In 2026, e-commerce success depends on more than just great products; it hinges on how effortlessly and securely customers can pay. As digital transactions evolve with AI-driven personalization, automation, and cross-border scalability, payment integration has become a strategic growth engine, not just a backend feature.

For CTOs, CEOs, and product leaders, the right payment infrastructure can unlock higher conversions, stronger customer trust, and a lasting competitive edge.

This comprehensive 2026 guide reveals how to choose, integrate, and optimize modern payment systems, from leveraging AI for fraud detection and checkout automation to preparing for the next wave of AI-powered consumer agents.

What is a Payment Gateway?

A payment gateway is a secure service that processes online payments for your website or app. It handles credit and debit card transactions, protects sensitive customer information, and ensures that payments are authorized and completed safely.

How Does a Payment Gateway Work?

-

Customer initiates checkout on your site or app.

-

Transaction details are sent to the gateway securely.

-

Gateway forwards payment data to the payment processor.

-

The processor approves or declines the transaction after fraud and fund checks.

-

Gateway communicates the result back to your website or app.

-

Funds are transferred to your merchant account if the payment is approved.

Read More: 7 Best Programming Languages For Retail & E-Commerce

Core Components of Modern Payment Integration

1. Merchant Account vs. Payment Gateway

A merchant account is a bank account that allows you to accept credit/debit card payments. Many modern gateways offer integrated merchant accounts for easy setup.

2. Payment Processors & Networks

Payment processors (Stripe, Adyen, Braintree, Square) handle the actual movement of money, evaluate fraud risks, and ensure funds are available.

Pro Tip: AI-powered processors dynamically route transactions to maximize approvals and reduce fees.

Key Benefits of Payment Gateway Integration in 2026

Integrating an online payment gateway provides a multitude of benefits that can significantly impact your e-commerce operations, including:

-

Access Actionable Insights: Gain real-time analytics on transactions, declines, and customer behavior using payment integration services to optimize sales and reduce losses.

-

Faster, Smooth Checkout: Provide secure, frictionless payment experiences that increase trust and reduce cart abandonment.

-

Automated Operations: Streamline refunds, recurring billing, and financial reporting with AI-driven automation.

-

Scalable for Global Growth: Accept multiple currencies, local payment methods, and scale easily as your business expands.

-

AI-Powered Fraud Protection: Detect and prevent fraudulent transactions instantly with machine-learning–driven systems.

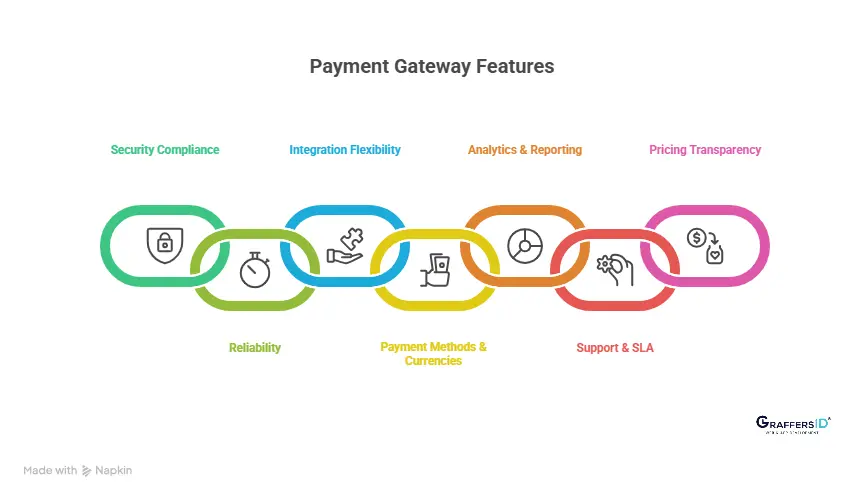

How to Choose the Best Payment Gateway for Your E-Commerce in 2026?

Choosing the right payment gateway is critical for smooth transactions, higher conversions, and secure operations. Here’s what decision-makers need to focus on in 2026:

- Security & Compliance: Ensure the gateway follows the latest PCI DSS standards, uses tokenization to protect card data, and implements encryption or zero-knowledge architecture. Strong security builds trust and shields your business from rising digital fraud threats.

- Reliability: A gateway should guarantee high uptime, global redundancy, and failover capabilities. This ensures your store stays operational 24/7, even during high-traffic periods or partial outages, preventing lost sales.

- Integration Flexibility: Look for API-first solutions that support plugins and are compatible with headless or composable commerce setups. Flexible integration allows seamless checkout experiences across web, mobile, and emerging channels.

- Payment Methods & Currencies: The gateway should handle multiple payment options, from credit/debit cards to digital wallets, BNPL, and local payment methods. Multi-currency support is essential for international customers and cross-border growth.

- Analytics & Reporting: Advanced reporting dashboards provide insights into transaction trends, decline reasons, and customer behavior. Data-driven analytics helps optimize payment flows and improve overall revenue performance.

- Support & SLA: Evaluate the provider’s developer resources, documentation, and responsiveness. Quick resolution of issues minimizes downtime and keeps your operations running smoothly.

