The Buy Now Pay Later (BNPL) industry has experienced rapid growth in recent years, providing consumers with a flexible and convenient alternative to traditional credit cards. As more people opt for buy now pay later app development services, there’s a growing demand for BNPL apps. In this blog post, we will explore the app development process and cost associated with creating a Buy Now Pay Later app.

Understanding the Buy Now Pay Later Concept

Before diving into the app development process, let’s briefly understand what Buy Now Pay Later is. BNPL allows consumers to make purchases and defer the payment for a specified period, often interest-free or with low interest. Users can split their payments into manageable installments, making it an attractive option for those looking to budget their expenses.

The Rise of Buy Now Pay Later Apps (BNPL)

The history of Buy Now Pay Later (BNPL) apps is a fascinating journey that reflects the evolution of consumer finance and the ever-changing landscape of digital payments. BNPL apps have become increasingly popular in recent years, but their origins can be traced back to several key developments in the finance and technology sectors.

- Layaway Plans (19th Century): The concept of paying for purchases over time can be traced back to the 19th century when layaway plans were introduced. Customers could select items in a store and make incremental payments until the full amount was paid, at which point they could take their goods home. This early form of deferred payment laid the foundation for the BNPL model.

- Credit Cards (20th Century): The introduction of credit cards in the mid-20th century revolutionized consumer spending. Credit cards allow consumers to make purchases and pay off their balances over time, offering convenience and flexibility. However, they often came with high-interest rates, which led to the need for more consumer-friendly financing options.

- Online Shopping and E-commerce (1990s): With the rise of the Internet, e-commerce platforms began to gain popularity in the 1990s. This shift in shopping habits provided a natural platform for new payment solutions, paving the way for BNPL services.

- The emergence of BNPL Services (the 2000s): The early 2000s saw the emergence of BNPL services in the form of online payment processors. Companies like PayPal Credit and Bill Me Later (later acquired by PayPal) allowed consumers to make purchases and defer payments, often without interest if paid within a specified time frame.

- Mobile Apps and the Smartphone Era (2010s): The proliferation of smartphones and mobile apps led to a surge in digital payment options. This environment provided a fertile ground for the development of BNPL apps, making it even easier for consumers to access these services on their mobile devices.

- Rapid Growth and Market Disruption (2010s – Present): Over the past decade, the BNPL industry has experienced explosive growth. Companies like Afterpay, Klarna, and Affirm have gained prominence, offering users seamless and user-friendly mobile apps that allow them to split payments into manageable installments. These apps have resonated with consumers, especially younger generations, who appreciate the transparent fee structures and the ability to avoid traditional credit card debt.

- Expansion and Diversification: BNPL apps have evolved beyond simple deferred payment solutions. They now offer additional features like virtual cards, rewards programs, and partnerships with various merchants, further solidifying their place in the digital payment ecosystem.

- Regulatory Scrutiny: As BNPL apps have gained popularity, they have come under regulatory scrutiny in various countries. Regulators are focusing on consumer protection, data privacy, and responsible lending practices, aiming to ensure that users are not overextending themselves financially.

