The banking and finance industry in 2026 is transforming faster than ever. From AI-powered fraud detection to blockchain-based settlements and microsecond trading systems, technology is rewriting the rules of financial innovation.

But behind every breakthrough in fintech lies one crucial decision: choosing the right programming language.

The languages you pick today determine how secure, scalable, and compliant your systems will be tomorrow. In a world driven by AI automation, cybersecurity mandates, and real-time digital transactions, the right tech stack can define your competitive edge.

In this blog, we break down the 7 best programming languages shaping modern banking and finance, revealing how global institutions use them to power AI analytics, digital banking, trading automation, and next-gen compliance systems.

Why the Right Programming Language is Crucial for Fintech Development in 2026?

In 2026, financial software works as an intelligent ecosystem powered by AI, automation, and real-time data. Choosing the right programming language directly impacts your system’s security, compliance, and performance.

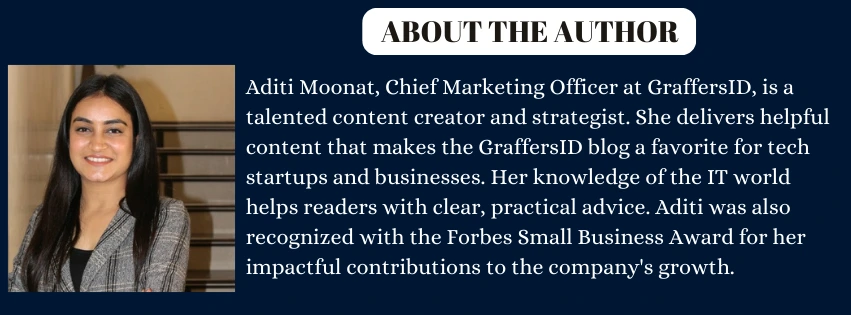

1. AI-Driven Fraud Detection and Risk Analytics

Financial institutions handle large amounts of private customer data, making them the main targets for cyberattacks. Banks now rely on AI and anomaly detection models to identify fraud in milliseconds. Languages with native AI and data science libraries power faster, smarter financial decision-making.

2. High Performance and Real-Time Scalability

From digital wallets to HFT systems, finance apps process millions of microtransactions per second. Asynchronous, low-latency languages ensure smooth execution and zero downtime.

3. Security and Compliance with Global Regulations

With GDPR 2.0, PCI DSS 4.0, and strict AI governance, finance systems must use secure languages supporting encryption, sandboxing, and compliance automation.

4. API-First and Cloud-Native Banking Systems

Modern banking runs on open APIs and BaaS models. The right language simplifies API integration, cloud deployments, and CI/CD pipelines for faster innovation.

Read More: Top 5 Automation Tools Transforming the Modern Banking Industry [2026 Guide]

How to Choose the Right Programming Language for Finance in 2026?

Before picking a language for fintech or banking development, consider:

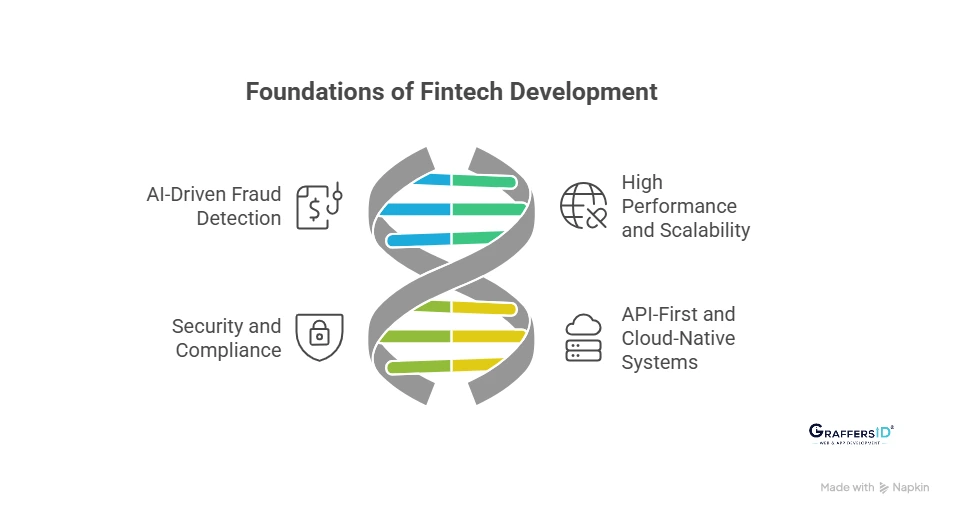

1. Security and Encryption: Choose a language that offers built-in encryption libraries, strong authentication, and protection against real-time cyber threats to ensure safe financial transactions.

