boost your credibility in the eyes of future investors and customers.

Product Development

Seed funding allows startups to develop a working prototype or MVP. This is a critical step in refining the product based on user feedback and attracting further investment.

Marketing and Expansion

With seed funding, startups can allocate resources to marketing efforts, enabling them to reach a larger audience and gain a competitive edge. It also provides the means for geographic or market expansion, helping startups grow their customer base.

Challenges and Risks of Seed Funding

Seed funding is an essential stage in the life cycle of many startups, providing the initial capital needed to turn innovative ideas into viable businesses. However, like any stage of financing, seed funding comes with its own set of challenges and risks. Here are some of the key challenges and risks associated with seed funding:

Limited Capital:

Seed funding typically provides startups with a relatively small amount of capital compared to later funding rounds. This limited capital can be a challenge for startups with ambitious growth plans, as it may not be sufficient to cover all expenses or execute their vision.

Uncertain Valuation:

Valuing a startup at the seed stage can be challenging, as there may be limited or no revenue to base the valuation on. This uncertainty can lead to disagreements between founders and investors, potentially causing delays or even deal breakages.

Lack of Track Record:

Startups at the seed stage often lack a proven track record of success. This can make it difficult to attract investors, as they may be hesitant to invest in unproven concepts or teams.

High Risk of Failure:

Seed-stage startups are inherently risky. Many startups fail at this stage due to market uncertainties, product-market fit issues, or other challenges. Investors are well aware of this risk and may demand significant equity in exchange for their investment.

Limited Resources:

Startups at the seed stage typically have limited resources, including personnel and infrastructure. This can make it challenging to execute their business plans effectively and compete in the market.

Founder Dilution:

To secure seed funding, founders often have to give up a significant portion of their equity. This dilution can reduce their ownership stake and control over the company, which may be a concern for some entrepreneurs.

Market Validation:

One of the primary objectives of seed funding is to validate the market demand for a product or service. If the market doesn’t respond as expected, it can be challenging to secure additional funding in later stages.

Investor Expectations:

Seed investors may have different expectations regarding the growth and direction of the startup. Managing these expectations and aligning them with the founders’ vision can be a challenge.

Competitive Landscape:

Startups often face competition from other businesses, including well-established players and other startups. Navigating a competitive landscape can be challenging, especially with limited resources.

Legal and Regulatory Risks:

Startups may face legal and regulatory challenges that can impact their operations or require costly compliance measures.

Exit Strategy:

Seed investors often expect an exit strategy, such as acquisition or going public, to provide returns on their investment. Developing and executing a viable exit strategy can be complex and uncertain.

Market Timing:

The timing of market entry can be critical to a startup’s success. Entering a market too early or too late can pose significant risks.

Despite these challenges and risks, seed funding remains a crucial step for many startups, providing them with the financial support needed to prove their concept and attract further investment. Success at the seed stage can open doors to additional funding rounds and long-term growth opportunities. Entrepreneurs and investors alike must carefully assess these challenges and risks and work together to mitigate them to increase the chances of a successful seed-funded startup.

Strategies to Mitigate Risks

Navigating the challenges and risks of seed funding requires a well-thought-out approach. Here are some strategies to help mitigate these challenges:

Diligent Business Planning

Before seeking seed funding, create a robust business plan. Outline your vision, mission, target market, and financial projections. A well-prepared business plan can instill confidence in potential investors.

Investor Selection

Choose investors who not only provide capital but also align with your business values and goals. Conduct due diligence on potential investors to ensure a strong partnership.

Clear Communication

Maintain transparent and regular communication with your investors. Update them on company progress, challenges, and future plans. This fosters trust and alignment.

Market Research

Continuous market research is vital. Stay updated on industry trends, customer preferences, and competitor strategies. This knowledge empowers you to make informed decisions.

Agility and Adaptability

In the fast-paced startup world, adaptability is key. Be open to pivoting your business strategy if market conditions change or new opportunities arise.

The Top Seed Funding Companies in the US

Selecting the right seed funding company can make a world of difference for your startup. Beyond financial support, seed funding companies often provide mentorship, networking opportunities, and valuable industry insights. It’s essential to research and choose a partner that aligns with your business goals and vision.