- Pricing Transparency: Understand all fees, including setup, per-transaction, currency conversion, and PCI compliance charges. Transparent pricing ensures accurate forecasting and prevents unexpected costs.

Modern gateways increasingly leverage AI-based dynamic routing to maximize approvals and reduce costs. Additionally, being agentic commerce-ready prepares your business for AI-driven autonomous transactions, a growing trend in 2026.

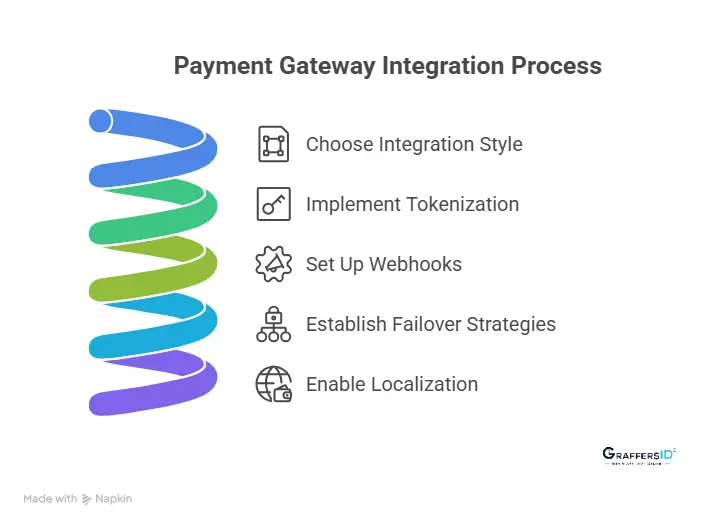

Step-by-Step Guide to Payment Gateway Integration in 2026

- Integration Styles: Choosing the right integration method is crucial. Hosted checkouts redirect customers to the gateway’s secure page, embedded iframes keep them on your site, and API-driven server-to-server integrations offer maximum flexibility and control for complex setups.

- Tokenization: Replacing sensitive card data with secure tokens ensures that no raw payment information is stored on your servers, reducing your PCI compliance scope while keeping transactions safe.

- Webhooks & Event Handling: Automating events like refunds, chargebacks, and notifications through webhooks ensures your payment system reacts in real-time, improving operational efficiency and customer experience.

- Failover Strategies: Implementing secondary gateways or circuit-breaker mechanisms helps maintain uninterrupted transactions during outages, minimizing revenue loss and improving reliability.

- Localization: Supporting geolocation-based payment options and automatically detecting customer currencies makes the checkout experience seamless, increases conversions, and supports global expansion.

How to Secure Your Payment Integration with AI Fraud Protection in 2026?

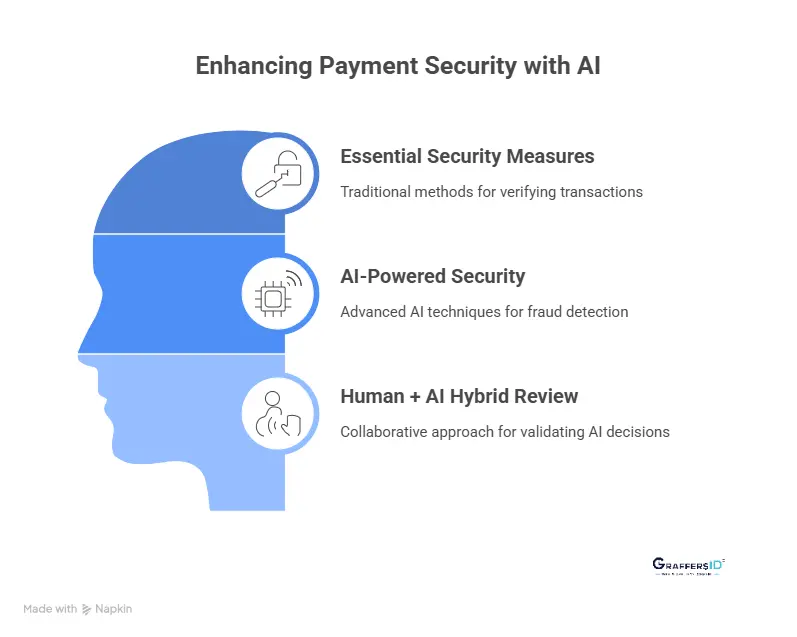

Essential Security Measures for Payment Gateway Integration

-

Address Verification Service (AVS): Confirms billing address matches the cardholder’s bank.

-

CVV Verification: Ensures cardholder identity with 3-4 digit security code.

-

3D Secure v2+: Adds an extra layer of authentication for safer transactions.

-

Device Fingerprinting: Detects unusual device behavior to prevent fraud.

-

Velocity Checks: Flags multiple rapid transactions from the same source.

AI-Powered Security for Payment Gateway Integration

-

Real-Time Anomaly Detection: Instantly identifies unusual transaction patterns.

-

AI-Based Fraud Scoring: Evaluates hundreds of behavioral signals for accurate risk assessment.

-

Synthetic/AI Credential Detection: Identifies fake or AI-generated user credentials to stop advanced fraud attempts.

