Artificial Intelligence (AI) continues to bring forward a major shift in almost all industries by reducing costs, streamlining operations, and providing customized customer experiences. Similarly, AI drives many modern insurance technologies, from improving fraud detection and compliance to automating customer support. However, to understand its actual impact, it is necessary to explore a specific, relevant use case. In this article, we’ll discuss a standard insurance policy purchasing lifecycle and how artificial intelligence (AI) may be used at all stages to make the process smarter, faster, and more efficient.

Overview of AI in Insurance

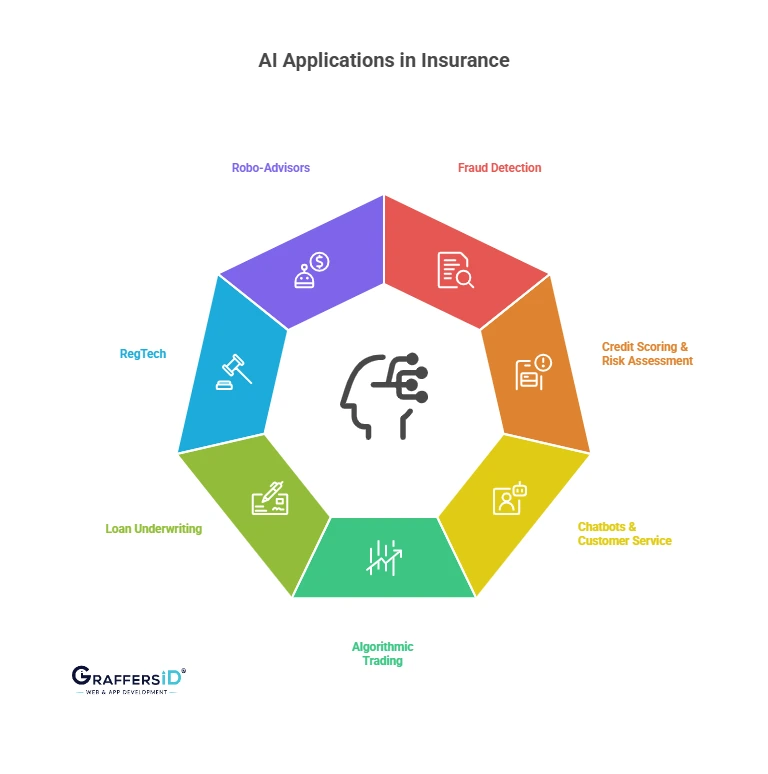

There are several different use cases for AI in insurance:

- Fraud Detection: Machine learning algorithms identify unusual patterns and report fraudulent transactions in real time.

- Credit Scoring & Risk Assessment: AI assesses non-traditional data (such as utility payments and social media activities) to evaluate creditworthiness.

- Chatbots & Customer Service: Natural Language Processing (NLP)-powered bots respond to numerous client inquiries 24/7.

- Algorithmic Trading: AI models forecast market patterns, allowing for high-frequency, low-risk trading methods.

- Loan Underwriting: Automated underwriting tools evaluate loan eligibility in real time.

- RegTech: AI provides real-time monitoring to assist insurance providers in adhering to constantly evolving rules and regulations.

- Robo-Advisors: AI-powered solutions that offer personalized investing guidance based on user objectives and risk tolerance.

Insurance Policy Lifecycle (Manual Approach)

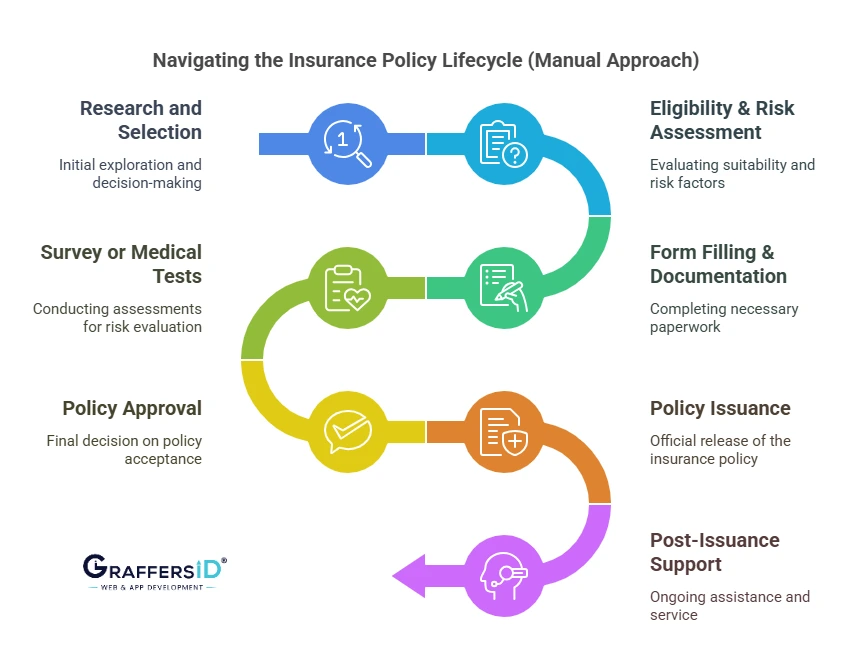

A normal insurance buying process looks like this:

- Research and Selection: The features, costs, and advantages of various plans are compared by customers when they spend time on the websites of various insurance companies. They could look for referrals or read internet reviews to find the most suitable policy.