Sequoia Capital

Overview: Sequoia Capital is a renowned venture capital firm with a strong presence in Silicon Valley. They have invested in several iconic companies, including Apple, Google, and Airbnb.

Why Choose Sequoia Capital?: Sequoia’s extensive experience and vast network in the tech industry make them an ideal choice for tech startups. They provide not only funding but also strategic guidance, helping startups navigate the competitive tech landscape.

Y Combinator

Overview: Y Combinator, often referred to as YC, is a prestigious startup accelerator program. They offer seed funding, mentorship, and a three-month program to help startups grow rapidly.

Why Choose Y Combinator?: YC’s rigorous program and alumni network are invaluable for startups aiming for rapid growth and scalability. Their successful graduates include Airbnb, Dropbox, and Reddit.

Andreessen Horowitz

Overview: Andreessen Horowitz, also known as a16z, is a leading venture capital firm with a strong focus on technology and innovation.

Why Choose Andreessen Horowitz?: With a16z’s industry expertise and a portfolio that includes Airbnb and Lyft, they provide startups with the resources needed to succeed in the tech world. Their hands-on approach and deep connections in Silicon Valley can be a significant advantage.

First Round Capital

Overview: First Round Capital is an early-stage venture capital firm that has invested in successful startups like Uber and Square.

Why Choose First Round Capital?: They are known for their hands-on approach and commitment to helping startups at the earliest stages of development. First Round Capital’s extensive network and expertise in nurturing early-stage companies make them a top choice for founders.

Accel Partners

Overview: Accel Partners is a global venture capital firm with a rich history of supporting startups, including Facebook and Dropbox.

Why Choose Accel Partners?: Their international reach and experience in scaling startups make them a valuable partner for ambitious entrepreneurs. Accel Partners’ portfolio spans various industries, offering startups a wide range of opportunities.

FAQs About Seed Funding

Q1: What is the typical amount of seed funding a startup receives?

A1: The quantum of seed funding a startup secures can vary significantly based on factors such as the industry, geographical location, and the comprehensiveness of the business plan. On average, seed funding rounds range from as low as $10,000 to as high as $2 million.

Q2: Is seed funding mandatory for all startups?

A2: Seed funding is not a universal prerequisite for startups. Some entrepreneurs opt to bootstrap their businesses, relying on personal savings and revenue generation to fund their operations and growth.

Q3: How can I connect with angel investors or venture capitalists for seed funding?

A3: Networking events, startup incubators, and online platforms like AngelList provide valuable avenues to connect with potential seed investors. Building relationships and showcasing your business proposition are crucial steps in attracting investors.

Q4: What percentage of equity should I offer to seed investors?

A4: The equity stake offered to seed investors can vary widely and depends on factors like the startup’s valuation, funding requirements, and investor expectations. Typically, seed investors may acquire equity stakes ranging from 10% to 25%.

Q5: Is seed funding taxable income for my startup?

A5: Seed funding is generally not categorized as taxable income for startups. Instead, it is viewed as an investment in the business and not treated as revenue.

Q6: How can I find seed funding for my startup?

A1: Finding seed funding involves networking, crafting a compelling pitch, and connecting with angel investors or venture capitalists who specialize in your industry. Don’t forget to leverage online platforms like Upwork, where you can find experts to help you with your pitch and business plan.

Q7: Is seed funding only for tech startups?

A2: While seed funding is commonly associated with tech startups, it is available to startups in various industries. The key is to demonstrate your idea’s potential for growth and profitability.

Q8: What should I include in my pitch to attract seed investors?

A3: Your pitch should include a clear problem statement, a unique solution, a strong team, market research, financial projections, and a well-thought-out business plan.

Seed funding is the lifeblood of many successful startups. It provides the financial support and resources needed to turn entrepreneurial dreams into reality. Whether you’re an aspiring entrepreneur seeking funding or an investor looking to support innovative ideas, seed funding offers a mutually beneficial path to growth and success.

Ready to Transform Your Startup Journey?

Are you eager to unlock the full potential of your startup? Whether you’re in need of app and web development for your startup, expert guidance, or simply want to hire talented developers to work on your ideas, GraffersID is here to assist you every step of the way.

How can I attract angel investors to fund my early-stage startup?