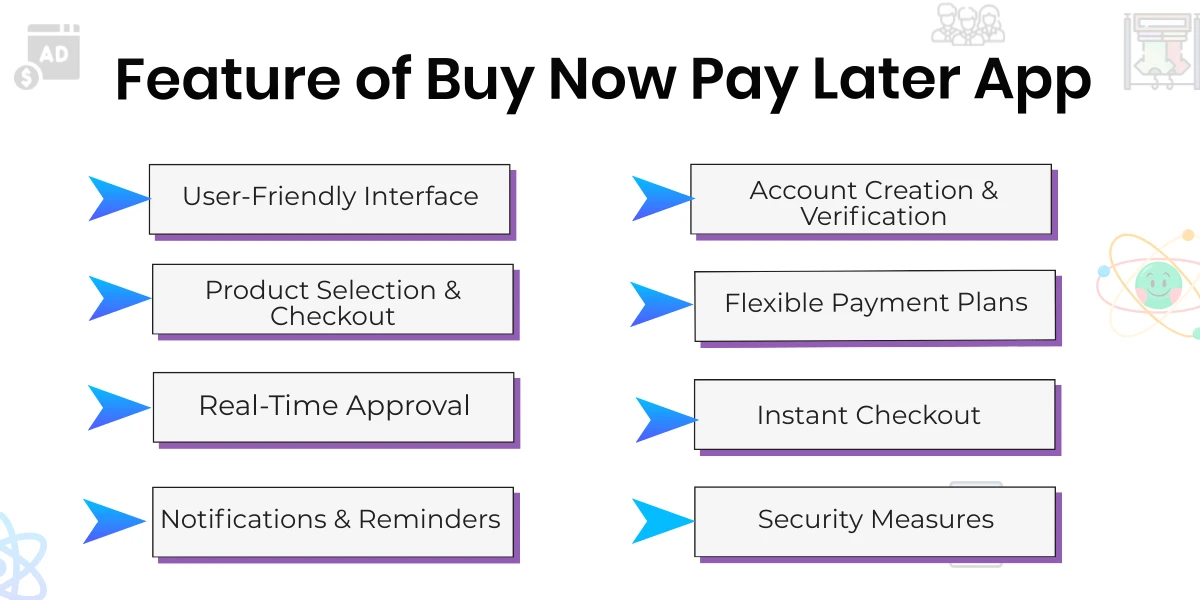

Key Features of a Buy Now Pay Later App

-

User-Friendly Interface

At the heart of every successful BNPL app lies a user-friendly interface that serves as the gateway to a seamless and enjoyable shopping experience. An intuitive interface empowers users to navigate through the app effortlessly, peruse an extensive range of products, and smoothly finalize their purchases without encountering any impediments or confusion.

-

Account Creation and Verification

The establishment of user accounts, coupled with robust verification processes, forms the bedrock of security and personalized services. Users should encounter a frictionless account creation process that allows them to furnish the requisite personal information and securely link their bank or payment accounts, ensuring the safeguarding of sensitive data.

-

Product Selection and Checkout

An extensive and diversified product selection from partner merchants is pivotal in enriching the shopping experience. Users should be provided with an array of options, enabling them to browse, select their desired products, and proceed through a straightforward and efficient checkout process that leaves no room for ambiguity.

-

Flexible Payment Plans

A core feature that distinguishes BNPL apps is the provision of flexible payment plans, allowing users to tailor the duration and frequency of their installment payments to their unique financial preferences and requirements. This flexibility contributes significantly to the appeal of BNPL services.

-

Real-Time Approval and Instant Checkout

The instant approval of payment plans is crucial to delivering a frictionless and satisfactory user experience. Users should receive immediate notifications regarding the approval status of their payment plan, enabling them to finalize their purchases promptly and without delays.

-

Notifications and Reminders

The incorporation of push notifications and timely reminders is instrumental in keeping users informed about their financial commitments. Regular reminders concerning upcoming payment due dates play an integral role in helping users stay on track, avoid late fees, and ensure their financial obligations are met promptly.

-

Security Measures

Security is of paramount importance in the realm of BNPL apps, given the sensitivity of user data and the financial transactions conducted within the app. Robust security measures, including stringent encryption, authentication, and authorization mechanisms, must be meticulously implemented to safeguard user information, protect against fraud, and maintain the trust of users and regulatory authorities alike.

The Buy Now Pay Later App Development Process

-

Market Research and Feasibility Study

The journey into BNPL app development commences with comprehensive market research and a thorough feasibility study. Market research serves as the foundation for understanding your target audience, analyzing competitors, and assessing potential challenges in the market. Simultaneously, the feasibility study evaluates the viability of your BNPL app concept within the current market landscape. It is during this phase that you lay the groundwork for a successful development journey.

-

Conceptualization and Planning

The next step involves the conceptualization of your BNPL app and comprehensive planning. At this stage, you define your app’s concept, features, and functionalities in detail. Your development plan should include a comprehensive roadmap, encompassing a detailed timeline and budget. This plan acts as a guiding document, ensuring that your app’s development aligns with your strategic objectives and resources.

-

Technology Stack Selection

Careful consideration in selecting the appropriate technology stack is crucial. This technology stack includes the development platform, programming languages, and frameworks that will underpin the app’s functionality and performance. This choice is a critical decision that can significantly impact the efficiency and scalability of your app.

-

Design and User Experience (UX/UI)

The aesthetics and user experience of your BNPL app play a pivotal role in its success. The design must be not only visually appealing but also attuned to user preferences and expectations. A user-friendly interface and seamless navigation are essential to ensure a delightful user experience, making users feel at ease as they shop and manage their payments.