Human + AI Hybrid Review

-

Edge cases are reviewed by analysts to validate AI decisions.

-

Continuous feedback improves machine learning models for smarter, faster fraud detection.

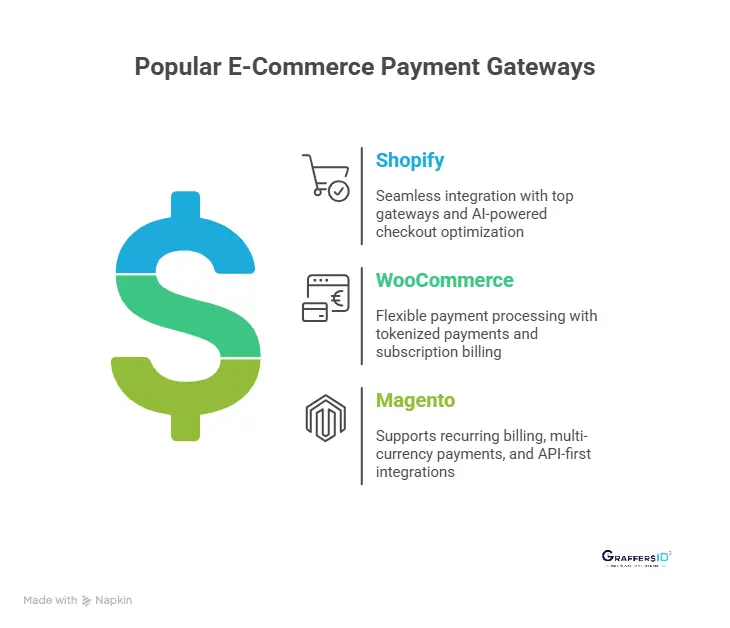

Best Payment Gateway Integrations for Popular E-Commerce Platforms in 2026

1. Shopify

Shopify integrates seamlessly with top gateways like Stripe, Adyen, PayPal, Braintree, and Square, enabling merchants to accept a wide range of payment methods. It also supports accelerated checkouts through Shop Pay and Apple Pay, while AI-powered checkout optimization tools help increase conversion rates and reduce cart abandonment.

2. WooCommerce

WooCommerce offers plugins for Stripe, PayPal, Square, and Authorize.Net, allowing flexible payment processing directly within WordPress. With features like tokenized payments, subscription billing, and headless-ready APIs, WooCommerce supports both simple online stores and complex, customized e-commerce setups.

3. Magento

Magento (Adobe Commerce) supports gateways like Stripe, Braintree, Authorize.Net, and Adyen via dedicated extensions. It enables recurring billing, multi-currency payments, and mobile wallet transactions, making it ideal for international stores and high-volume merchants. The trend toward composable and headless commerce means API-first payment integrations are increasingly critical for scalable and future-proof setups.

Tip: Prioritize API-first, AI-ready gateways for future-proof e-commerce architecture.

How to Track Payment Integration Performance in 2026?

Payment Integration Metrics to Track for Higher Conversions

To maximize conversions and streamline your e-commerce operations, track these essential metrics:

-

Sales Volume & Average Order Value (AOV): Measure overall revenue and customer spending trends.

-

Acceptance Rates: Monitor the percentage of successful transactions to reduce declines.

-

Chargebacks & Refunds: Identify patterns to prevent losses and improve customer trust.

-

Payment Method Popularity: See which cards, wallets, or BNPL options your customers prefer.

-

Device & Location Analytics: Understand user behavior by device type and geographic region.

-

Subscription Metrics: Track recurring revenue, churn, and customer lifetime value (LTV) for subscription-based offerings.

-

Checkout Abandonment: Identify drop-off points to optimize the payment experience.

AI Enhancements for Faster and Safer Payment Gateway Integration

Leverage AI and automation to boost efficiency, reduce costs, and improve conversions:

-

Smart Routing: Dynamically route transactions across multiple processors to maximize approvals and minimize fees.

-

Personalized Payment Options: Suggest the most convenient payment methods or BNPL options for each customer.

-

Agentic AI Readiness: Prepare your payment systems for autonomous AI agents that can make purchases on behalf of users.

Conclusion

In 2026, payment integration is no longer just a technical necessity; it’s a strategic growth driver. Businesses that leverage AI-powered gateways, advanced fraud prevention, and seamless multi-platform integration can boost conversions, reduce revenue loss, and deliver frictionless experiences to global customers.

From tokenized transactions and predictive fraud scoring to agentic commerce readiness, the modern payment stack is central to scaling e-commerce efficiently.

Staying ahead requires continuous optimization, data-driven insights, and adoption of cutting-edge AI technologies. By integrating the right payment solutions and monitoring key metrics, companies can future-proof their operations and capitalize on emerging commerce trends.

Ready to take your e-commerce payments to the next level? At GraffersID, we build scalable, AI-enhanced payment systems, secure e-commerce platforms, and future-ready payment infrastructures. Hire our Fintech developers, payment engineers, or full-stack e-commerce teams to accelerate your growth in 2026 and beyond.