Starting a new venture is an exciting endeavor, but finding the necessary funding to turn your idea into a reality can be quite challenging. Fortunately, angel investors can play a crucial role in providing the financial backing your early-stage startup needs. In this guide, we’ll walk you through effective strategies to attract angel investors and secure funding for your business.

Understanding Angel Investors

Angel investors are individuals who invest their personal funds into early-stage startups in exchange for ownership equity or convertible debt. Unlike traditional venture capitalists, angel investors often invest smaller amounts and are more willing to take risks on innovative and unproven ideas.

Preparing Your Startup for Investment

-

Conducting Competitor Research

Before seeking angel investment, it’s essential to understand your market landscape. Research your competitors, identify gaps in the market, and pinpoint what sets your startup apart. This information will not only help you refine your business strategy but also demonstrate to potential investors that you’ve done your homework.

-

Defining Your Unique Selling Proposition (USP)

Angel investors are attracted to startups with a clear USP that solves a problem or fulfills a need in a unique way. Define what makes your product or service special and how it adds value to your target audience. Highlighting your USP can make your startup more appealing to investors looking for innovation.

Crafting a Compelling Pitch

-

Creating an Engaging Elevator Pitch

Your elevator pitch is a concise and captivating overview of your startup. It should communicate your business idea, target market, and the problem you’re solving. Incorporate your USP and the potential for growth. Remember, a strong elevator pitch can make a lasting impression on potential angel investors.

-

Developing a Detailed Business Plan

A well-structured business plan outlines your startup’s goals, target audience, revenue model, marketing strategy, and financial projections. A comprehensive plan demonstrates your commitment to success and helps angel investors envision the future of your business.

Leveraging Your Network

-

Tapping into Your Personal Connections

Networking plays a significant role in attracting angel investors. Leverage your personal and professional contacts to get introductions to potential investors. Attending industry events, workshops, and startup meetups can also help you expand your network and connect with those interested in funding startups.

-

Seeking Recommendations and Introductions

Consider seeking recommendations from mentors, advisors, or other entrepreneurs who have successfully secured angel investments. An introduction from a trusted source can greatly increase your credibility and chances of getting noticed by potential investors.

Showcasing Traction and Potential

-

Demonstrating Traction

Angel investors want to see that your startup is gaining traction in the market. Present data on customer acquisition, user engagement, and any milestones achieved. This evidence of progress can instill confidence in investors and show them that your business is on the right track.

-

Outlining Future Growth

While showcasing current traction is essential, outlining your plans for future growth is equally important. Investors want to know how their investment will contribute to your startup’s expansion. Clearly articulate your growth strategy, including marketing initiatives, product development, and scalability plans.

What percentage of equity should I offer to angel investors?

The equity percentage offered to angel investors can vary widely depending on factors such as the stage of your startup, the amount of investment, and the investor’s expectations. It’s crucial to strike a balance between attracting investment and retaining a reasonable amount of ownership.

How do angel investors typically exit their investments?

Angel investors typically exit their investments through methods such as acquisition by a larger company or an initial public offering (IPO). Some investments may also result in a buyback of shares by the startup. It’s important to discuss potential exit strategies with investors to align expectations.

What role do angel investors play in the business?

While angel investors often provide funding, they can also offer valuable expertise, guidance, and connections. Some may take on advisory roles or join your board of directors. Be open to discussing the level of involvement an investor desires and how it aligns with your business goals.

What are the key factors that investors look for when considering funding a startup in its Series A round?

Investors evaluate several key factors when considering funding a startup in its Series A round. These factors help them assess the potential for growth, sustainability, and return on investment.

Understanding Series A Funding

Series A funding marks a pivotal juncture in the life of a startup. It typically comes after a successful seed funding round and is aimed at accelerating the company’s growth. During this stage, startups seek larger investments to scale their operations, enhance their product or service, and penetrate the market more deeply.

Key Factors Investors Look For

1. Market Opportunity and Potential

Investors seek startups operating in a burgeoning market with substantial growth potential. A well-defined target market and a clear understanding of how the startup’s offering addresses a significant problem or need are essential. Thorough market research and the ability to showcase the startup’s potential to capture a meaningful market share can be a game-changer.

2. Strong Value Proposition

A solid value proposition sets a startup apart from its competitors. Investors look for a unique selling proposition that clearly communicates why customers would choose this startup’s solution over others. This could be a technological edge, a disruptive approach, or a novel business model.