2. AI and Automation Capabilities: Opt for languages that integrate smoothly with AI and ML frameworks to enable predictive analytics, fraud detection, and risk modeling.

3. Compliance and Regulation Support: Select languages compatible with global financial regulations like GDPR, PCI DSS, and AML, making compliance automation easier and more reliable.

4. Performance and Scalability: Use languages designed for high-speed data processing and concurrent transactions to handle the large scale of real-time financial operations.

5. System Integration and Interoperability: Ensure the language supports smooth integration with APIs, blockchain systems, and existing banking infrastructure for smooth connectivity.

Top 7 Programming Languages for Banking and Finance in 2026

Choosing the right programming language can define how fast, secure, and compliant your fintech solution becomes. Here are the top 7 programming languages driving banking innovation in 2026, and what makes each stand out.

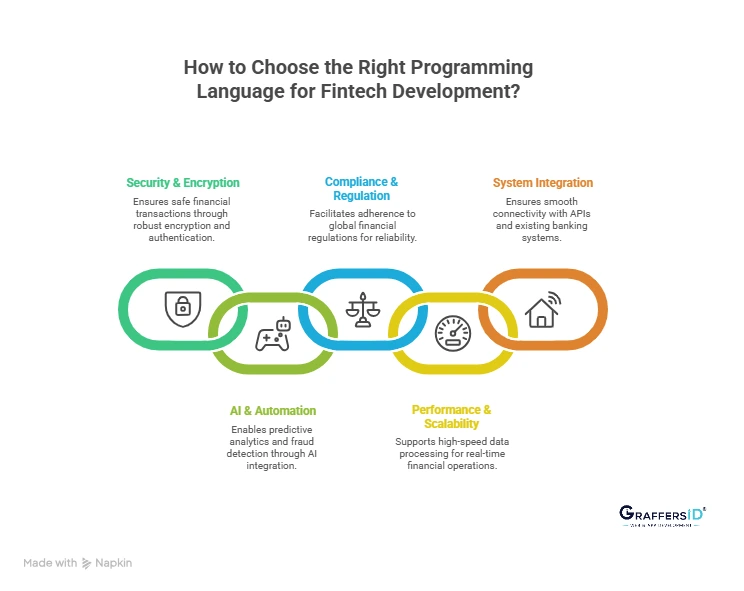

1. Node.js: Best for Real-Time Payments and Fintech APIs

Node.js powers real-time digital payments and API-driven banking in 2026. Its event-driven, non-blocking I/O architecture allows instant updates across millions of concurrent transactions.

With the rise of real-time payment rails, CBDCs (Central Bank Digital Currencies), and open banking APIs, Node.js is powering ultra-scalable fintech backends.

Why is Node.js Popular in 2026?

- Strong scalability: Ideal for handling numerous parallel connections, which is important for online banking services.

- Non-blocking I/O: Enables real-time updates of data, which are essential for stock trading and digital wallets.

- Solid API support: Integrates well with third-party banking providers.

Use Cases: Neobanks, digital wallets, instant P2P payments.

Example: Monzo and Revolut use Node.js for real-time fintech APIs and open banking systems.

GraffersID offers expert Node.js developers to help you build real-time, regulation-ready fintech backends.

2. Python: Best for AI, Data Analytics, and Fraud Detection

Python remains the AI-first language for financial analytics and automation in 2026. Its large ecosystem of ML and data science libraries makes it ideal for fraud prediction, credit scoring, and algorithmic trading.

Why is Python Popular in 2026?

- Integrates smoothly with PyTorch, TensorFlow, and Scikit-learn.

- Simplifies data modeling, predictive risk analysis, and reporting.

- Enables explainable AI (XAI) for transparent finance systems.

Use Cases: AI credit scoring, predictive risk modeling, algorithmic trading.

Example: Goldman Sachs and JPMorgan use Python to power AI-based risk engines and fraud analytics.

3. Java: Best for Enterprise Banking and Compliance Systems

Java continues to dominate core banking infrastructure due to its reliability and compliance-friendly frameworks. It’s the go-to choice for secure, large-scale financial platforms across the globe.

Why is Java Popular in 2026?

- Built-in enterprise security and transaction safety.

- JVM ensures high performance across platforms.

- Ideal for AML, KYC, and compliance automation systems.