- Eligibility & Risk Assessment: Once the consumer has selected a policy, he/she is requested to fill in a personal information questionnaire containing questions regarding age, occupation, income level, medical history, lifestyle habits, etc. The information collected by the insurer is used to assess the likelihood of risk associated with offering the person insurance coverage.

- Form Filling & Documentation: Application forms are filled out manually by users. This method is generally time-consuming and prone to errors. They also have to upload some documents, such as proof of identity, income statements, and even medical reports.

- Survey or Medical Tests: Medical tests or health checkups may be necessary, depending on the type of insurance (home, car, life, or health). These tests are carried out to verify the data that has been submitted and estimate the actual risk.

- Policy Approval: The insurance companies then examine the data collected to assess the total risk. Based on the risk assessment, they determine the appropriate premium to charge and whether to approve the application.

- Policy Issuance: Once approved and the payment is made, the policy document is prepared and sent to the client in either hard copy or digital form.

- Post-Issuance Support: Following issuance of the insurance, clients may need help with claims, renewals, policy upgrades, or general inquiries. This stage is important for maintaining customer satisfaction and retention.

Read More: What Is an AI Appointment Scheduling Agent? Benefits, Use Cases, and Setup (2026)

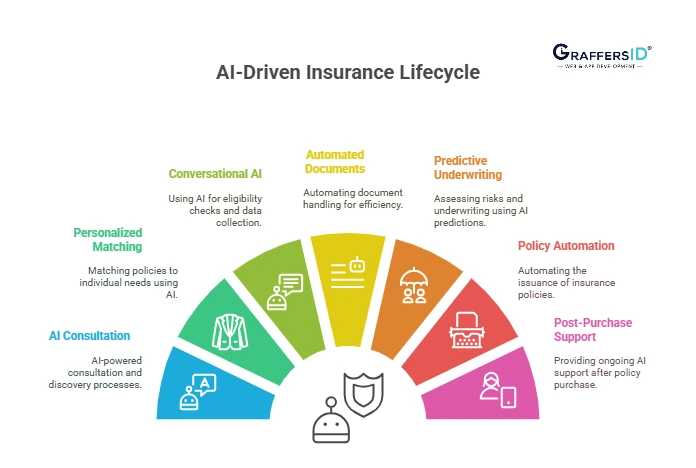

AI-Driven Insurance Policy Lifecycle

Let’s now analyze how AI can improve every stage of this process:

- AI-Powered Consultation & Discovery

- The initial interaction is made by AI chatbots. These bots can respond to thousands of questions in real time, such as “What does this policy cover?” and “What is the claim process?”

- AI is also capable of analyzing user behavior on the website, including the policies they click on and the amount of time they spend in particular sections, and making product recommendations based on their preferences.

- Personalized Policy Matching

- AI divides users and makes policy recommendations using decision trees and grouping algorithms. For example, a nonsmoker who is 25 years old and has no pre-existing medical issues might be referred to low-premium, high-coverage plans.

- To help users make well-informed decisions, the algorithms may perform cost-benefit assessments for a variety of policy situations in the background.

- Eligibility & Data Collection via Conversational AI

- In place of lengthy, static forms, consumers engage with chatbots that adapt their inquiries in response to past responses. For example, if a user discloses they have diabetes, follow-up inquiries about current medication and treatment history could be made.

- This interactive style ensures greater data accuracy, lowers drop-off rates, and boosts engagement.

- Automated Document Handling

- AI-driven OCR systems can scan uploaded documents, collect necessary data (such as name, date of birth, and medical history), and compare it with data entered in forms.

- AI also automatically identifies missing information, groups papers into categories, and asks for the necessary adjustments.

- Risk Assessment & Predictive Underwriting

- Future claim probability can be predicted by AI models trained on past claim data. This makes it possible for insurers to make data-driven coverage choices more quickly.

- Risk assessments can be constantly improved by integrating real-time data from connected home devices or wearables (such as fitness trackers) into the underwriting model.

- Policy Issuance Automation

- AI may automatically create policy documents once they have been approved and submit them for e-signature via safe online channels.

- Smart contracts ensure transparency and trust by automating premium deductions, fund distribution, and insurance activation based on established guidelines.

- Post-Purchase AI Support

- AI virtual assistants are available even after closing to help consumers with claims filing, renewal alerts, and policy adjustments.

- AI can process damaged photos for claims (like auto insurance), calculate repair prices, and start the reimbursement procedure.

- AI also monitors usage trends and proactively suggests changes or upgrades to policies.

Did You Know?

AI-driven chatbots helped insurance companies reduce customer churn rate by 38% and speed up the processing of claims by 24%. Are you curious how this will affect your company?