3. Traction and Growth Metrics

Startups that have gained traction and can provide concrete growth metrics have a competitive edge. Investors closely examine metrics like monthly active users, customer acquisition cost, churn rate, and revenue growth. Consistent, sustainable growth is a strong indicator of a startup’s potential.

4. Exceptional Team

A talented, adaptable, and driven team is a cornerstone of startup success. Investors evaluate the founders’ expertise, their ability to execute the business plan, and their passion for the venture. A cohesive team with a track record of overcoming challenges is highly attractive to investors.

5. Product or Service Innovation

Innovation is a key driver of success in the startup ecosystem. Investors want to see how a startup’s product or service stands out in the market, whether through technological innovation, unique features, or a novel approach to solving a problem.

6. Monetization Strategy

Investors need a clear understanding of how a startup plans to monetize its offering. Whether it’s through subscriptions, freemium models, or other strategies, a well-defined monetization plan demonstrates the startup’s ability to generate revenue and achieve profitability.

7. Competitive Landscape Assessment

A thorough analysis of the competitive landscape showcases a startup’s awareness of its rivals and its strategy to outperform them. Investors appreciate startups that can identify their unique advantages and articulate how they will maintain a competitive edge.

8. Clear and Realistic Financials

Transparent and well-structured financial projections reassure investors of a startup’s fiscal responsibility. Investors analyze the startup’s burn rate, runway, and forecasts to assess its financial health and sustainability.

In the dynamic realm of startup funding, securing Series A funding is a pivotal step that requires meticulous preparation and a compelling value proposition. Investors seek a combination of a promising market opportunity, a standout product or service, demonstrated growth, and a dedicated team. By addressing these key factors, startups can enhance their appeal to investors and pave the way for accelerated growth and success.

For more insights on startup funding and strategies, feel free to reach out to us!

How can You build strong relationships with potential investors to increase my startup’s chances of receiving funding?

In the dynamic world of startups, securing funding is often a critical milestone for growth and success. To increase your startup’s chances of receiving funding, it’s crucial to cultivate strong relationships with potential investors. This section explores effective strategies to build and nurture these relationships, ultimately enhancing your startup’s appeal and credibility within the investor community.

Understanding the Importance of Investor Relationships

Building connections with potential investors offers more than just financial benefits. A solid investor relationship can provide mentorship, guidance, and access to valuable industry insights. These relationships are built on trust, credibility, and effective communication.

Building Trust and Credibility

-

Providing Clear Business Plans

Investors appreciate a well-defined business plan that outlines your startup’s goals, target market, competition analysis, and revenue projections. A clear plan demonstrates your strategic thinking and commitment to achieving milestones.

-

Demonstrating Industry Expertise

Investors want to see that you have a deep understanding of your industry. Showcase your expertise by highlighting your team’s experience, industry partnerships, and innovative solutions that set your startup apart. This establishes confidence in your ability to navigate challenges and seize opportunities.

Effective Communication Strategies

-

Tailoring Your Pitch

Every investor is unique, so customize your pitch to align with their interests and priorities. Research potential investors thoroughly to understand their investment history and preferences. This personalized approach shows that you value their time and have considered how their expertise aligns with your business.

-

Providing Regular Updates

Maintain open lines of communication by sharing regular updates on your startup’s progress. Highlight achievements, address challenges, and outline upcoming milestones. Timely updates demonstrate transparency and a commitment to delivering results.

Networking Opportunities

-

Attending Industry Events

Participating in industry conferences, seminars, and networking events provides a platform to connect with potential investors. Engage in meaningful conversations, exchange ideas, and explore potential partnerships. Remember, these events are not just about pitching; they’re about building genuine relationships.

-

Utilizing Online Platforms

Online platforms, including investor networks and social media, offer opportunities to showcase your startup to a broader audience. Share insightful content, engage in discussions, and connect with investors who share your vision. Online interactions can lead to offline relationships and investment opportunities.

Why Israeli Tech Ventures Seek US Incorporation?

In recent times, a significant shift has been observed within Israel’s tech startup ecosystem. An increasing number of innovative ventures are choosing to incorporate in the United States, primarily in Delaware, known for its business-friendly environment. This trend has been fueled by various factors, including attractive funding opportunities, pro-business policies, and concerns stemming from a planned judicial overhaul within Israel’s borders. This article explores the reasons behind this migration and its implications, We will walk through the Israeli-US tech relations.