Use Cases: Payment gateways, core banking modules, and regulatory compliance.

Example: JPMorgan’s Athena and Citi’s Quartz use Java for AI-enabled risk and compliance systems.

4. C++: Best for High-Frequency Trading and Quantitative Finance

C++ is widely used for high-frequency trading (HFT) and quantitative analytics in 2026. Its unmatched execution speed supports microsecond-level trade execution for global financial markets.

Why is C++ Popular in 2026?

- Offers low latency and real-time processing.

- Provides direct memory control for performance optimization.

- Integrates with GPU engines for quant-driven analytics.

Use Cases: Algorithmic trading, risk computation, derivatives pricing.

Example: Top hedge funds and trading firms rely on C++ for ultra-fast financial execution systems.

5. SQL: Best for Data Integrity, Compliance, and Fraud Reporting

SQL remains critical for data accuracy, audit trails, and compliance reporting in financial systems. It ensures data transparency and regulatory traceability, even in AI-integrated finance workflows.

Why is SQL Popular in 2026?

- Handles large financial datasets with accuracy.

- Enables AML, KYC, and fraud analytics through structured data.

- Integrates easily with BI and ML tools for anomaly detection.

Use Cases: AML dashboards, fraud monitoring, compliance analytics.

Example: Stripe and PayPal use SQL data lakes for secure global transaction management.

Read More: Customer Support and Service Automation: How to Set it Up in 2026?

6. TypeScript & JavaScript: Best for Web and Mobile Banking Apps

With fintech going digital-first, TypeScript and JavaScript lead front-end innovation in 2026. They power real-time, interactive dashboards for mobile and web banking experiences.

Why are JavaScript & TypeScript Popular in 2026?

- Type safety for scalable and secure fintech UIs.

- Perfect for building Open Banking portals and Web3 interfaces.

- Works smoothly with modern AI-driven front-end frameworks.

Use Cases: Fintech dashboards, digital wallets, API-based platforms.

Example: Nubank and Wise use TypeScript to build responsive, secure fintech frontends.

7. Rust: Best for Blockchain, CBDCs, and DeFi Platforms

Rust is the fastest-growing language in finance as of 2026, powering CBDC systems, DeFi protocols, and blockchain-based settlements. Its memory-safe and concurrent architecture ensures zero vulnerabilities and faster performance.

Why is Rust Popular in 2026?

- Prevents security bugs and buffer overflows.

- Offers concurrency for high-performance financial operations.

- Perfect for blockchain, tokenized assets, and digital custody systems.

Use Cases: Smart contracts, blockchain banking, asset tokenization.

Example: Rust underpins leading DeFi ecosystems and CBDC development frameworks.

Comparison Table: Best Programming Languages for Banking and Finance in 2026

| Language | Best For | Key Features | Examples of Use |

|---|---|---|---|

| Node.js | Fintech APIs, real-time payments | Async I/O, scalable | Revolut, Monzo |

| Python | AI-driven finance, fraud detection | AI/ML libraries | JPMorgan, Goldman Sachs |

| Java | Enterprise banking & compliance | Secure, scalable, JVM ecosystem | Core banking, AML |

| C++ | HFT & quant finance | Low latency, optimized memory | Hedge funds, exchanges |

| SQL | Compliance & fraud detection | Query power, data integrity | Stripe, PayPal |

| JavaScript/TS | Web & mobile banking | Secure UI, scalable | Neobanks, fintech dashboards |

| Rust | Blockchain & DeFi | Memory safety, concurrency | DeFi, CBDCs |

Which Programming Language is Best for Your Fintech Project in 2026?

1. Node.js for Real-Time Banking Systems: Use Node.js to build high-performance, real-time payment backends and instant transaction systems.

2. Python for AI-Powered Finance Solutions: Choose Python for AI-driven analytics, fraud detection, and automated trading platforms.

3. Java for Enterprise-Grade Banking Applications: Opt for Java to create secure, compliant, and large-scale enterprise banking systems.

4. C++ for High-Frequency Trading Platforms: Go with C++ to achieve ultra-low latency in trading, derivatives, and quantitative finance.

5. SQL for Compliance and Financial Data Management: Use SQL to maintain transaction integrity, ensure audit readiness, and detect fraud patterns.

6. TypeScript for Digital Banking Interfaces: Pick TypeScript to design interactive fintech dashboards and mobile-first banking experiences.

7. Rust for Blockchain and DeFi Development: Adopt Rust to build secure blockchain-based banking, tokenized assets, and DeFi ecosystems.