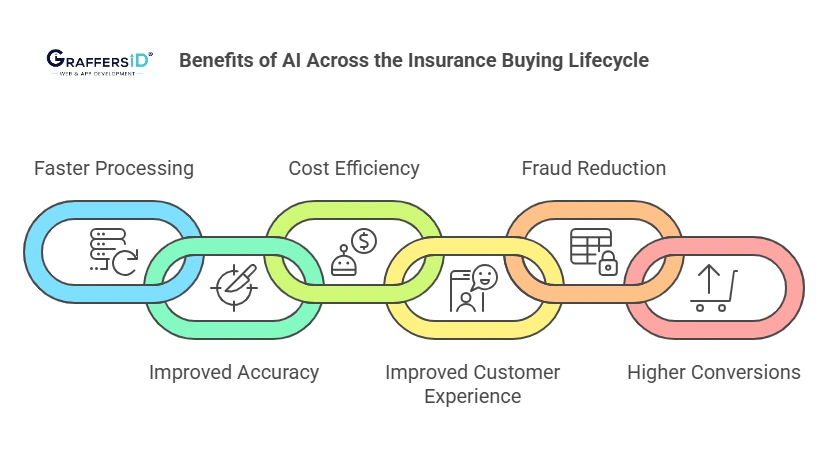

Benefits of AI in Insurance Lifecycle

- Faster Processing: AI reduces wait times from days to minutes, particularly in underwriting and customer support.

- Improved Accuracy: Machine learning algorithms reduce human error while entering data and documenting.

- Cost Efficiency: Operating costs can be reduced by automating repetitive processes like form processing and Q&A.

- Improved Customer Experience: Interactive and personalized touchpoints maintain user satisfaction and engagement.

- Fraud Reduction: Pattern recognition reduces fraud payouts by identifying claim abnormalities.

- Higher Conversions: Policy purchase rates are increased through AI suggestions and streamlined onboarding.

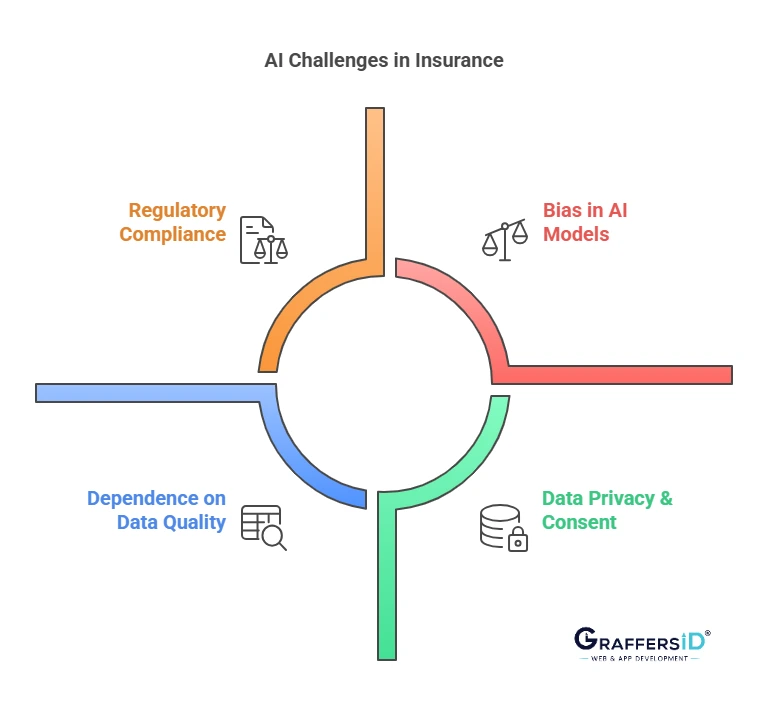

Challenges & Considerations of AI in Insurance

- Data Privacy & Consent: AI systems manage extremely private data. Thus, user consent, strong data encryption, and adherence to data protection regulations are crucial.

- Regulatory Compliance: All AI-related fintech activities must abide by insurance-specific laws, such as HIPAA in the US, GDPR in Europe, and IRDAI in India.

- Bias in AI Models: AI may unjustly reject policies or inflate premiums for particular groups if trained on biased previous data.

- Dependence on Data Quality: The quality of the input data determines how well AI performs. Outdated or inadequate data can result in poor decisions and reduced trust.

Conclusion

Conclusion

Artificial Intelligence is changing how the insurance industry works by making processes more customer-focused as well as quicker and more effective. AI improves each step, reduces operational stress, and improves value for clients and insurance companies. As technology advances, insurance companies that want to stay relevant in the digital-first era must adopt AI.

Are you set to integrate AI into your insurance procedures and transform your consumer experiences?

GraffersID specializes in developing scalable, intelligent solutions for financial and insurtech companies. Our skilled AI developers can transform your idea into a high-performing product, whether your goal is to automate risk assessment, improve user experience with AI chatbots, or create secure backend infrastructures.

👉 Schedule a free consultation today to discuss how AI can speed up the development of your insurance products.