Why Israeli Startups Are Choosing the US

Attractive Business Environment in Delaware

Delaware’s reputation as a pro-business state with favorable tax benefits, such as low corporate and state sales taxes, makes it an appealing destination for Israeli startups. These financial incentives play a significant role in the decision to establish legal identities abroad.

Apprehension About Judicial Overhaul

The planned judicial overhaul in Israel, led by Prime Minister Benjamin Netanyahu’s government, has created apprehension among entrepreneurs. While the overhaul’s direct impact on the tech sector is limited, concerns about long-term effects, corruption, and uncertainty have prompted some startups to seek incorporation in Delaware.

Impact on the Israeli Government and Economy

The Israeli government faces an economic risk as this trend continues. The tech sector contributes substantially to the country’s GDP and tax income. If the proposed changes continue to unsettle the tech industry, it could result in a noticeable brain drain, impacting the nation’s economic stability.

Survey Insights on Startup Relocation

According to a survey by the Israel Innovation Authority (IIA), the number of Israeli tech startups incorporated in Delaware has surged from 20% in 2022 to a staggering 80% in 2023. Companies are also planning to register future intellectual property overseas, driven by the prevailing uncertainty.

Business Considerations vs. Political Factors

While concerns about the Israeli government’s policies have played a role in this migration, it’s crucial to note that many entrepreneurs and investors primarily base their decisions on business considerations. Israel’s tech sector heavily relies on foreign investment, and recent factors like interest rate hikes and funding challenges have led startups to seek locations with more abundant capital.

Voices from the Industry

Ronen Feldman, ProntoNLP.ai

For Ronen Feldman, the founder and CEO of ProntoNLP.ai, the decision to incorporate in Delaware is clear: it’s about prioritizing shareholders, investors, and the company’s growth.

Tomer Tzach, CropX

Tomer Tzach, CEO and co-founder of CropX, is considering relocating his company’s incorporation to Delaware to ensure continued growth in a stable environment.

Michael Fertik, Heroic Ventures

Michael Fertik, founder of Heroic Ventures, recommends Delaware incorporation to startups seeking funding, emphasizing the benefits of certainty in an uncertain world.

Adam Fisher, Bessemer Venture Partners

Adam Fisher, a partner at Bessemer Venture Partners and a long-time investor in Israeli startups, advises entrepreneurs to incorporate in Delaware while maintaining an Israeli presence to navigate the prevailing uncertainty.

The Psychological Aspect of Relocation

According to Ayal Shenhav, head of hi-tech and venture capital at law firm Gross & Co., the decision to set up shop in Delaware is largely psychological. It reflects a perception of instability rather than concrete evidence of corruption or judicial misconduct.

The Future of Israeli Tech

Despite these changes, Yaron Samid, managing partner of the TechAviv Founder Partners fund, remains optimistic about the future of Israeli tech. He believes that Israel’s incredible talent pool will continue to produce outstanding companies, regardless of their corporate structures, whether U.S. or Israeli. In the end, what truly matters is the strength of the tech ecosystem.

Conclusion

The trend of Israeli tech startups incorporated in the United States, particularly in Delaware, is a response to a complex web of factors, including business considerations, government policies, and concerns about the future. While it may raise questions about the future of Israel’s tech landscape, the resilience of its talent pool and innovative spirit remains unwavering.

Israeli-US Tech Relations

In today’s ever-evolving technological landscape, collaborations and partnerships between countries have become instrumental in driving innovation and fostering economic growth. One such partnership that has gained significant attention and continues to flourish is the relationship between Israel and the United States. In this article, we will delve into the depths of Israeli-US tech relations, exploring how this alliance has not only revolutionized industries but also set a remarkable precedent for international cooperation in the tech sector.

Understanding the Roots

The roots of Israeli-US tech relations can be traced back several decades. Israel, often referred to as the “Startup Nation,” has consistently demonstrated its prowess in innovation and entrepreneurship. With a population known for its strong technological acumen, Israel’s emergence as a global tech powerhouse was almost inevitable.

The United States, on the other hand, boasts a robust tech ecosystem with Silicon Valley at its epicenter. The convergence of talent, capital, and a culture that encourages risk-taking has made the U.S. a global leader in technology.