-

Development

The development phase is the heart of the BNPL app creation process. It involves coding, integrating features, and building the app’s core functionality. Backend development, payment processing systems, user account management, and seamless integration with third-party APIs are essential components of this phase. Attention to detail, coding best practices, and rigorous testing are paramount to ensure the app functions flawlessly.

-

Integration with Payment Gateways

Seamless integration with reliable payment gateways is fundamental for the efficient processing of transactions. Payment gateways serve as the bridge between your app and the financial ecosystem, ensuring secure and reliable payment processing. A meticulous integration process is essential to prevent payment-related issues.

-

Testing and Quality Assurance

The testing and quality assurance phase is a critical step in ensuring that your app is free of issues and ready for launch. Rigorous testing is conducted to evaluate the app’s functionality, security, and user experience. Testing procedures encompass both manual and automated tests, and the goal is to identify and rectify any bugs or issues that may arise. Quality assurance is essential to ensure the app’s reliability and robustness.

-

Launch and Marketing

Once the app has completed the testing phase, it’s time to proceed with the app’s launch. Whether your target platforms are iOS, Android, or both, a well-executed launch is crucial to making your app available to users. Simultaneously, you must develop a comprehensive marketing strategy to promote the app, attract users, and gain a competitive edge in the market. Marketing activities may include content creation, social media promotion, partnerships with merchants, and targeted advertising.

-

Monitoring and Maintenance

The post-launch phase involves continuous monitoring of the app’s performance, user feedback, and security. Regular updates and maintenance are essential to ensure the app remains competitive, secure, and capable of adapting to an ever-evolving digital landscape. Monitoring also involves tracking key performance indicators (KPIs) to identify areas for improvement and optimization. User feedback plays a crucial role in shaping app updates and improvements.

-

Regulatory Compliance

Ensuring regulatory compliance is a non-negotiable aspect of BNPL app development. Your app must adhere to local and international financial regulations, especially those related to lending, data security, and consumer protection. Compliance is not only a legal requirement but also an essential factor in gaining the trust of both users and regulatory authorities. Compliance efforts should be ongoing, as regulatory landscapes can change over time.

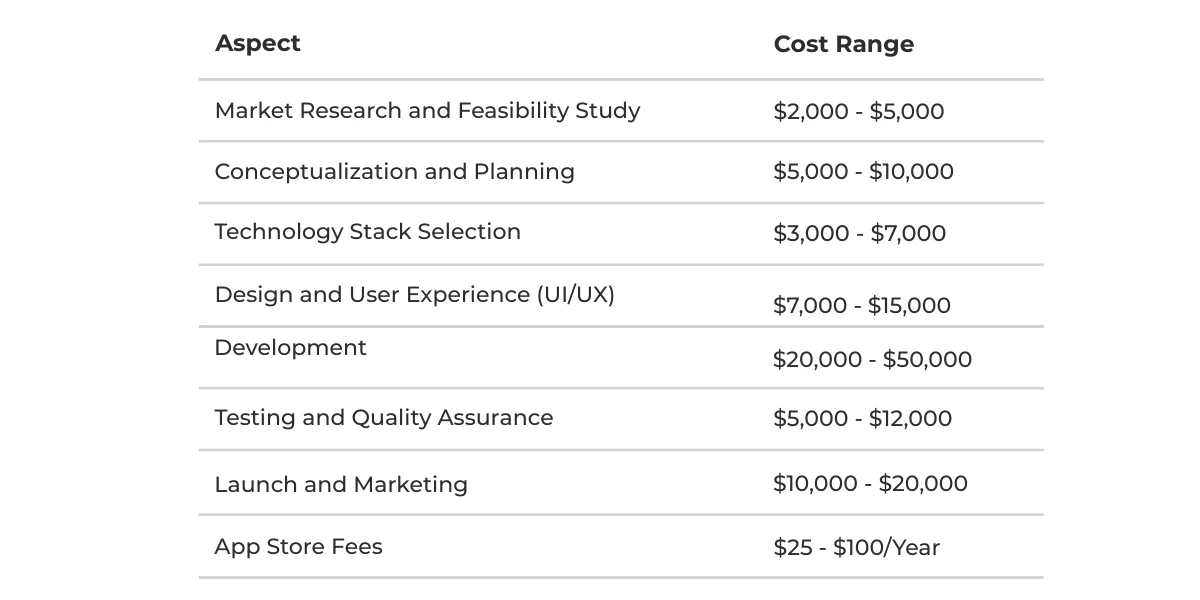

Cost of Buy Now Pay Later App Development

The cost of developing a Buy Now Pay Later (BNPL) app can vary significantly depending on various factors, including the complexity of the app, the features and functionality you want to incorporate, the technology stack you choose, and the development team’s location and expertise. Here’s an overview of the cost factors to consider:

- Development Team: The choice of development team plays a crucial role in determining the cost. If you hire an in-house team, you’ll have higher ongoing expenses, including salaries, benefits, and office space. Outsourcing to a development agency or hiring freelancers might offer cost savings, but it’s essential to ensure they have the required expertise.

- App Features and Complexity: The more features and complexity you want in your BNPL app, the higher the development cost. Basic apps with core features will cost less than apps with advanced features like real-time approval, credit scoring, and integration with a wide range of payment gateways.

- Technology Stack: The choice of technology stack influences costs. Open-source technologies and frameworks can be more cost-effective, but custom solutions and proprietary technologies may incur additional expenses. Consider the long-term maintenance costs associated with your chosen technology stack.

- Platform (iOS, Android, or Both): Developing for both iOS and Android will typically be more expensive than targeting a single platform. Cross-platform development frameworks like React Native or Flutter can reduce development costs by enabling code reusability.

- Design and User Experience: A well-designed app with a focus on user experience is essential for the success of a BNPL app. Quality design can increase development costs, but it is often a worthwhile investment as it can attract and retain users.

- Regulatory Compliance: Ensuring your BNPL app complies with local and international financial regulations is essential. Compliance efforts, including legal consultation and security measures, can add to the development cost.

- Testing and Quality Assurance: Rigorous testing and quality assurance are critical to ensure the app’s reliability. This phase can involve additional costs, including testing tools and the time needed for comprehensive testing.

- Maintenance and Updates: Post-launch, ongoing maintenance and updates are necessary to keep the app running smoothly and to address user feedback. Budgeting for these ongoing expenses is essential.

- Marketing and Promotion: While not strictly a development cost, marketing and promotion are crucial to making users aware of your BNPL app. Marketing costs may include advertising, content creation, social media campaigns, and partnerships.

- Infrastructure and Hosting: If your BNPL app relies on cloud services, you’ll need to budget for hosting and infrastructure costs, which can vary depending on usage.

- App Store Fees: Both Apple App Store and Google Play Store charge fees for publishing and distributing apps. These fees should be considered in your overall development cost.

To provide a rough estimate, developing a basic BNPL app for a single platform may cost anywhere from $50,000 to $100,000. However, a more feature-rich and complex app can cost significantly more, potentially exceeding $200,000 or more. It’s important to conduct a thorough cost analysis, obtain quotes from development teams, and create a detailed budget that considers all of the above factors.

Best Buy Now Pay Later Apps

These apps provide convenience, transparency, and budget-friendly options for shoppers. In this section, we will explore some of the best BNPL apps available in the United States, detailing their features, pros and cons, user ratings, late fees, interest rates, and credit limits.

1) Affirm

Affirm is a well-established BNPL app that focuses on providing users with flexible financing options. With Affirm, you can split your purchase into easy-to-understand monthly payments, making larger expenses more manageable.

Pros:

- Flexible Repayment Options: Affirm stands out for its array of repayment plans, allowing users to select the terms that best suit their budget.

- No Late Fees: Affirm’s policy of no late fees offers peace of mind to users who may occasionally miss a payment.

- Transparent Interest Rates: Affirm provides transparency by displaying interest rates upfront, making it easy to understand the total cost of borrowing.

Cons:

- Limited Merchant Support: Not all merchants accept Affirm, limiting your shopping choices.

- Variable Interest Rates: Depending on your creditworthiness, you may face higher interest rates.

Features: Affirm offers installment payment plans for both online and in-store purchases. You can check your eligibility without affecting your credit score, making it easy to plan your purchases.

Ratings: Affirm boasts a favorable rating of 4.6/5 on the App Store, reflecting its user-friendly experience and reliability.

Late Fees: The absence of late fees means users can avoid penalties for occasional delays in payments.