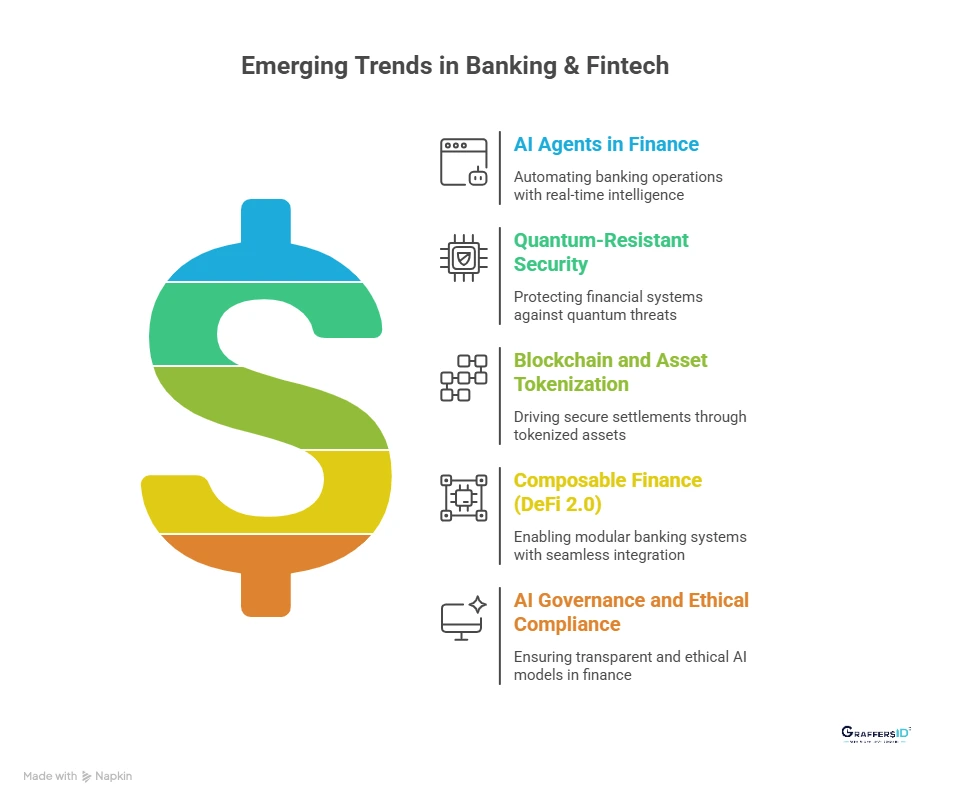

Top Emerging Trends in Banking & Fintech (2026 and Beyond)

The financial industry is changing quickly, and new technologies are changing how banking and fintech software are developed.

1. AI Agents in Finance: AI-powered autonomous agents are transforming banking operations by automating portfolio optimization, fraud detection, and KYC verification with real-time intelligence.

2. Quantum-Resistant Security: Banks are adopting quantum-safe encryption to protect sensitive transactions and future-proof global financial systems against quantum computing threats.

3. Blockchain and Asset Tokenization: Blockchain is driving secure, transparent settlements through tokenized assets and CBDC-based payments, reducing intermediaries and transaction costs.

4. Composable Finance (DeFi 2.0): Composable Finance enables modular, API-first banking systems where institutions can build and connect multiple financial products smoothly in real time.

5. AI Governance and Ethical Compliance: Financial institutions are now required to deploy explainable and transparent AI models to meet evolving global compliance and ethical standards.

Conclusion

In 2026, fintech success depends on more than just coding speed; it’s about AI-driven innovation, security-first architecture, and regulatory compliance.

The programming language you choose directly impacts how your system scales, integrates with AI models, and protects sensitive financial data.

-

Need real-time banking systems? → Use Node.js.

-

Building AI-powered finance solutions? → Go with Python.

-

Developing secure enterprise banking apps? → Choose Java.

-

Targeting ultra-fast trading systems? → C++ leads the way.

-

Ensuring data integrity and compliance? → SQL is essential.

-

Designing interactive fintech dashboards? → TypeScript excels.

-

Innovating with DeFi and blockchain banking? → Rust is the future.

By aligning your tech stack with the right programming language, you can build future-proof, compliant, and intelligent financial systems that thrive in the AI-driven economy.

At GraffersID, we help banks, fintech startups, and enterprises hire top remote developers to create secure, scalable, and regulation-ready financial platforms.

Scale your fintech project with expert talent today! Contact us now!