Collaborative Ventures

1. Research and Development Initiatives

One of the key aspects of Israeli-US tech relations is collaborative research and development initiatives. Both countries recognize the importance of investing in cutting-edge technology. Corporations and research institutions from Israel and the U.S. frequently collaborate on projects that range from artificial intelligence to cybersecurity.

2. Investment and Funding

Israel has attracted substantial investment from American venture capital firms. This influx of capital has not only accelerated the growth of Israeli startups but also cemented the ties between the two nations. The investments span various sectors, including biotech, fintech, and autonomous vehicles.

3. Cybersecurity Synergy

Cybersecurity is an area where Israel’s expertise has been particularly beneficial for the United States. Israeli cybersecurity firms have played a crucial role in enhancing the resilience of U.S. institutions and corporations against cyber threats.

Achieving Technological Milestones

4. Mobileye: Revolutionizing Autonomous Driving

Mobileye, an Israeli company specializing in autonomous driving technology, has been at the forefront of transforming the automotive industry. Its groundbreaking innovations in vision-based advanced driver-assistance systems (ADAS) have garnered significant interest from major U.S. automakers.

5. Biotech Advancements

Israeli-US collaboration in the biotech sector has led to groundbreaking advancements in healthcare. From genetic research to pharmaceuticals, joint efforts have resulted in the development of life-saving treatments and therapies.

6. Aerospace Innovations

The aerospace industry has also witnessed the positive impact of Israeli-US tech relations. Collaborative projects in this sector have contributed to the development of advanced aviation technologies and satellite systems.

Challenges and Opportunities

7. Geopolitical Sensitivities

While the tech partnership is thriving, it is not without challenges. Geopolitical sensitivities in the Middle East occasionally cast a shadow over Israeli-US relations. Navigating these complexities requires diplomatic finesse.

8. Intellectual Property Concerns

Protecting intellectual property is a paramount concern in the tech world. Both nations must work together to ensure the fair and ethical use of innovative technologies while safeguarding the interests of innovators.

Future Prospects

9. Expanding Horizons

The future of Israeli-US tech relations holds immense promise. Both countries are actively exploring new frontiers such as quantum computing, clean energy, and space exploration. These ventures are expected to further deepen their collaboration.

10. Global Impact

The impact of Israeli-US tech relations extends beyond the borders of the two nations. Their joint innovations have the potential to address global challenges, from climate change to healthcare crises.

Israeli-US tech relations stand as a testament to the power of collaboration in the tech-driven world. This partnership has not only driven technological advancements but has also fostered mutual economic growth. As Israel and the United States continue to explore new avenues of innovation, the world eagerly anticipates the transformative solutions that will emerge from their joint efforts.

FAQs

Q1: How do I identify the right investors for my startup?

A1: Research is key. Look for investors who have a history of investing in your industry or similar ventures. Platforms like AngelList, Crunchbase, and LinkedIn can help you identify potential investors.

Q2: What should I include in my pitch?

A2: Your pitch should cover your startup’s value proposition, target market, competitive advantage, revenue model, and funding needs. Tailor your pitch based on the investor’s background and interests.

Q3: How often should I provide updates to investors?

A3: Aim for regular updates, such as monthly or quarterly emails. Share significant milestones, growth metrics, and any challenges you’re addressing. Transparency fosters trust.

Cultivating strong relationships with potential investors is a multifaceted endeavor that requires clear communication, industry expertise, and a personalized approach. By demonstrating your startup’s value and aligning it with investor interests, you’ll not only increase your chances of securing funding but also lay the foundation for mutually beneficial, long-lasting partnerships. Remember, building relationships takes time, so be patient and persistent in your efforts.

Conclusion:

Unless you already have a high bank balance, putting together finances to launch a new business demands serious planning and effort. While raising funds for your startup, it is crucial to weigh the benefits and downsides of available funding options. Make sure to check all the pros/cons of the funding option you are choosing so that you can enjoy the greatest flexibility at the least cost.

You can also consider obtaining funds from a mix of different sources. Even if you land a significant band, you may need additional cash to manage unanticipated events and expenses. Fortunately, the rise of financing sources like peer-to-peer lending and crowdfunding has brought more range of financing options for entrepreneurs than ever before.