Interest: Interest rates vary based on individual factors, typically ranging from 0% to 30%.

Credit Limit: Credit limits are determined by various factors and may vary for each user.

2) Klarna

About Klarna: Klarna is a widely accepted BNPL app that collaborates with a broad network of merchants, making it easy to find your favorite products and deals with just a few clicks.

Pros:

- Wide Merchant Network: Klarna’s extensive list of partner merchants provides a diverse array of shopping options.

- 0% Interest Plans: Klarna offers 0% interest on select plans, making it more affordable for users.

- User-Friendly App: Klarna’s app is known for its intuitive design and easy navigation.

Cons:

- Variable Interest Rates: Some Klarna plans may come with high interest rates, which can increase the cost of your purchase.

- Late Fees: Klarna may charge late fees in certain circumstances, so it’s important to make timely payments.

Features: Klarna offers a range of payment options, including interest-free financing and a shopping app that helps users discover the latest discounts and deals.

Ratings: Klarna enjoys a high user satisfaction rating of 4.7/5 on the App Store, reflecting its user-friendly experience.

Late Fees: Late fees may apply in specific situations, so it’s crucial to stay on top of your payment schedule.

Interest: Interest rates vary based on the specific plan you choose, with some plans offering 0% interest.

Credit Limit: Credit limits are determined individually and can vary based on several factors.

3) Afterpay:

About Afterpay: Afterpay is renowned for its straightforward approach to BNPL, offering users a simple way to split their purchases into four equal payments over a six-week period.

Pros:

- No Interest or Late Fees with Timely Payments: Afterpay is well-received for not charging interest or late fees as long as payments are made on time.

- User-Friendly Interface: Afterpay’s app and website are designed for a hassle-free shopping experience.

- Extensive Merchant Support: Afterpay is accepted by numerous retailers, broadening your shopping options.

Cons:

- Limited Payment Flexibility: Afterpay primarily offers a four-payment installment plan, limiting payment duration flexibility.

- Late Fees for Missed Payments: Missing payments can result in significant late fees, so diligent payment management is essential.

Features: Afterpay’s simple approach allows users to make purchases and divide their payments into four equal installments over six weeks, both for online and in-store shopping.

Ratings: Afterpay boasts an impressive rating of 4.8/5 on the App Store, reflecting the high level of user satisfaction.

Late Fees: Late fees may be charged for missed payments, making it crucial to stick to the payment schedule.

Interest: Afterpay does not charge interest on its installment plans when payments are made on time.

Credit Limit: Credit limits are determined based on various factors and may increase over time with responsible use.

4) Sezzle

About Sezzle: Sezzle is a BNPL app known for its interest-free installment payment options and a user-friendly approval process.

Pros:

- Interest-Free Payment Plans: Sezzle offers interest-free installment plans, making it a cost-effective option.

- No Late Fees: Users can avoid late fees with Sezzle.

- Easy Approval Process: Sezzle’s approval process is relatively lenient, increasing accessibility.

Cons:

- Smaller Merchant Network: Sezzle may not be accepted by as many merchants compared to some other BNPL apps, potentially limiting your shopping choices.

- Primarily for Online Shopping: Sezzle is primarily designed for online shopping, which may not suit all users.

Features: Sezzle provides interest-free installment payments over six weeks, making it an attractive option for cost-conscious shoppers.

Ratings: Sezzle maintains a solid rating of 4.5/5 on the App Store, indicating a positive user experience.

Late Fees: Sezzle does not impose late fees, reducing the financial stress associated with occasional payment delays.

Interest: Interest is not charged on Sezzle’s installment plans.

Credit Limit: Credit limits are determined individually, considering factors such as creditworthiness.

Turn Your BNPL App Idea into Reality with GraffersID

Are you ready to bring your Buy Now Pay Later (BNPL) app idea to life? Look no further than GraffersID, your trusted partner in app development. We specialize in creating innovative, user-friendly, and secure BNPL apps tailored to your unique vision and needs. Our team of experienced developers, designers, and experts will work closely with you to ensure your app not only meets but exceeds your expectations. Whether you’re starting from scratch or looking to enhance an existing app, GraffersID has the skills and experience to make your BNPL app a success. Don’t miss out on the opportunity to be a part of the evolving fintech landscape. Contact us today, and let’s embark on this exciting journey together!